As a homeowner or a potential homebuyer, you may have come across the term "Fannie Mae Form 1084" during your mortgage application process. But what exactly is this form, and why is it important? In this article, we'll delve into the basics of Fannie Mae Form 1084, its purpose, and what you need to know about it.

Fannie Mae Form 1084 is a document used by lenders to determine the income and employment status of borrowers who are self-employed or have non-traditional income sources. The form is designed to help lenders assess the creditworthiness of borrowers who don't have traditional W-2 income or who have complex income structures. By understanding the basics of Fannie Mae Form 1084, you'll be better equipped to navigate the mortgage application process and increase your chances of approval.

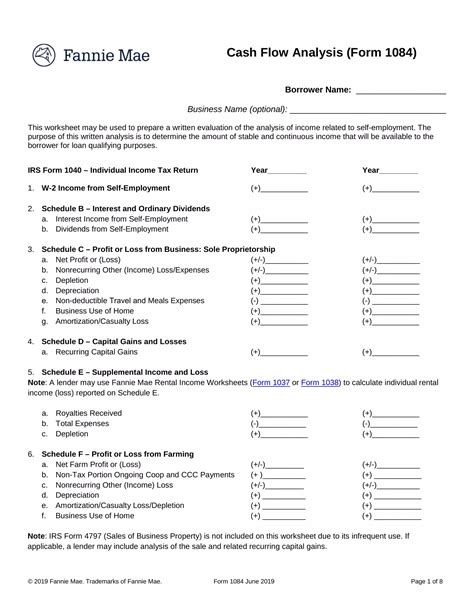

What is Fannie Mae Form 1084?

Fannie Mae Form 1084 is a standardized form used by lenders to verify the income and employment status of borrowers who are self-employed or have non-traditional income sources. The form requires borrowers to provide detailed financial information, including their business income, expenses, and tax returns. This information helps lenders determine the borrower's creditworthiness and ability to repay the loan.

Who needs to complete Fannie Mae Form 1084?

Not all borrowers need to complete Fannie Mae Form 1084. Typically, the form is required for self-employed borrowers or those with non-traditional income sources, such as:

- Small business owners

- Freelancers

- Independent contractors

- Commission-based sales professionals

- Borrowers with rental income or other investment income

If you're a borrower with a traditional W-2 income and no complex income structures, you may not need to complete Fannie Mae Form 1084.

What information is required on Fannie Mae Form 1084?

Fannie Mae Form 1084 requires borrowers to provide detailed financial information, including:

- Business income and expenses

- Tax returns (personal and business)

- Financial statements (balance sheet and income statement)

- Business structure and ownership information

- Income and employment verification

Borrowers must also provide documentation to support their income and employment claims, such as:

- Pay stubs

- W-2 forms

- 1099 forms

- Business licenses and registrations

- Letters from accountants or bookkeepers

How to complete Fannie Mae Form 1084

Completing Fannie Mae Form 1084 can be a complex and time-consuming process. Here are some tips to help you navigate the form:

- Gather all required documentation and financial information before starting the form.

- Use a calculator to ensure accurate calculations and minimize errors.

- Consider consulting with a mortgage broker or financial advisor to help with the application process.

- Take your time and review the form carefully before submitting it to the lender.

Benefits of Fannie Mae Form 1084

Fannie Mae Form 1084 provides several benefits to borrowers and lenders, including:

- Accurate income and employment verification

- Improved creditworthiness assessment

- Increased loan approval rates

- Reduced risk of loan defaults

- Compliance with regulatory requirements

By using Fannie Mae Form 1084, lenders can ensure that borrowers have the financial means to repay their loans, reducing the risk of defaults and foreclosures.

Common mistakes to avoid when completing Fannie Mae Form 1084

When completing Fannie Mae Form 1084, borrowers should avoid common mistakes that can lead to delays or loan denials, such as:

- Inaccurate or incomplete financial information

- Missing or incomplete documentation

- Failure to sign and date the form

- Inconsistent or contradictory information

- Failure to disclose all income sources

By avoiding these common mistakes, borrowers can increase their chances of loan approval and ensure a smooth mortgage application process.

Conclusion

Fannie Mae Form 1084 is a critical document in the mortgage application process for self-employed borrowers or those with non-traditional income sources. By understanding the basics of the form and providing accurate and complete financial information, borrowers can increase their chances of loan approval and achieve their homeownership goals. Remember to take your time, gather all required documentation, and seek professional help if needed to ensure a successful mortgage application process.

We hope you found this article informative and helpful. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with your friends and family who may be interested in learning more about Fannie Mae Form 1084.

What is Fannie Mae Form 1084 used for?

+Fannie Mae Form 1084 is used to verify the income and employment status of borrowers who are self-employed or have non-traditional income sources.

Who needs to complete Fannie Mae Form 1084?

+Self-employed borrowers or those with non-traditional income sources, such as small business owners, freelancers, and independent contractors, typically need to complete Fannie Mae Form 1084.

What information is required on Fannie Mae Form 1084?

+The form requires borrowers to provide detailed financial information, including business income and expenses, tax returns, financial statements, and income and employment verification.