Filing tax forms can be a daunting task, especially for those who are new to the process. One such form that may cause confusion is Form 05-158, used for reporting certain types of income or claiming specific deductions. In this article, we will provide a comprehensive guide on how to complete Form 05-158, breaking down the process into manageable steps.

Understanding Form 05-158

Before we dive into the step-by-step guide, it's essential to understand the purpose of Form 05-158 and who needs to file it. This form is typically used by individuals who have received income from sources that are not subject to withholding, such as freelance work, self-employment, or rental income. It's also used to claim deductions for expenses related to these types of income.

Gathering Required Documents

To complete Form 05-158 accurately, you'll need to gather specific documents and information. These may include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your employer identification number (EIN) if you're self-employed

- Records of income from freelance work, self-employment, or rental income

- Receipts for expenses related to these types of income

- Your tax return from the previous year (if applicable)

Step 1: Fill in Your Personal Information

The first section of Form 05-158 requires you to fill in your personal information, including your name, address, Social Security number or ITIN, and EIN (if applicable). Make sure to double-check this information for accuracy.

Step 2: Report Your Income

In this section, you'll report your income from sources that are not subject to withholding. This may include:

- Freelance work: List your clients and the amount of money you earned from each

- Self-employment: Report your net earnings from self-employment

- Rental income: List your rental properties and the amount of money you earned from each

Step 3: Claim Your Deductions

Next, you'll claim deductions for expenses related to your income. This may include:

- Business expenses: List your business expenses, such as equipment, supplies, and travel expenses

- Home office deduction: Calculate your home office deduction using the simplified option or the actual expenses method

- Rental expenses: List your rental expenses, such as mortgage interest, property taxes, and maintenance costs

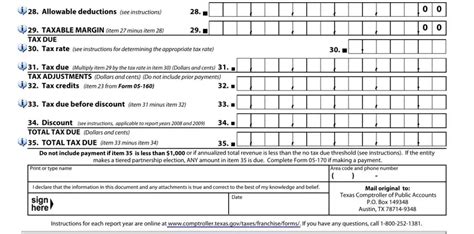

Step 4: Calculate Your Tax Liability

Using the information you've reported, calculate your tax liability. You'll need to subtract your deductions from your total income to determine your taxable income.

Step 5: Sign and Date the Form

Finally, sign and date the form. Make sure to keep a copy of the completed form for your records.

Additional Tips and Considerations

- Make sure to file Form 05-158 on time to avoid penalties and interest

- Keep accurate records of your income and expenses to support your tax return

- Consider consulting a tax professional if you're unsure about how to complete the form

Common Mistakes to Avoid

- Failing to report all income from sources that are not subject to withholding

- Not keeping accurate records of expenses and income

- Not signing and dating the form

- Filing the form late or not filing it at all

Conclusion

Completing Form 05-158 can seem daunting, but by following these steps and tips, you can ensure accuracy and avoid common mistakes. Remember to keep accurate records, report all income, and claim your deductions to minimize your tax liability. If you're unsure about any part of the process, consider consulting a tax professional.

We hope this guide has been helpful in completing Form 05-158. If you have any questions or need further assistance, please don't hesitate to comment below.

What is Form 05-158 used for?

+Form 05-158 is used to report income from sources that are not subject to withholding, such as freelance work, self-employment, or rental income. It's also used to claim deductions for expenses related to these types of income.

Who needs to file Form 05-158?

+Individuals who have received income from sources that are not subject to withholding, such as freelance work, self-employment, or rental income, need to file Form 05-158.

What documents do I need to complete Form 05-158?

+You'll need to gather specific documents and information, including your Social Security number or ITIN, employer identification number (EIN) if you're self-employed, records of income from freelance work, self-employment, or rental income, and receipts for expenses related to these types of income.