In the state of Illinois, tax season can be a daunting time for many residents. With numerous forms to fill out and deadlines to meet, it's essential to understand the various documents you'll be working with. One such form that may require some clarification is Form 1099-G. If you're a recipient of this form, you're likely wondering what it's used for and how it affects your tax obligations.

Form 1099-G is a crucial document that reports certain types of income and payments to the Internal Revenue Service (IRS). In Illinois, this form is used to report various government payments, including state and local income tax refunds, unemployment benefits, and other types of income. Understanding the different aspects of Form 1099-G can help you navigate the tax preparation process more efficiently. Here are five ways to understand Form 1099-G in Illinois:

What is Form 1099-G?

Form 1099-G is an information return used by the government to report various types of income and payments to the IRS. In Illinois, this form is used to report state and local income tax refunds, unemployment benefits, and other types of income. The form is typically mailed to recipients by January 31st of each year, and it's essential to keep it for your tax records.

The information reported on Form 1099-G includes:

- State and local income tax refunds

- Unemployment benefits

- Other types of income, such as agricultural payments and fishing boat proceeds

Why do I need Form 1099-G?

You'll need Form 1099-G to accurately report your income and claim any applicable credits or deductions on your tax return. The form provides essential information that you'll use to complete your tax return, and it's used by the IRS to verify the income and payments reported on your return.

In Illinois, you may receive Form 1099-G if you:

- Received a state or local income tax refund

- Claimed unemployment benefits

- Received other types of income reported on the form

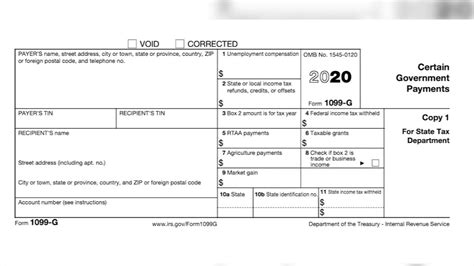

How to Read Form 1099-G

Form 1099-G can seem complex, but understanding the different sections and boxes can help you navigate the form more efficiently. Here's a breakdown of the key sections and boxes:

- Box 1: State and local income tax refunds

- Box 2: Unemployment benefits

- Box 3: Other types of income

- Box 4: Federal income tax withheld

- Box 5: State and local income tax withheld

How to Report Form 1099-G Income on Your Tax Return

When reporting Form 1099-G income on your tax return, you'll need to follow these steps:

- Review the form carefully to ensure accuracy

- Report the income and payments on the applicable lines of your tax return

- Claim any applicable credits or deductions

- Keep a copy of the form for your tax records

In Illinois, you'll report Form 1099-G income on:

- Line 1 of Form IL-1040: State and local income tax refunds

- Line 6 of Schedule A (Form IL-1040): Unemployment benefits

- Line 21 of Form IL-1040: Other types of income

Tips for Illinois Residents Receiving Form 1099-G

As an Illinois resident receiving Form 1099-G, here are some tips to keep in mind:

- Verify the accuracy of the form before reporting the income on your tax return

- Keep a copy of the form for your tax records

- Report the income and payments on the applicable lines of your tax return

- Claim any applicable credits or deductions

Common Mistakes to Avoid When Reporting Form 1099-G Income

When reporting Form 1099-G income, it's essential to avoid common mistakes that can delay your tax refund or lead to penalties. Here are some mistakes to avoid:

- Reporting incorrect income or payments

- Failing to report income or payments

- Claiming incorrect credits or deductions

By understanding Form 1099-G and following these tips, you can ensure accurate reporting of your income and payments and avoid common mistakes.

Conclusion

Form 1099-G is an essential document for Illinois residents who receive state and local income tax refunds, unemployment benefits, and other types of income. By understanding the different aspects of Form 1099-G, you can navigate the tax preparation process more efficiently and avoid common mistakes. Remember to verify the accuracy of the form, report the income and payments on the applicable lines of your tax return, and claim any applicable credits or deductions.

We hope this article has helped you understand Form 1099-G in Illinois. If you have any questions or need further clarification, please don't hesitate to comment below.

What is Form 1099-G used for?

+Form 1099-G is used to report state and local income tax refunds, unemployment benefits, and other types of income to the IRS.

Why do I need Form 1099-G?

+You'll need Form 1099-G to accurately report your income and claim any applicable credits or deductions on your tax return.

How do I report Form 1099-G income on my tax return?

+Report the income and payments on the applicable lines of your tax return, and claim any applicable credits or deductions.