Direct deposit is a convenient way to receive your paycheck, tax refund, or other recurring payments directly into your bank account. TD Bank, one of the largest banks in North America, offers direct deposit services to its customers. If you're a TD Bank customer, you'll need to complete a direct deposit form to set up this service. In this article, we'll guide you through the easy steps to complete the TD Bank direct deposit form.

Understanding the Benefits of Direct Deposit

Before we dive into the steps to complete the TD Bank direct deposit form, let's quickly review the benefits of direct deposit. With direct deposit, you can:

- Receive your payments faster and more securely

- Avoid waiting in line to deposit your check

- Reduce the risk of lost or stolen checks

- Earn interest on your deposited funds immediately

- Easily track your deposits online or through the TD Bank mobile app

Step 1: Gather Required Information

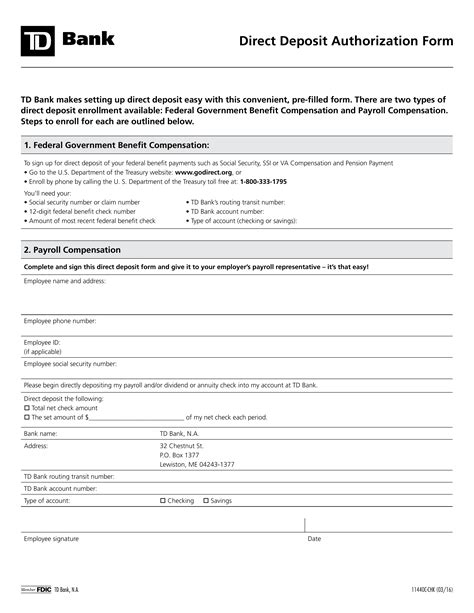

To complete the TD Bank direct deposit form, you'll need to gather some required information. This includes:

- Your name and address

- Your TD Bank account number and routing number (found on your check or bank statement)

- The type of payment you want to deposit (e.g., paycheck, tax refund, etc.)

- The payment frequency (e.g., weekly, biweekly, monthly, etc.)

Locating Your Account and Routing Numbers

If you're not sure where to find your account and routing numbers, here's a helpful tip:

- Check your TD Bank check: Your account number is the second set of numbers at the bottom of your check, and your routing number is the first set of numbers.

- Log in to your TD Bank online banking account: You can find your account and routing numbers under the "Account Details" section.

- Call TD Bank customer service: You can reach out to TD Bank's customer service team to ask for your account and routing numbers.

Step 2: Download and Print the Direct Deposit Form

Once you have all the required information, you can download and print the TD Bank direct deposit form from the TD Bank website. You can also visit a TD Bank branch near you to obtain a copy of the form.

Alternative Options

If you're unable to print the form, you can also:

- Call TD Bank customer service to request a form be mailed to you

- Visit a TD Bank branch to complete the form in person

Step 3: Fill Out the Direct Deposit Form

Now it's time to fill out the direct deposit form. Make sure to:

- Use black ink and print clearly

- Fill out all required fields

- Double-check your account and routing numbers

- Sign and date the form

<h3/Common Mistakes to Avoid

When filling out the form, be careful to avoid common mistakes such as:

- Incorrect account or routing numbers

- Missing or incomplete information

- Unsigned or undated form

Step 4: Submit the Completed Form

Once you've completed the form, you can submit it to TD Bank in several ways:

- Mail the form to the address listed on the form

- Fax the form to the number listed on the form

- Take the form to a TD Bank branch near you

<h3/TD Bank's Processing Time

After submitting the form, TD Bank will process your direct deposit request. This may take a few days to a week, depending on the complexity of the request.

Step 5: Verify Your Direct Deposit

After TD Bank has processed your direct deposit request, you'll need to verify that the deposits are being made correctly. You can do this by:

- Checking your account online or through the TD Bank mobile app

- Reviewing your account statements

- Contacting TD Bank customer service if you have any questions or concerns

<h3/Troubleshooting Tips

If you encounter any issues with your direct deposit, here are some troubleshooting tips:

- Check your account and routing numbers for accuracy

- Verify that your employer or payment provider has sent the payment

- Contact TD Bank customer service for assistance

By following these easy steps, you can complete the TD Bank direct deposit form and start enjoying the benefits of direct deposit. Remember to double-check your information, submit the form correctly, and verify your deposits to ensure a smooth and hassle-free experience.

What is the TD Bank direct deposit form?

+The TD Bank direct deposit form is a document that allows you to set up direct deposit services with TD Bank. It requires your account and routing numbers, as well as other identifying information.

How long does it take to process a direct deposit request?

+TD Bank's processing time for direct deposit requests may vary, but it typically takes a few days to a week.

Can I submit the direct deposit form online?

+No, TD Bank does not currently offer online submission for direct deposit forms. You can mail, fax, or take the form to a TD Bank branch near you.