As a partnership, filing tax returns can be a complex and time-consuming process. Form 1065, also known as the U.S. Return of Partnership Income, is a critical document that must be submitted to the IRS annually. To make this process easier, many tax professionals and partnerships rely on specialized software designed specifically for Form 1065 preparation. In this article, we will explore the 5 best Form 1065 software options for partnership tax returns.

The Importance of Accurate Partnership Tax Returns

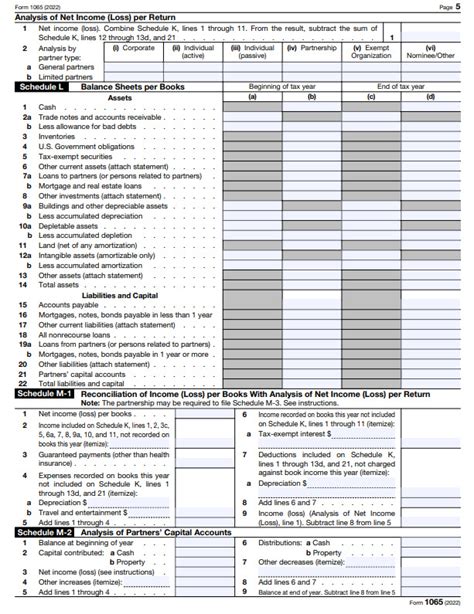

Accurate and timely filing of partnership tax returns is crucial to avoid penalties, fines, and potential audits. The IRS requires partnerships to file Form 1065, which reports the partnership's income, deductions, and credits. This form also includes the Schedule K-1, which provides each partner's share of income, deductions, and credits.

Key Features to Look for in Form 1065 Software

When selecting a Form 1065 software, there are several key features to consider:

- Ease of use: The software should be user-friendly, with an intuitive interface that makes it easy to navigate and prepare the return.

- Accuracy: The software should accurately calculate the partnership's income, deductions, and credits, as well as each partner's share.

- Compliance: The software should ensure compliance with IRS regulations and deadlines.

- Integration: The software should integrate with other tax preparation software, if necessary.

- Support: The software provider should offer reliable customer support and training.

5 Best Form 1065 Software Options

Based on these criteria, here are the 5 best Form 1065 software options for partnership tax returns:

1. Drake Software

Drake Software is a comprehensive tax preparation software that includes a module specifically designed for Form 1065 preparation. The software offers a user-friendly interface, accurate calculations, and compliance with IRS regulations.

Key Features:

- Easy data entry: Drake Software offers a simple and intuitive data entry process.

- Automatic calculations: The software automatically calculates the partnership's income, deductions, and credits.

- Compliance: Drake Software ensures compliance with IRS regulations and deadlines.

2. ATX Tax Software

ATX Tax Software is a robust tax preparation software that includes a Form 1065 module. The software offers advanced features, such as automated calculations and compliance checks.

Key Features:

- Advanced calculations: ATX Tax Software offers advanced calculations, including depreciation and amortization.

- Compliance checks: The software performs compliance checks to ensure accuracy and avoid errors.

- Integration: ATX Tax Software integrates with other tax preparation software.

3. CCH Axcess Tax

CCH Axcess Tax is a comprehensive tax preparation software that includes a Form 1065 module. The software offers advanced features, such as automated calculations and compliance checks.

Key Features:

- Automated calculations: CCH Axcess Tax offers automated calculations, including depreciation and amortization.

- Compliance checks: The software performs compliance checks to ensure accuracy and avoid errors.

- Integration: CCH Axcess Tax integrates with other tax preparation software.

4. Thomson Reuters UltraTax CS

Thomson Reuters UltraTax CS is a comprehensive tax preparation software that includes a Form 1065 module. The software offers advanced features, such as automated calculations and compliance checks.

Key Features:

- Automated calculations: Thomson Reuters UltraTax CS offers automated calculations, including depreciation and amortization.

- Compliance checks: The software performs compliance checks to ensure accuracy and avoid errors.

- Integration: Thomson Reuters UltraTax CS integrates with other tax preparation software.

5. TaxSlayer Pro

TaxSlayer Pro is a comprehensive tax preparation software that includes a Form 1065 module. The software offers advanced features, such as automated calculations and compliance checks.

Key Features:

- Automated calculations: TaxSlayer Pro offers automated calculations, including depreciation and amortization.

- Compliance checks: The software performs compliance checks to ensure accuracy and avoid errors.

- Integration: TaxSlayer Pro integrates with other tax preparation software.

Final Thoughts

Preparing Form 1065 can be a complex and time-consuming process, but with the right software, it can be made easier. The 5 best Form 1065 software options listed above offer a range of features, including ease of use, accuracy, compliance, and integration. When selecting a software, consider your specific needs and choose the one that best fits your requirements.

What is Form 1065?

+Form 1065 is the U.S. Return of Partnership Income, which is a tax form that partnerships must file annually with the IRS.

What is the deadline for filing Form 1065?

+The deadline for filing Form 1065 is typically March 15th of each year.

Can I prepare Form 1065 manually?

+While it is possible to prepare Form 1065 manually, it is not recommended, as it can be complex and time-consuming. Using specialized software can make the process easier and more accurate.