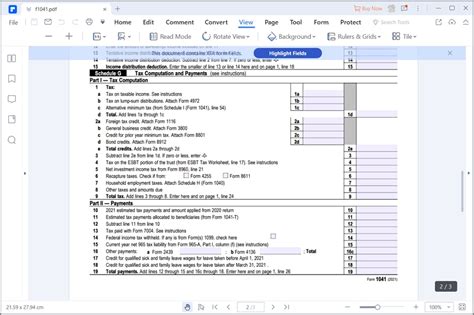

The world of tax filing can be complex and overwhelming, especially when it comes to estate and trust taxation. One of the most critical components of the tax return for estates and trusts is Form 1041, which includes Schedule D. This schedule is used to report the capital gains and losses from the sale of assets, such as stocks, bonds, and real estate. In this article, we will delve into the five essential tips for completing Form 1041 Schedule D accurately and efficiently.

Understanding the Basics of Form 1041 Schedule D

Before we dive into the tips, it's essential to understand the basics of Form 1041 Schedule D. This schedule is used to report the capital gains and losses from the sale of assets, which are then used to calculate the estate's or trust's taxable income. The schedule requires the taxpayer to provide detailed information about each sale, including the date of sale, the proceeds from the sale, and the basis of the asset.

Tip 1: Keep Accurate Records

Keeping accurate records is crucial when it comes to completing Form 1041 Schedule D. This includes maintaining detailed records of each sale, including the date of sale, the proceeds from the sale, and the basis of the asset. It's also essential to keep records of any wash sales, which occur when an asset is sold at a loss and a substantially identical asset is purchased within 30 days. Having accurate records will help ensure that the schedule is completed correctly and that the estate or trust is taking advantage of all eligible deductions.

Tip 2: Determine the Correct Basis

Determining the correct basis of an asset is critical when completing Form 1041 Schedule D. The basis is the original purchase price of the asset, plus any additional costs, such as commissions and fees. If the asset has appreciated in value, the basis will be used to calculate the gain or loss on the sale. It's essential to use the correct basis to avoid underreporting or overreporting gains or losses.

Tip 3: Report All Sales

All sales of assets must be reported on Form 1041 Schedule D, regardless of whether they result in a gain or loss. This includes sales of stocks, bonds, real estate, and other investment assets. Failure to report all sales can result in penalties and interest, so it's essential to ensure that all sales are accurately reported.

Tip 4: Calculate Gains and Losses Correctly

Calculating gains and losses correctly is critical when completing Form 1041 Schedule D. The gain or loss on the sale of an asset is calculated by subtracting the basis from the proceeds of the sale. If the result is a positive number, it's a gain, and if it's a negative number, it's a loss. It's essential to use the correct calculation to avoid underreporting or overreporting gains or losses.

Tip 5: Consider the Impact of Wash Sales

Wash sales can have a significant impact on the calculation of gains and losses on Form 1041 Schedule D. A wash sale occurs when an asset is sold at a loss and a substantially identical asset is purchased within 30 days. If a wash sale occurs, the loss on the original sale is disallowed, and the basis of the new asset is adjusted accordingly. It's essential to consider the impact of wash sales when completing the schedule to avoid underreporting or overreporting gains or losses.

Additional Tips and Considerations

In addition to the five essential tips outlined above, there are several other considerations to keep in mind when completing Form 1041 Schedule D. These include:

- Use the correct forms and schedules: In addition to Form 1041 Schedule D, you may also need to complete other forms and schedules, such as Schedule K-1 or Form 8949.

- Keep accurate records of basis: Keeping accurate records of basis is essential to ensure that gains and losses are calculated correctly.

- Consider the impact of tax law changes: Tax law changes can impact the calculation of gains and losses on Form 1041 Schedule D. It's essential to stay up-to-date on any changes and consider their impact on your tax return.

Take Action

By following these five essential tips, you can ensure that Form 1041 Schedule D is completed accurately and efficiently. Remember to keep accurate records, determine the correct basis, report all sales, calculate gains and losses correctly, and consider the impact of wash sales. If you're unsure about any aspect of the process, consider consulting with a tax professional or seeking additional guidance from the IRS.

Frequently Asked Questions

What is Form 1041 Schedule D used for?

+Form 1041 Schedule D is used to report the capital gains and losses from the sale of assets, such as stocks, bonds, and real estate.

What is the basis of an asset?

+The basis of an asset is the original purchase price, plus any additional costs, such as commissions and fees.

What is a wash sale?

+A wash sale occurs when an asset is sold at a loss and a substantially identical asset is purchased within 30 days.