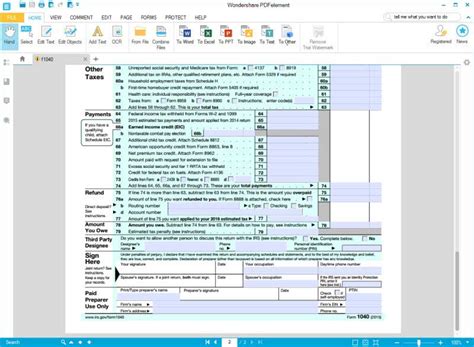

As tax season approaches, millions of Americans will be filling out their Form 1040, the standard form used for personal income tax returns. One of the most important lines on the form is Line 15a, which deals with the reporting of income taxes withheld from various sources. In this article, we will explore five tips for accurately and efficiently filling out Form 1040 Line 15a.

Tax season can be a daunting time for many individuals, with complex forms and regulations that can be difficult to navigate. However, with the right guidance and support, filling out your tax return can be a straightforward process. Line 15a is a critical component of Form 1040, as it requires you to report the total amount of income taxes withheld from various sources, such as your employer, pensions, and retirement accounts.

Failing to accurately complete Line 15a can result in delays or even penalties, which is why it's essential to take the time to understand the requirements and best practices for filling out this line. In this article, we will provide you with five valuable tips to help you complete Form 1040 Line 15a with confidence.

Tip 1: Gather All Relevant Documents

Before starting to fill out Line 15a, it's crucial to gather all relevant documents that show the amount of income taxes withheld from various sources. These documents may include:

- Form W-2, which reports your income and taxes withheld from your employer

- Form 1099-R, which reports income and taxes withheld from pensions and retirement accounts

- Form 1099-MISC, which reports miscellaneous income and taxes withheld

- Form 1099-INT, which reports interest income and taxes withheld

Make sure to review each document carefully and note the amount of taxes withheld, as this information will be used to complete Line 15a.

Tip 2: Understand the Different Types of Withholding

When filling out Line 15a, it's essential to understand the different types of withholding that may apply to your situation. There are several types of withholding, including:

- Federal income tax withholding: This is the most common type of withholding and applies to most types of income, including wages and pensions.

- State and local income tax withholding: Some states and local governments also withhold income taxes, which may be reported on Line 15a.

- Backup withholding: This type of withholding applies to certain types of income, such as interest and dividends, where the payer is required to withhold taxes if the recipient fails to provide their taxpayer identification number.

Understanding the different types of withholding will help you accurately complete Line 15a and avoid any potential errors or penalties.

Tip 3: Report All Withholding on Line 15a

When completing Line 15a, it's essential to report all withholding from various sources. This includes:

- Federal income tax withholding from Form W-2 and Form 1099-R

- State and local income tax withholding from Form W-2 and Form 1099-R

- Backup withholding from Form 1099-INT and Form 1099-MISC

Make sure to add up all the withholding amounts from each document and report the total on Line 15a.

Tip 4: Be Aware of Potential Errors and Penalties

Failing to accurately complete Line 15a can result in errors and penalties, which can delay your refund or even lead to additional taxes owed. Some common errors to avoid include:

- Underreporting or overreporting withholding amounts

- Failing to report all withholding sources

- Math errors when adding up withholding amounts

To avoid potential errors and penalties, double-check your math and ensure that you have reported all withholding amounts accurately.

Tip 5: Seek Professional Help If Needed

If you're unsure about how to complete Line 15a or have complex tax situations, it's always a good idea to seek professional help. A tax professional can guide you through the process and ensure that your tax return is accurate and complete.

Additionally, if you're experiencing financial difficulties or have questions about your tax bill, a tax professional can also provide you with advice and support.

In conclusion, filling out Form 1040 Line 15a requires attention to detail and an understanding of the different types of withholding that may apply to your situation. By gathering all relevant documents, understanding the different types of withholding, reporting all withholding on Line 15a, being aware of potential errors and penalties, and seeking professional help if needed, you can ensure that your tax return is accurate and complete.

Don't hesitate to reach out to a tax professional if you have any questions or concerns about filling out Form 1040 Line 15a. With the right guidance and support, you can navigate the tax filing process with confidence.

What is Form 1040 Line 15a?

+Form 1040 Line 15a is the line on the Form 1040 tax return where you report the total amount of income taxes withheld from various sources, such as your employer, pensions, and retirement accounts.

What documents do I need to complete Form 1040 Line 15a?

+You will need to gather all relevant documents that show the amount of income taxes withheld from various sources, including Form W-2, Form 1099-R, Form 1099-MISC, and Form 1099-INT.

What are the potential errors and penalties associated with Form 1040 Line 15a?

+Failing to accurately complete Form 1040 Line 15a can result in errors and penalties, including underreporting or overreporting withholding amounts, failing to report all withholding sources, and math errors.