As a railroad employee, understanding the various tax forms and benefits can be overwhelming. One of the key forms you'll receive as a railroad retiree is Form 1099 RRB, which reports your railroad retirement benefits. In this article, we'll delve into the details of Form 1099 RRB, its purpose, and what you can expect to see on the form.

The Importance of Form 1099 RRB

The Railroad Retirement Board (RRB) is responsible for administering retirement benefits for railroad employees. As a retiree, you'll receive Form 1099 RRB to report your taxable benefits. This form is crucial for tax purposes, as it helps you accurately report your income and claim any applicable deductions or credits.

What is Form 1099 RRB?

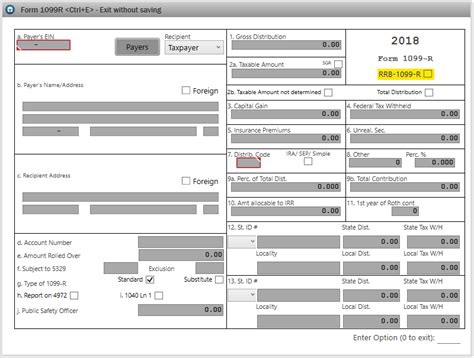

Form 1099 RRB is an annual statement that reports your railroad retirement benefits, including annuity payments, supplemental annuity payments, and lump-sum payments. The form is divided into two main sections: Box 1, which reports your gross annuity payments, and Box 2, which reports your supplemental annuity payments.

Who Receives Form 1099 RRB?

You'll receive Form 1099 RRB if you're a railroad retiree and have received benefits from the RRB during the tax year. This includes:

- Retirees receiving annuity payments

- Beneficiaries receiving survivor benefits

- Employees receiving lump-sum payments

Understanding the Components of Form 1099 RRB

Here's a breakdown of the key components of Form 1099 RRB:

- Box 1: Gross Annuity Payments: This box reports your total annuity payments for the tax year, including any lump-sum payments.

- Box 2: Supplemental Annuity Payments: This box reports your supplemental annuity payments, which are additional benefits paid to certain retirees.

- Box 3: Name and Address: This section shows your name and address, as well as the RRB's name and address.

- Box 4: Recipient's Account Number: This box displays your unique account number with the RRB.

Taxation of Railroad Retirement Benefits

Railroad retirement benefits are taxable, but the taxability varies depending on your age and the type of benefits you receive. Generally, your benefits are taxed as ordinary income, but you may be eligible for certain deductions or credits.

- Age 62 and Older: If you're 62 or older, your benefits are subject to taxation.

- Under Age 62: If you're under 62, your benefits are generally not taxable.

Reporting Form 1099 RRB on Your Tax Return

When reporting your railroad retirement benefits on your tax return, you'll need to:

- Report the gross annuity payments (Box 1) on Line 21 of your Form 1040

- Report the supplemental annuity payments (Box 2) on Line 21 of your Form 1040

- Claim any applicable deductions or credits, such as the Railroad Retirement Credit

Practical Tips for Railroad Retirees

Here are some practical tips to keep in mind:

- Keep accurate records of your benefits and tax documents

- Consult with a tax professional to ensure accurate reporting

- Take advantage of deductions and credits available to railroad retirees

How to Obtain a Duplicate Form 1099 RRB

If you've lost or misplaced your Form 1099 RRB, you can request a duplicate copy from the RRB:

- Call the RRB's toll-free number: 1-877-772-5772

- Visit the RRB's website:

- Mail a written request to the RRB's address

Conclusion

Form 1099 RRB is a critical tax document for railroad retirees, reporting their taxable benefits and helping them accurately report their income. By understanding the components of Form 1099 RRB and how to report your benefits on your tax return, you'll be better equipped to navigate the tax process and ensure you're taking advantage of available deductions and credits.

Benefits and Working Mechanisms of Railroad Retirement

The Railroad Retirement system provides a comprehensive benefits package for railroad employees, including annuity payments, supplemental annuity payments, and lump-sum payments. Here's an overview of the benefits and working mechanisms of railroad retirement:

Eligibility Requirements

To be eligible for railroad retirement benefits, you must meet certain requirements:

- Age: You must be at least 62 years old (50 years old for disability benefits)

- Service: You must have at least 10 years of credited railroad service

- Earnings: You must have earned a minimum amount of creditable earnings

Types of Benefits

There are several types of benefits available to railroad retirees, including:

- Annuity Payments: Monthly payments based on your earnings record

- Supplemental Annuity Payments: Additional benefits paid to certain retirees

- Lump-Sum Payments: One-time payments for certain benefits, such as unused vacation time

Benefit Calculations

Your benefits are calculated based on your earnings record, age, and type of benefit. Here's a simplified example of how your benefits might be calculated:

- Annuity Payments: 1.45% of your average indexed monthly earnings (AIME) multiplied by the number of years of credited service

Railroad Retirement and Social Security

Railroad retirement benefits are integrated with Social Security benefits. If you're eligible for both railroad retirement and Social Security benefits, your benefits will be coordinated to ensure you receive the maximum amount.

Frequently Asked Questions

Here are some frequently asked questions about Form 1099 RRB and railroad retirement benefits:

Q: What is the deadline for reporting railroad retirement benefits on my tax return?

A: The deadline for reporting railroad retirement benefits on your tax return is April 15th of each year.Q: Can I claim a deduction for my railroad retirement benefits?

A: Yes, you may be eligible for a deduction for your railroad retirement benefits, depending on your age and type of benefit.Q: How do I request a duplicate Form 1099 RRB?

A: You can request a duplicate Form 1099 RRB by calling the RRB's toll-free number, visiting the RRB's website, or mailing a written request to the RRB's address.What is the purpose of Form 1099 RRB?

+Form 1099 RRB reports your railroad retirement benefits, including annuity payments, supplemental annuity payments, and lump-sum payments.

Who receives Form 1099 RRB?

+Railroad retirees, beneficiaries, and employees receiving lump-sum payments receive Form 1099 RRB.

How do I report my railroad retirement benefits on my tax return?

+Report your gross annuity payments (Box 1) and supplemental annuity payments (Box 2) on Line 21 of your Form 1040.