The Form 1065 Schedule M-3 is a critical component of the partnership tax return, providing the Internal Revenue Service (IRS) with detailed information about a partnership's financial performance. For partnerships with total assets exceeding $10 million, the Schedule M-3 is a mandatory requirement. However, even for smaller partnerships, understanding and mastering the Schedule M-3 can be beneficial in ensuring accurate and compliant tax reporting. In this article, we will delve into the world of Form 1065 Schedule M-3, exploring its significance, benefits, and challenges. We will also provide five essential tips to help partnerships navigate the complexities of the Schedule M-3.

Why is the Schedule M-3 Important?

The Schedule M-3 is a critical component of the partnership tax return, as it provides the IRS with a detailed picture of a partnership's financial performance. The schedule requires partnerships to reconcile their financial statement net income (loss) to their taxable income (loss). This reconciliation is essential, as it enables the IRS to verify the accuracy of a partnership's tax return and identify potential errors or discrepancies.

Benefits of Mastering the Schedule M-3

Mastering the Schedule M-3 can have numerous benefits for partnerships, including:

- Improved accuracy: By accurately completing the Schedule M-3, partnerships can ensure that their tax returns are accurate and compliant with IRS regulations.

- Reduced risk of audit: By providing a detailed and accurate picture of a partnership's financial performance, the Schedule M-3 can help reduce the risk of an IRS audit.

- Enhanced financial transparency: The Schedule M-3 requires partnerships to provide detailed financial information, which can help promote transparency and accountability within the partnership.

Tip 1: Understand the Requirements and Exceptions

To master the Schedule M-3, it's essential to understand the requirements and exceptions that apply to your partnership. For example:

- Partnerships with total assets exceeding $10 million are required to file the Schedule M-3.

- Partnerships with total assets below $10 million may voluntarily file the Schedule M-3.

- Certain types of partnerships, such as real estate investment trusts (REITs) and real estate mortgage investment conduits (REMICs), are exempt from filing the Schedule M-3.

Tip 2: Identify and Report Financial Statement Items

The Schedule M-3 requires partnerships to identify and report financial statement items, including:

- Net income (loss)

- Total assets

- Total liabilities

- Equity

It's essential to accurately identify and report these items, as they will be used to reconcile the partnership's financial statement net income (loss) to their taxable income (loss).

Tip 3: Reconcile Financial Statement Net Income (Loss) to Taxable Income (Loss)

The Schedule M-3 requires partnerships to reconcile their financial statement net income (loss) to their taxable income (loss). This reconciliation involves:

- Identifying and reporting financial statement items

- Identifying and reporting taxable income (loss)

- Reconciling the two amounts

It's essential to accurately reconcile the financial statement net income (loss) to the taxable income (loss), as this will ensure that the partnership's tax return is accurate and compliant with IRS regulations.

Tip 4: Complete the Required Schedules and Statements

The Schedule M-3 requires partnerships to complete several schedules and statements, including:

- Schedule M-3, Part I: Financial Statement Net Income (Loss) Reconciliation

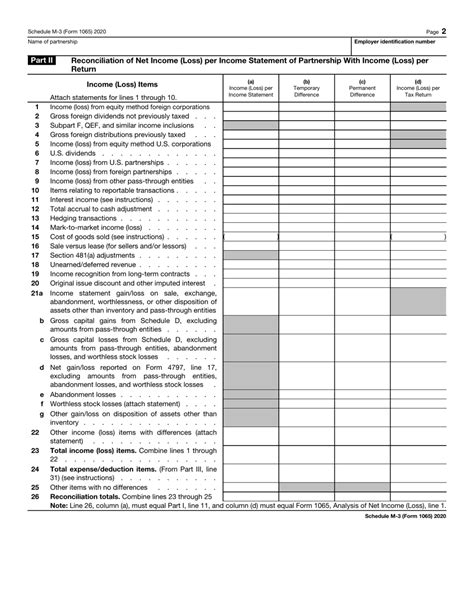

- Schedule M-3, Part II: Reconciliation of Net Income (Loss) per the Financial Statements to Net Income (Loss) per the Income Statement

- Statement 1: Financial Statement Net Income (Loss) Reconciliation

It's essential to accurately complete these schedules and statements, as they provide critical information about the partnership's financial performance.

Tip 5: Seek Professional Help When Needed

Mastering the Schedule M-3 can be complex and time-consuming, especially for partnerships with complex financial structures. If you're unsure about any aspect of the Schedule M-3, it's essential to seek professional help from a qualified tax professional or accountant.

By following these five essential tips, partnerships can master the Form 1065 Schedule M-3 and ensure accurate and compliant tax reporting.

Get Started with Mastering the Schedule M-3 Today!

Mastering the Schedule M-3 requires time, effort, and expertise. If you're ready to get started, we encourage you to take the first step today. Whether you're a seasoned tax professional or a newcomer to the world of partnership taxation, our expert team is here to help. Contact us today to learn more about our Schedule M-3 services and how we can help you achieve accurate and compliant tax reporting.

What is the purpose of the Schedule M-3?

+The Schedule M-3 is used to reconcile a partnership's financial statement net income (loss) to their taxable income (loss).

Who is required to file the Schedule M-3?

+Partnerships with total assets exceeding $10 million are required to file the Schedule M-3.

What is the deadline for filing the Schedule M-3?

+The deadline for filing the Schedule M-3 is typically April 15th for calendar-year partnerships.