As a taxpayer, navigating the complexities of tax forms can be overwhelming, especially when dealing with foreign earned income. Form 1116, also known as the Foreign Tax Credit (Individual, Estate, or Trust), is a crucial document for individuals who have earned income from foreign sources. In this article, we will delve into the specifics of Form 1116 Schedule B, providing a comprehensive, step-by-step guide to help you accurately complete this section.

Understanding Form 1116 Schedule B

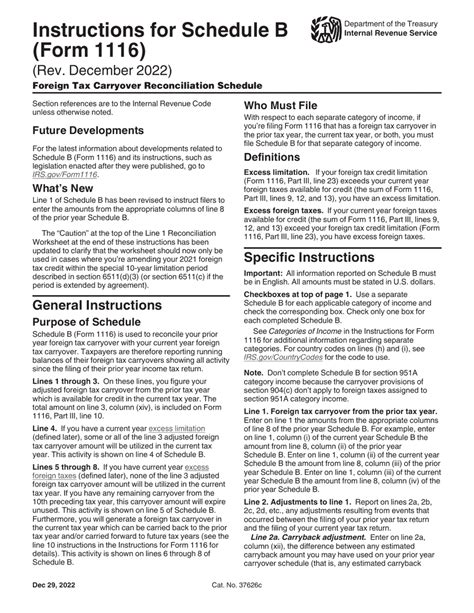

Before we dive into the instructions, it's essential to understand the purpose of Form 1116 Schedule B. This schedule is used to calculate the foreign tax credit limitation, which is the maximum amount of foreign taxes that can be claimed as a credit against U.S. tax liability. The foreign tax credit limitation is calculated separately for each category of income, such as passive income, general category income, and active category income.

Step 1: Identify the Category of Income

The first step in completing Form 1116 Schedule B is to identify the category of income you are reporting. The categories of income are:

- Passive category income (e.g., dividends, interest, rents)

- General category income (e.g., wages, salaries, business income)

- Active category income (e.g., self-employment income, business income)

Step 2: Calculate the Foreign Taxes Paid

Once you have identified the category of income, you need to calculate the foreign taxes paid on that income. This includes taxes paid to a foreign government, including withholding taxes and taxes paid on a tax return.

- List the foreign country where the taxes were paid

- Enter the amount of foreign taxes paid

- Enter the exchange rate used to convert the foreign taxes to U.S. dollars

Step 3: Calculate the Foreign Tax Credit Limitation

The foreign tax credit limitation is calculated by multiplying the foreign taxes paid by the ratio of U.S. tax liability to total worldwide tax liability.

- Enter the U.S. tax liability

- Enter the total worldwide tax liability

- Calculate the ratio of U.S. tax liability to total worldwide tax liability

- Multiply the foreign taxes paid by the ratio

Step 4: Calculate the Excess Foreign Taxes

If the foreign taxes paid exceed the foreign tax credit limitation, the excess is carried over to the next tax year.

- Enter the excess foreign taxes

- Enter the carryover amount

Step 5: Complete the Schedule B Worksheet

The Schedule B worksheet is used to summarize the calculations and determine the foreign tax credit limitation.

- Enter the category of income

- Enter the foreign taxes paid

- Enter the foreign tax credit limitation

- Enter the excess foreign taxes

Tips and Reminders

- Keep accurate records of foreign taxes paid, including receipts and invoices

- Use the correct exchange rate to convert foreign taxes to U.S. dollars

- Ensure that the foreign tax credit limitation is calculated correctly to avoid errors

- Consult with a tax professional if you are unsure about any part of the process

Additional Resources

For more information on Form 1116 Schedule B, consult the following resources:

- IRS Publication 519: U.S. Tax Guide for Aliens

- IRS Form 1116 Instructions

- IRS Website: irs.gov

Conclusion

Completing Form 1116 Schedule B requires attention to detail and a thorough understanding of the foreign tax credit limitation. By following these step-by-step instructions, you can ensure that you accurately complete this section and claim the correct amount of foreign tax credit. Remember to keep accurate records and consult with a tax professional if you are unsure about any part of the process.

FAQs

What is the purpose of Form 1116 Schedule B?

+Form 1116 Schedule B is used to calculate the foreign tax credit limitation, which is the maximum amount of foreign taxes that can be claimed as a credit against U.S. tax liability.

What are the categories of income on Form 1116 Schedule B?

+The categories of income are passive category income, general category income, and active category income.

How do I calculate the foreign tax credit limitation?

+The foreign tax credit limitation is calculated by multiplying the foreign taxes paid by the ratio of U.S. tax liability to total worldwide tax liability.

We hope this article has provided you with a comprehensive understanding of Form 1116 Schedule B. If you have any further questions or concerns, please don't hesitate to reach out.