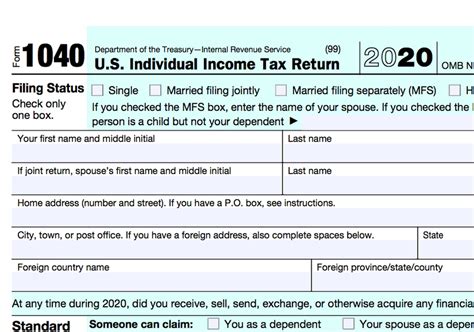

File Form 1 Tax Return With Ease And Accuracy

Filing tax returns is an essential part of being a responsible citizen, and it can be a daunting task, especially for those who are new to the process. The Form 1 tax return is a crucial document that individuals and businesses must submit to the tax authorities to report their income, expenses, and tax liability. In this article, we will guide you through the process of filing Form 1 tax return with ease and accuracy.

Understanding Form 1 Tax Return

The Form 1 tax return is a document that individuals and businesses must submit to the tax authorities to report their income, expenses, and tax liability. It is a crucial document that helps the tax authorities to assess the tax liability of an individual or business and ensure that they are in compliance with the tax laws.

Who Needs to File Form 1 Tax Return?

Not everyone needs to file a Form 1 tax return. However, individuals and businesses that meet certain criteria must submit this form to the tax authorities. These include:

- Individuals who have an income above a certain threshold

- Businesses that have a taxable income

- Individuals who have made capital gains or losses

- Individuals who have made charitable donations

Benefits of Filing Form 1 Tax Return Accurately

Filing Form 1 tax return accurately has several benefits. These include:

- Avoiding penalties and fines for non-compliance

- Ensuring that you are taking advantage of all the tax deductions and credits available to you

- Getting a refund if you have overpaid your taxes

- Reducing the risk of an audit

- Ensuring that you are in compliance with the tax laws

How to File Form 1 Tax Return

Filing Form 1 tax return can be a complex process, but it can be broken down into several steps. These include:

- Gathering all the necessary documents and information

- Filling out the Form 1 tax return form accurately and completely

- Submitting the form to the tax authorities

- Paying any tax liability or requesting a refund

Common Mistakes to Avoid When Filing Form 1 Tax Return

When filing Form 1 tax return, there are several common mistakes to avoid. These include:

- Failing to report all income

- Claiming incorrect deductions and credits

- Failing to submit the form on time

- Failing to pay any tax liability

- Failing to keep accurate records

Tips for Filing Form 1 Tax Return Accurately

Filing Form 1 tax return accurately requires attention to detail and careful planning. Here are some tips to help you file your Form 1 tax return accurately:

- Start early to avoid last-minute rush

- Gather all the necessary documents and information

- Use tax software or consult a tax professional

- Double-check your calculations and entries

- Keep accurate records

Conclusion

Filing Form 1 tax return can be a complex process, but it can be broken down into several steps. By understanding the benefits of filing Form 1 tax return accurately, avoiding common mistakes, and following tips for filing accurately, you can ensure that you are in compliance with the tax laws and avoiding any penalties or fines.

We hope this article has been informative and helpful in guiding you through the process of filing Form 1 tax return with ease and accuracy. If you have any questions or comments, please feel free to share them below.

What is Form 1 tax return?

+Form 1 tax return is a document that individuals and businesses must submit to the tax authorities to report their income, expenses, and tax liability.

Who needs to file Form 1 tax return?

+Individuals and businesses that meet certain criteria, such as having an income above a certain threshold or making charitable donations, must file Form 1 tax return.

What are the benefits of filing Form 1 tax return accurately?

+Filing Form 1 tax return accurately can help you avoid penalties and fines, ensure you are taking advantage of all tax deductions and credits, and reduce the risk of an audit.