As a business owner, filing taxes can be a daunting task, especially when it comes to navigating the complexities of Form 1065. One crucial section of this form is Line 20, which deals with "Other Deductions." In this article, we will delve into the world of Other Deductions and explore the worksheet that helps you calculate this essential line item.

Understanding the Importance of Other Deductions

Before we dive into the worksheet, it's essential to understand why Other Deductions are crucial for your business. These deductions represent expenses that don't fit into other categories, such as operating expenses, salaries, or taxes. By accurately calculating Other Deductions, you can reduce your taxable income and ultimately lower your tax liability.

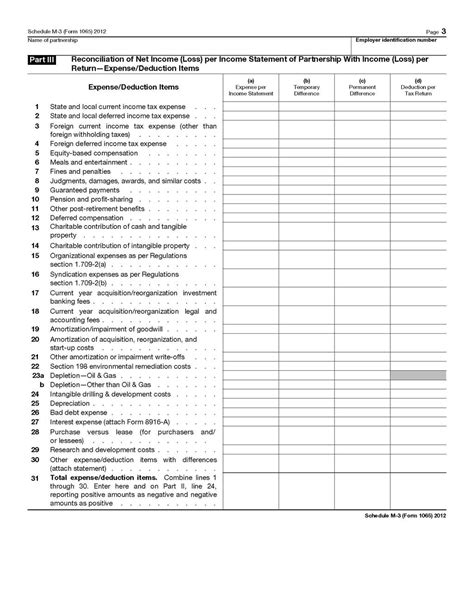

What is the Other Deductions Worksheet?

The Other Deductions Worksheet is a companion to Form 1065, Line 20. It's a tool designed to help you calculate the total amount of Other Deductions for your business. The worksheet is typically found in the instructions for Form 1065 or can be downloaded from the IRS website.

Completing the Other Deductions Worksheet

To complete the worksheet, you'll need to gather information about your business's expenses. Here's a step-by-step guide to help you navigate the process:

Step 1: Identify Eligible Expenses

Start by reviewing your business's financial records to identify expenses that qualify as Other Deductions. These may include:

- Professional fees (e.g., attorney, accountant, or consultant fees)

- Bank fees and charges

- Credit card interest

- Insurance premiums (excluding health insurance)

- Travel expenses (excluding meals and lodging)

- Education expenses

- Miscellaneous business expenses

Step 2: Categorize Expenses

Group your eligible expenses into categories, such as:

- Professional fees

- Bank fees and charges

- Credit card interest

- Insurance premiums

- Travel expenses

- Education expenses

- Miscellaneous business expenses

Step 3: Calculate Total Expenses

Calculate the total amount for each category by adding up the individual expenses.

Step 4: Complete the Worksheet

Transfer the total amount for each category to the corresponding line on the worksheet. Add up the totals to arrive at the overall Other Deductions amount.

Step 5: Report on Form 1065

Enter the total Other Deductions amount from the worksheet on Form 1065, Line 20.

Common Mistakes to Avoid

When completing the Other Deductions Worksheet, be aware of the following common mistakes:

- Incorrect categorization: Ensure you correctly categorize expenses to avoid misreporting.

- Omitting expenses: Double-check your financial records to ensure you haven't missed any eligible expenses.

- Inaccurate calculations: Verify your calculations to avoid errors.

Tips for Maximizing Other Deductions

To maximize your Other Deductions, consider the following tips:

- Maintain accurate records: Keep detailed records of your business expenses to ensure you can claim all eligible deductions.

- Consult a tax professional: If you're unsure about what expenses qualify as Other Deductions, consult a tax professional for guidance.

- Stay up-to-date on tax law changes: Familiarize yourself with changes to tax laws and regulations that may impact your Other Deductions.

Conclusion

In conclusion, accurately calculating Other Deductions is crucial for minimizing your business's tax liability. By understanding the importance of Other Deductions and completing the worksheet correctly, you can ensure you're taking advantage of all eligible expenses. Remember to maintain accurate records, consult a tax professional if needed, and stay informed about tax law changes to maximize your Other Deductions.

Take Action

- Review your business's financial records to identify eligible expenses.

- Complete the Other Deductions Worksheet accurately.

- Consult a tax professional if you're unsure about any aspect of the process.

By following these steps and tips, you'll be well on your way to optimizing your Other Deductions and reducing your tax liability.

FAQs

What is the purpose of the Other Deductions Worksheet?

+The Other Deductions Worksheet is a tool designed to help you calculate the total amount of Other Deductions for your business.

What types of expenses qualify as Other Deductions?

+Other Deductions may include professional fees, bank fees and charges, credit card interest, insurance premiums, travel expenses, education expenses, and miscellaneous business expenses.

How do I report Other Deductions on Form 1065?

+Enter the total Other Deductions amount from the worksheet on Form 1065, Line 20.