Family law can be a complex and daunting topic, especially when it comes to paperwork and legal proceedings. One important document that plays a significant role in California family law is the FL-341 form. In this article, we will delve into the essential facts about the FL-341 form, also known as the Income and Expense Declaration, and explore its significance in family law cases.

As we navigate the world of family law, it's crucial to understand the intricacies of the FL-341 form and its role in determining child support, spousal support, and other financial aspects of divorce and separation cases. By the end of this article, you'll be well-equipped with the knowledge to tackle the FL-341 form and make informed decisions about your family law case.

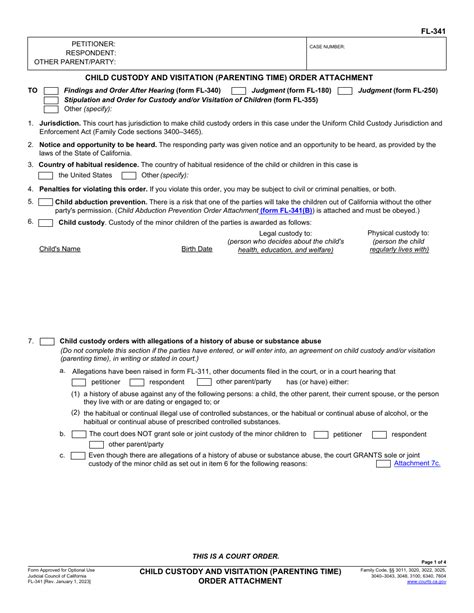

What is the FL-341 Form?

The FL-341 form, also known as the Income and Expense Declaration, is a mandatory document in California family law cases. It's a sworn statement that provides a comprehensive picture of an individual's income, expenses, assets, and debts. The form is used to determine the financial situation of both parties involved in a divorce, separation, or child custody case.

Purpose of the FL-341 Form

The primary purpose of the FL-341 form is to provide a transparent and accurate representation of an individual's financial situation. The form helps the court to:

- Determine child support and spousal support payments

- Calculate the division of community property and debts

- Assess the financial needs of both parties

- Make informed decisions about other financial aspects of the case

Who Needs to Complete the FL-341 Form?

In California, the FL-341 form is a mandatory document in most family law cases. The following individuals typically need to complete the form:

- Parties involved in a divorce or separation case

- Parents seeking child support or custody

- Individuals requesting spousal support

- Parties involved in a domestic violence case

Consequences of Not Completing the FL-341 Form

Failure to complete the FL-341 form can have serious consequences, including:

- Delayed or denied court proceedings

- Inaccurate financial assessments

- Unfavorable court decisions

- Potential penalties or fines

How to Complete the FL-341 Form

Completing the FL-341 form requires careful attention to detail and accurate financial information. Here are some tips to help you complete the form:

- Gather all necessary financial documents, including pay stubs, tax returns, and bank statements

- Be honest and transparent about your income, expenses, assets, and debts

- Use the correct format and follow the instructions carefully

- Attach supporting documents, such as receipts and invoices, to the form

Common Mistakes to Avoid

When completing the FL-341 form, it's essential to avoid common mistakes, such as:

- Inaccurate or incomplete financial information

- Failure to attach supporting documents

- Not signing the form or using the correct format

What to Do After Completing the FL-341 Form

After completing the FL-341 form, you'll need to:

- File the form with the court

- Serve the form on the opposing party

- Wait for the court's review and decision

Seeking Professional Help

If you're unsure about completing the FL-341 form or need assistance with your family law case, consider seeking professional help from an experienced family law attorney.

In conclusion, the FL-341 form is a crucial document in California family law cases. By understanding its purpose, requirements, and completion process, you can navigate the complexities of family law with confidence. Remember to seek professional help if you need assistance with completing the form or navigating your family law case.

We hope this article has provided you with valuable insights into the FL-341 form and its significance in family law cases. If you have any questions or comments, please feel free to share them below.

What is the purpose of the FL-341 form?

+The primary purpose of the FL-341 form is to provide a transparent and accurate representation of an individual's financial situation.

Who needs to complete the FL-341 form?

+Parties involved in a divorce or separation case, parents seeking child support or custody, individuals requesting spousal support, and parties involved in a domestic violence case typically need to complete the form.

What happens if I don't complete the FL-341 form?

+Failure to complete the FL-341 form can result in delayed or denied court proceedings, inaccurate financial assessments, unfavorable court decisions, and potential penalties or fines.