Filing taxes can be a daunting task, especially for individuals and businesses in Idaho who need to navigate the complexities of state-specific tax forms. One of the most critical forms for Idaho taxpayers is the Idaho Tax Form 51, also known as the Idaho Individual Income Tax Return. In this comprehensive guide, we will walk you through the step-by-step process of filling out and filing Idaho Tax Form 51, ensuring you comply with the state's tax regulations and avoid any potential penalties.

Understanding Idaho Tax Form 51: Importance and Purpose

Idaho Tax Form 51 is a vital document for individuals and businesses operating in Idaho, as it serves as the primary means of reporting income and paying state income taxes. The form is used to calculate the taxpayer's liability for state income taxes, taking into account various income sources, deductions, and credits. By accurately completing and filing Form 51, taxpayers can ensure they meet their state tax obligations and avoid any potential fines or penalties.

Why File Idaho Tax Form 51?

Filing Idaho Tax Form 51 is mandatory for all Idaho residents, part-year residents, and non-residents who earned income from Idaho sources. The form is used to report various types of income, including wages, salaries, tips, and self-employment income. By filing Form 51, taxpayers can:

- Report their Idaho income and claim deductions and credits

- Calculate their state income tax liability

- Pay any owed taxes or request a refund

- Take advantage of Idaho-specific tax credits and deductions

Who Needs to File Idaho Tax Form 51?

Idaho Tax Form 51 is required for:

- Idaho residents who earned income from any source

- Part-year residents who earned income from Idaho sources

- Non-residents who earned income from Idaho sources

- Businesses operating in Idaho, including corporations, partnerships, and sole proprietorships

Gathering Required Documents

Before starting the filing process, it's essential to gather all required documents and information. This includes:

- Federal income tax return (Form 1040)

- W-2 forms for all employers

- 1099 forms for self-employment income

- Interest statements (1099-INT)

- Dividend statements (1099-DIV)

- Capital gains statements (1099-B)

- Charitable donation receipts

- Medical expense receipts

- Business expense records (for self-employment income)

Filing Status and Exemptions

Taxpayers need to determine their filing status and claim any applicable exemptions. Idaho recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

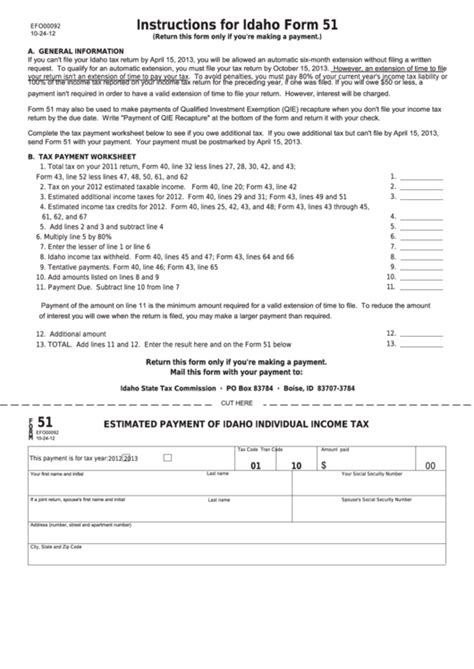

Filing Idaho Tax Form 51: Step-by-Step Instructions

Now that we've covered the basics, let's dive into the step-by-step process of filling out and filing Idaho Tax Form 51.

- Download and print Form 51: Visit the Idaho State Tax Commission website to download and print Form 51.

- Complete the header section: Enter your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Report income: Report all income from Idaho sources, including wages, salaries, tips, and self-employment income.

- Claim deductions and credits: Claim deductions for charitable donations, medical expenses, and business expenses. Also, claim credits for Idaho-specific tax credits, such as the Idaho Child Tax Credit.

- Calculate tax liability: Calculate your state income tax liability using the Idaho tax tables or tax calculator.

- Pay owed taxes or request a refund: If you owe taxes, pay the amount due by the filing deadline. If you're due a refund, request a direct deposit or paper check.

Filing Options and Deadlines

Taxpayers can file Idaho Tax Form 51 electronically or by mail. The filing deadline is typically April 15th, but this date may vary if you're filing an amended return or requesting an extension.

- E-file: File electronically using the Idaho State Tax Commission's online portal or through a tax software provider.

- Mail: Mail your completed Form 51 to the Idaho State Tax Commission.

Common Mistakes to Avoid

When filing Idaho Tax Form 51, avoid the following common mistakes:

- Inaccurate income reporting: Ensure you report all income from Idaho sources accurately.

- Incorrect deductions and credits: Claim only eligible deductions and credits.

- Math errors: Double-check your calculations to avoid math errors.

- Missing signatures: Sign and date your return to avoid delays.

Amended Returns and Audits

If you need to amend your return or respond to an audit, follow these steps:

- Amended returns: File Form 51X, Amended Idaho Individual Income Tax Return, to correct errors or report additional income.

- Audits: Respond to audit notices promptly, providing required documentation and information.

Conclusion

Filing Idaho Tax Form 51 is a crucial step in meeting your state tax obligations. By following the step-by-step instructions outlined in this guide, you'll be able to accurately complete and file your return, avoiding potential penalties and fines. Remember to gather all required documents, claim eligible deductions and credits, and avoid common mistakes.

Final Tips and Reminders

- Seek professional help: Consult a tax professional or accountant if you're unsure about any aspect of the filing process.

- Stay organized: Keep accurate records of your income, deductions, and credits.

- File on time: Meet the filing deadline to avoid penalties and interest.

What is the deadline for filing Idaho Tax Form 51?

+The filing deadline for Idaho Tax Form 51 is typically April 15th, but this date may vary if you're filing an amended return or requesting an extension.

Can I file Idaho Tax Form 51 electronically?

+Yes, you can file Idaho Tax Form 51 electronically using the Idaho State Tax Commission's online portal or through a tax software provider.

What are the penalties for not filing Idaho Tax Form 51?

+Penalties for not filing Idaho Tax Form 51 include a late filing fee, interest on owed taxes, and potential audit and examination fees.