Filing taxes can be a daunting task, especially for individuals who have experienced a significant loss or are trying to claim a refund. One of the forms that can help with this process is Form 1045, also known as the Application for Tentative Refund. In this article, we will provide you with six essential Form 1045 filing instructions to help you navigate the process.

Understanding Form 1045

Before we dive into the instructions, it's essential to understand what Form 1045 is and who can use it. Form 1045 is used to apply for a tentative refund of taxes paid in a prior year. This form is typically used by individuals who have experienced a significant loss, such as a net operating loss (NOL), and want to claim a refund of taxes paid in a prior year.

Who Can File Form 1045?

Form 1045 can be filed by individuals, estates, and trusts who have experienced a net operating loss (NOL) or other losses that can be carried back to a prior year. To qualify, you must have a loss that is greater than your taxable income for the year.

6 Essential Form 1045 Filing Instructions

1. Determine Your Eligibility

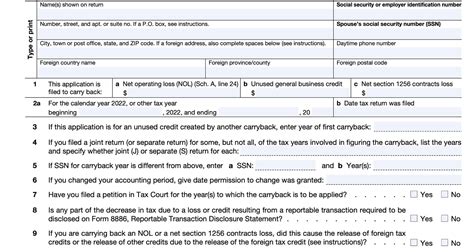

Before filing Form 1045, you need to determine if you are eligible to file. To qualify, you must have a net operating loss (NOL) or other losses that can be carried back to a prior year. You can calculate your NOL by completing Form 1045, Schedule A.

2. Gather Required Documents

To file Form 1045, you will need to gather several documents, including:

- Your tax return for the year you are claiming the loss

- Your tax return for the prior year

- Form 1045, Schedule A

- Form 1045, Schedule B

3. Complete Form 1045, Schedule A

Form 1045, Schedule A is used to calculate your net operating loss (NOL). To complete this schedule, you will need to provide information about your income, deductions, and losses.

4. Complete Form 1045, Schedule B

Form 1045, Schedule B is used to calculate your tentative refund. To complete this schedule, you will need to provide information about your tax liability for the prior year.

5. File Form 1045

Once you have completed Form 1045, Schedule A and Schedule B, you can file Form 1045. You can file the form electronically or by mail. If you file electronically, you can use the IRS's e-file system. If you file by mail, you will need to send the form to the IRS address listed in the instructions.

6. Wait for Your Refund

After you file Form 1045, you will need to wait for your refund. The IRS will review your application and issue a refund if you are eligible. You can check the status of your refund by using the IRS's "Where's My Refund?" tool.

Tips and Reminders

- Make sure to file Form 1045 by the deadline to avoid penalties and interest.

- Keep a copy of your Form 1045 and supporting documents for your records.

- If you have any questions or need help with the filing process, consider consulting a tax professional.

Common Mistakes to Avoid

- Failing to provide required documentation

- Miscalculating your net operating loss (NOL)

- Filing Form 1045 late or missing the deadline

Conclusion

Filing Form 1045 can be a complex process, but with the right instructions and guidance, you can navigate it with ease. By following these six essential Form 1045 filing instructions, you can ensure that you are eligible to file and receive your refund in a timely manner. Remember to keep a copy of your Form 1045 and supporting documents for your records, and consider consulting a tax professional if you have any questions or need help with the filing process.

Frequently Asked Questions

What is Form 1045?

+Form 1045 is the Application for Tentative Refund, used to claim a refund of taxes paid in a prior year.

Who can file Form 1045?

+Individuals, estates, and trusts who have experienced a net operating loss (NOL) or other losses that can be carried back to a prior year.

What is the deadline for filing Form 1045?

+The deadline for filing Form 1045 is typically the same as the deadline for filing your tax return.