Unlocking the Mysteries of Form 1065 K-1 Codes

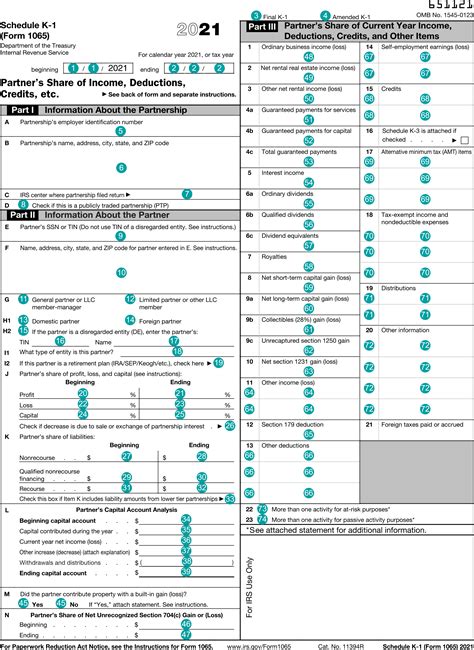

As a partner in a partnership or a shareholder in an S corporation, receiving a Form 1065 K-1 or Form 1120S K-1 can be a daunting experience, especially when faced with the numerous codes and schedules that accompany it. The Form 1065 K-1 is a crucial document that reports your share of income, deductions, and credits from a partnership, while the Form 1120S K-1 serves the same purpose for S corporations. Decoding these codes is essential to accurately report your share of income and claim the correct deductions on your tax return.

In this article, we will delve into the world of Form 1065 K-1 codes, explaining the different types of codes, how to read them, and what they mean for your tax obligations. By the end of this article, you will have a comprehensive understanding of Form 1065 K-1 codes and be able to navigate the complexities of partnership and S corporation taxation with confidence.

Understanding the Basics of Form 1065 K-1 Codes

The Form 1065 K-1 is a schedules-based form, which means that the information is presented in a series of schedules and codes. These codes are used to identify the type of income, deduction, or credit being reported. The codes are usually presented in a three-digit format, with the first digit indicating the type of item being reported (e.g., income, deduction, or credit).

Types of Form 1065 K-1 Codes

There are several types of codes used on the Form 1065 K-1, including:

- Income codes: These codes report the partner's share of income from the partnership, such as ordinary business income, rental income, or interest income.

- Deduction codes: These codes report the partner's share of deductions, such as business expenses, charitable contributions, or mortgage interest.

- Credit codes: These codes report the partner's share of tax credits, such as the foreign tax credit or the research and development credit.

How to Read Form 1065 K-1 Codes

Reading Form 1065 K-1 codes can be challenging, but understanding the format and structure of the codes can make it easier. Here are some tips for reading Form 1065 K-1 codes:

- Identify the code type: The first digit of the code indicates the type of item being reported (e.g., income, deduction, or credit).

- Understand the code description: The code description provides a brief explanation of the item being reported.

- Check the schedule: The schedule number indicates which schedule the code is related to (e.g., Schedule K-1, Schedule K-2, etc.).

Common Form 1065 K-1 Codes

Here are some common Form 1065 K-1 codes:

- Code 1: Ordinary business income: This code reports the partner's share of ordinary business income from the partnership.

- Code 2: Rental income: This code reports the partner's share of rental income from the partnership.

- Code 3: Interest income: This code reports the partner's share of interest income from the partnership.

- Code 4: Dividend income: This code reports the partner's share of dividend income from the partnership.

- Code 5: Capital gains: This code reports the partner's share of capital gains from the partnership.

How to Report Form 1065 K-1 Codes on Your Tax Return

Reporting Form 1065 K-1 codes on your tax return is crucial to accurately report your share of income and claim the correct deductions. Here are some tips for reporting Form 1065 K-1 codes:

- Use the correct schedule: Use the correct schedule to report the Form 1065 K-1 codes (e.g., Schedule K-1, Schedule K-2, etc.).

- Report the correct code: Report the correct code for each item being reported (e.g., income, deduction, or credit).

- Check the instructions: Check the instructions for the specific code to ensure accurate reporting.

Tips and Tricks for Decoding Form 1065 K-1 Codes

Here are some tips and tricks for decoding Form 1065 K-1 codes:

- Use the IRS instructions: Use the IRS instructions for the Form 1065 K-1 to understand the codes and schedules.

- Consult a tax professional: Consult a tax professional if you are unsure about how to read or report Form 1065 K-1 codes.

- Keep accurate records: Keep accurate records of your partnership or S corporation income and expenses to ensure accurate reporting.

Conclusion

Decoding Form 1065 K-1 codes can be a complex task, but understanding the basics of the codes and how to read them can make it easier. By following the tips and tricks outlined in this article, you can accurately report your share of income and claim the correct deductions on your tax return. Remember to always consult a tax professional if you are unsure about how to read or report Form 1065 K-1 codes.

Take Action

- If you have received a Form 1065 K-1 or Form 1120S K-1, review the codes and schedules to understand your share of income and deductions.

- Consult a tax professional if you are unsure about how to read or report Form 1065 K-1 codes.

- Keep accurate records of your partnership or S corporation income and expenses to ensure accurate reporting.

What is a Form 1065 K-1?

+A Form 1065 K-1 is a schedule-based form that reports a partner's share of income, deductions, and credits from a partnership.

What are the different types of Form 1065 K-1 codes?

+There are three main types of Form 1065 K-1 codes: income codes, deduction codes, and credit codes.

How do I report Form 1065 K-1 codes on my tax return?

+Use the correct schedule to report the Form 1065 K-1 codes, and report the correct code for each item being reported.