New Jersey Form 1099 G is an essential document for individuals and businesses that need to report certain types of income to the state. In this article, we will provide a comprehensive guide on how to file Form 1099 G in New Jersey, including the types of income that need to be reported, the filing requirements, and the steps to follow.

Understanding Form 1099 G

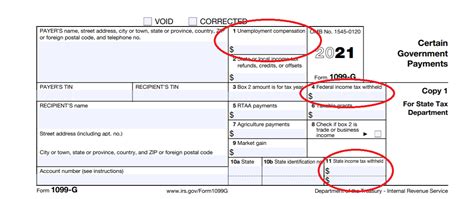

Form 1099 G is a tax form used to report certain types of income, such as unemployment compensation, state and local income tax refunds, and other types of income. The form is used by the state of New Jersey to track the income of its residents and to ensure that the correct amount of taxes is paid. The form is typically filed by employers, government agencies, and other organizations that make payments to individuals.

Types of Income Reported on Form 1099 G

Form 1099 G is used to report a variety of types of income, including:

- Unemployment compensation

- State and local income tax refunds

- Reemployment assistance

- Trade readjustment allowances

- Disaster relief payments

- Other types of income

Filing Requirements

To determine if you need to file Form 1099 G, you will need to check the following requirements:

- You are an employer or a government agency that made payments to individuals

- You made payments of $600 or more to an individual in a calendar year

- You made payments to an individual that are subject to state and local income tax withholding

Steps to File Form 1099 G

Filing Form 1099 G is a straightforward process that can be completed in a few steps:

- Gather Information: You will need to gather the necessary information to complete the form, including the recipient's name, address, and social security number, as well as the amount of income paid.

- Complete the Form: You will need to complete Form 1099 G, which can be downloaded from the New Jersey Department of Treasury website or obtained from a tax professional.

- File the Form: You will need to file the form with the New Jersey Department of Treasury by the required deadline, which is typically January 31st of each year.

- Provide a Copy to the Recipient: You will also need to provide a copy of the form to the recipient by the required deadline.

Deadlines and Penalties

The deadline to file Form 1099 G is typically January 31st of each year. Failure to file the form by the deadline can result in penalties and fines.

Common Mistakes to Avoid

When filing Form 1099 G, there are several common mistakes to avoid, including:

- Late Filing: Failing to file the form by the deadline can result in penalties and fines.

- Inaccurate Information: Providing inaccurate information on the form can result in delays and additional scrutiny.

- Missing Information: Failing to provide all required information can result in delays and additional scrutiny.

Tips for Filing Form 1099 G

Here are some tips to keep in mind when filing Form 1099 G:

- Use the Correct Form: Make sure to use the correct form, which can be downloaded from the New Jersey Department of Treasury website or obtained from a tax professional.

- Double-Check Information: Double-check all information on the form to ensure accuracy.

- File Electronically: Consider filing the form electronically to avoid delays and additional scrutiny.

Additional Resources

For more information on filing Form 1099 G in New Jersey, you can visit the following resources:

- New Jersey Department of Treasury: The New Jersey Department of Treasury website provides detailed information on filing Form 1099 G, including the necessary forms and instructions.

- Internal Revenue Service: The Internal Revenue Service website provides additional information on filing Form 1099 G, including the federal requirements and deadlines.

FAQs

Here are some frequently asked questions about filing Form 1099 G in New Jersey:

- What is the deadline to file Form 1099 G?: The deadline to file Form 1099 G is typically January 31st of each year.

- What types of income need to be reported on Form 1099 G?: Form 1099 G is used to report a variety of types of income, including unemployment compensation, state and local income tax refunds, and other types of income.

- Who needs to file Form 1099 G?: Employers, government agencies, and other organizations that make payments to individuals need to file Form 1099 G.

What is the penalty for late filing of Form 1099 G?

+The penalty for late filing of Form 1099 G can range from $30 to $100 per form, depending on the number of forms filed late.

Can I file Form 1099 G electronically?

+Do I need to provide a copy of Form 1099 G to the recipient?

+We hope this guide has provided you with the necessary information to file Form 1099 G in New Jersey. If you have any additional questions or concerns, please don't hesitate to contact us.