Filing tax returns as a non-resident alien in the United States can be a daunting task, especially when it comes to navigating the complexities of Form 1040NR. As a non-resident alien, you are required to file a tax return if you have income from U.S. sources, and Form 1040NR is the form specifically designed for this purpose. In this article, we will provide you with 7 essential tips for filing Form 1040NR, ensuring that you comply with the tax laws and avoid any potential penalties.

Understanding Form 1040NR

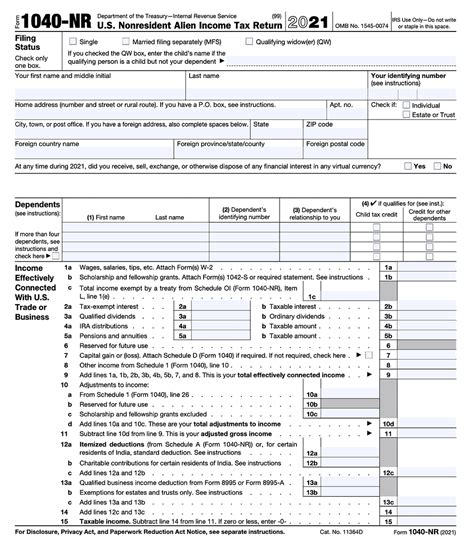

Form 1040NR is the U.S. Nonresident Alien Income Tax Return, which is used by non-resident aliens to report their income from U.S. sources. The form is used to calculate the tax liability on the income earned, and it is typically filed on an annual basis. As a non-resident alien, it is essential to understand the requirements and rules surrounding Form 1040NR to ensure compliance with the tax laws.

Tips for Filing Form 1040NR

Tip 1: Determine Your Filing Status

Before filing Form 1040NR, you need to determine your filing status. Your filing status will depend on your marital status and whether you have dependents. As a non-resident alien, you can file as single, married filing separately, or qualifying widow(er). It is essential to choose the correct filing status to ensure that you are reporting your income correctly and taking advantage of the available deductions and credits.

Tip 2: Gather Required Documents

To file Form 1040NR, you will need to gather various documents, including:

- W-2 forms from U.S. employers

- 1099 forms for freelance work or other income

- Interest statements from U.S. banks

- Dividend statements from U.S. corporations

- Proof of residency in a foreign country

It is essential to gather all the required documents to ensure that you are reporting your income accurately and taking advantage of the available deductions and credits.

Tip 3: Report All Income from U.S. Sources

As a non-resident alien, you are required to report all income from U.S. sources on Form 1040NR. This includes income from:

- U.S. employment

- Freelance work

- Interest from U.S. banks

- Dividends from U.S. corporations

- Rental income from U.S. properties

It is essential to report all income from U.S. sources to avoid penalties and ensure compliance with the tax laws.

Tip 4: Claim Available Deductions and Credits

As a non-resident alien, you may be eligible for various deductions and credits on Form 1040NR. These may include:

- Standard deduction

- Itemized deductions

- Foreign earned income exclusion

- Foreign tax credit

It is essential to claim all available deductions and credits to reduce your tax liability and maximize your refund.

Tip 5: File Form 1040NR on Time

Form 1040NR is typically due on April 15th of each year, but the deadline may vary depending on your specific situation. It is essential to file Form 1040NR on time to avoid penalties and interest on any outstanding tax liability.

Tip 6: Seek Professional Help if Needed

Filing Form 1040NR can be complex, especially if you have multiple sources of income or complex tax situations. If you need help with filing Form 1040NR, it is essential to seek professional help from a qualified tax professional or accountant. They can help you navigate the complexities of the tax laws and ensure that you are in compliance.

Tip 7: Keep Accurate Records

Finally, it is essential to keep accurate records of your income, deductions, and credits. This will help you to ensure that you are reporting your income accurately and taking advantage of the available deductions and credits. You should also keep records of your Form 1040NR filing, including a copy of the filed form and any supporting documentation.

By following these 7 essential tips, you can ensure that you are filing Form 1040NR correctly and avoiding any potential penalties or interest on your tax liability. Remember to seek professional help if needed, and keep accurate records to ensure compliance with the tax laws.

Now that you have read these essential tips, we encourage you to share your thoughts and experiences with filing Form 1040NR in the comments below. If you have any questions or need further clarification on any of the tips, please don't hesitate to ask.

What is Form 1040NR?

+Form 1040NR is the U.S. Nonresident Alien Income Tax Return, which is used by non-resident aliens to report their income from U.S. sources.

Who needs to file Form 1040NR?

+Non-resident aliens who have income from U.S. sources need to file Form 1040NR.

What is the deadline for filing Form 1040NR?

+The deadline for filing Form 1040NR is typically April 15th of each year, but may vary depending on your specific situation.