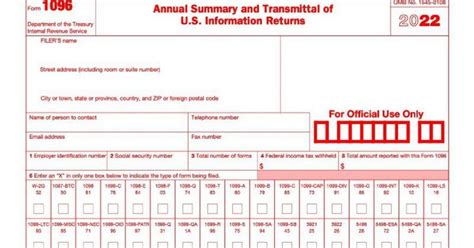

Correcting errors on tax forms is a crucial step in ensuring compliance with the IRS and avoiding any potential penalties. Form 1096, Annual Summary and Transmittal of U.S. Information Returns, is a critical document that summarizes information returns, such as Forms 1099, and is used to report miscellaneous income to the IRS. If you've made errors on your Form 1096, don't worry - correcting them is a relatively straightforward process.

The Importance of Correcting Form 1096 Errors

Filing accurate tax forms is essential to avoid delays in processing, potential penalties, and even audits. The IRS takes errors on tax forms seriously, and correcting them promptly can help prevent any adverse consequences. Form 1096 is a critical document that summarizes information returns, and errors on this form can impact the accuracy of the information reported.

Common Errors on Form 1096

Before we dive into the correction process, it's essential to identify common errors that can occur on Form 1096. These include:

- Incorrect or missing payer information

- Incorrect or missing payee information

- Incorrect or missing payment amounts

- Missing or incorrect box numbers

- Failure to sign the form

Step-by-Step Guide to Correcting Form 1096

Correcting errors on Form 1096 involves several steps. Follow these steps carefully to ensure accuracy and compliance.

Step 1: Identify the Error

The first step is to identify the error on the Form 1096. Review the form carefully and check for any discrepancies or missing information. If you're unsure about the error, consult the IRS instructions or seek professional help.

Step 2: Prepare a Corrected Form 1096

Once you've identified the error, prepare a corrected Form 1096. You can obtain a blank Form 1096 from the IRS website or use tax preparation software. Fill out the corrected form with the accurate information, ensuring that you've corrected the error.

Step 3: Mark the Corrected Form

Mark the corrected Form 1096 as "CORRECTED" in the top margin of the form. This is essential to indicate that the form is a corrected version.

Step 4: Sign the Corrected Form

Sign the corrected Form 1096 in the same manner as the original form. Ensure that you've signed the form with the same title and authority as the original form.

Step 5: Submit the Corrected Form

Submit the corrected Form 1096 to the IRS, along with a copy of the original form, if requested. You can submit the corrected form electronically or by mail, depending on the IRS requirements.

Best Practices for Avoiding Errors on Form 1096

To avoid errors on Form 1096, follow these best practices:

- Verify payer and payee information carefully

- Double-check payment amounts and box numbers

- Ensure that the form is signed correctly

- Review the form carefully before submitting it to the IRS

Penalties for Errors on Form 1096

The IRS imposes penalties for errors on Form 1096, including:

- Late filing fees

- Accuracy-related penalties

- Failure-to-file penalties

To avoid these penalties, it's essential to correct errors promptly and accurately.

Conclusion

Correcting errors on Form 1096 is a critical step in ensuring compliance with the IRS and avoiding potential penalties. By following the step-by-step guide outlined above, you can correct errors accurately and efficiently. Remember to identify the error, prepare a corrected form, mark the corrected form, sign the corrected form, and submit the corrected form to the IRS. By following best practices and avoiding common errors, you can ensure accurate and compliant tax reporting.

Call to Action

We encourage you to share your experiences or ask questions about correcting Form 1096 errors in the comments section below. Additionally, if you found this article helpful, please share it with your colleagues or friends who may benefit from this information.

FAQ Section

What is the deadline for filing Form 1096?

+The deadline for filing Form 1096 is typically January 31st of each year, unless the deadline falls on a weekend or holiday, in which case it will be the next business day.

Can I file Form 1096 electronically?

+Yes, you can file Form 1096 electronically through the IRS's FIRE (Filing Information Returns Electronically) system.

What are the consequences of not correcting errors on Form 1096?

+The consequences of not correcting errors on Form 1096 can include penalties, fines, and even audits. It's essential to correct errors promptly and accurately to avoid these consequences.