Filling out the FL2 NC form can be a daunting task, especially for those who are new to the process. The FL2 NC form is a crucial document used to report on the income and expenses of a company, and it's essential to fill it out accurately to avoid any errors or penalties. In this article, we will guide you through the process of filling out the FL2 NC form correctly, highlighting five key ways to ensure you get it right.

Understanding the FL2 NC Form

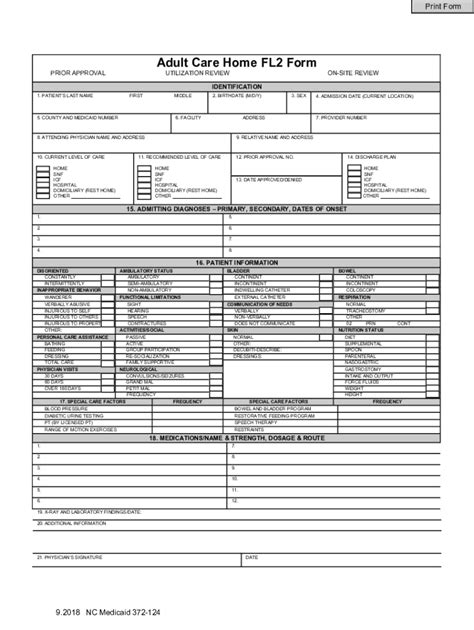

Before we dive into the ways to fill out the FL2 NC form correctly, it's essential to understand the purpose of the form and its structure. The FL2 NC form is used to report on the income and expenses of a company, and it's typically filed annually. The form consists of several sections, including the company's details, income, expenses, and tax calculations.

Section 1: Company Details

The first section of the FL2 NC form requires you to provide the company's details, including the company name, address, and tax identification number. It's essential to ensure that the information provided is accurate and up-to-date.

5 Ways to Fill Out the FL2 NC Form Correctly

1. Gather All Necessary Documents

Before starting to fill out the FL2 NC form, it's essential to gather all necessary documents, including the company's financial statements, receipts, and invoices. Having all the required documents will ensure that you have all the necessary information to fill out the form accurately.

2. Use the Correct Accounting Method

The FL2 NC form requires you to use the correct accounting method, either cash or accrual. It's essential to choose the correct method to ensure that your financial statements are accurate and comply with the relevant tax laws.

3. Report All Income and Expenses

The FL2 NC form requires you to report all income and expenses, including salaries, wages, rent, and utilities. It's essential to ensure that all income and expenses are reported accurately to avoid any errors or penalties.

4. Calculate Tax Correctly

The FL2 NC form requires you to calculate the company's tax liability correctly. It's essential to ensure that all tax calculations are accurate and comply with the relevant tax laws.

5. Review and Verify the Form

Finally, it's essential to review and verify the FL2 NC form before submitting it. Ensure that all information is accurate, and all calculations are correct. You can also use tax software or consult a tax professional to ensure that the form is filled out correctly.

Common Mistakes to Avoid

When filling out the FL2 NC form, there are several common mistakes to avoid. These include:

- Inaccurate or incomplete company details

- Using the wrong accounting method

- Failing to report all income and expenses

- Incorrect tax calculations

- Failing to review and verify the form

Benefits of Filling Out the FL2 NC Form Correctly

Filling out the FL2 NC form correctly has several benefits, including:

- Avoiding errors or penalties

- Ensuring compliance with tax laws

- Reducing the risk of audit

- Improving financial management

- Enhancing credibility and reputation

Conclusion

Filling out the FL2 NC form correctly is essential to ensure compliance with tax laws and avoid any errors or penalties. By following the five ways outlined in this article, you can ensure that your FL2 NC form is filled out accurately and correctly. Remember to gather all necessary documents, use the correct accounting method, report all income and expenses, calculate tax correctly, and review and verify the form.

What is the purpose of the FL2 NC form?

+The FL2 NC form is used to report on the income and expenses of a company, and it's typically filed annually.

What are the common mistakes to avoid when filling out the FL2 NC form?

+Common mistakes to avoid include inaccurate or incomplete company details, using the wrong accounting method, failing to report all income and expenses, incorrect tax calculations, and failing to review and verify the form.

What are the benefits of filling out the FL2 NC form correctly?

+The benefits of filling out the FL2 NC form correctly include avoiding errors or penalties, ensuring compliance with tax laws, reducing the risk of audit, improving financial management, and enhancing credibility and reputation.