Navigating the complexities of family law can be overwhelming, especially when it comes to filing crucial documents like the FL-341 D form. The FL-341 D form, also known as the Declaration of Disclosure, is a critical document in the California divorce process that requires transparency and honesty from both parties. Failing to file this form correctly can lead to delays, additional costs, and even the dismissal of your case. In this article, we will delve into the world of FL-341 D form filing, providing you with expert tips to ensure a successful and stress-free experience.

Understanding the FL-341 D Form

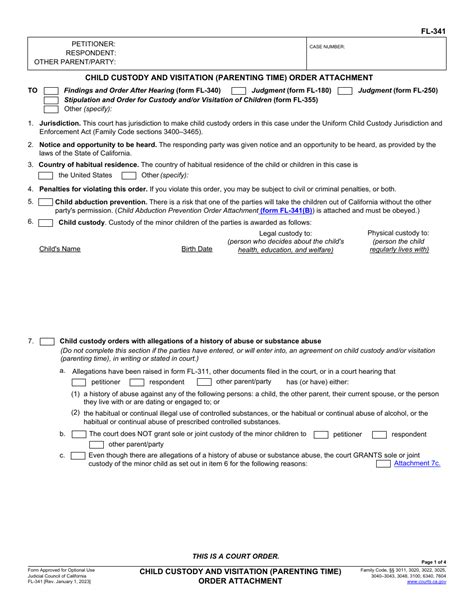

The FL-341 D form is a declaration that must be filed by both parties in a California divorce case. This document serves as a sworn statement that discloses all assets, debts, income, and expenses. The purpose of the FL-341 D form is to ensure that both parties have a clear understanding of the financial situation and to facilitate a fair and equitable division of assets.

Why is the FL-341 D Form Important?

The FL-341 D form is a crucial component of the California divorce process. Failing to file this form correctly can lead to severe consequences, including:

- Delays in the divorce process

- Additional costs and fees

- Dismissal of the case

- Accusations of hiding assets or income

Tips for FL-341 D Form Filing Success

To ensure a successful FL-341 D form filing experience, follow these expert tips:

1. Gather All Necessary Documents

Before filing the FL-341 D form, gather all necessary documents, including:

- Financial statements

- Bank statements

- Tax returns

- Investment accounts

- Retirement accounts

- Debt statements

Having all documents ready will ensure that you provide accurate and complete information on the FL-341 D form.

2. Be Honest and Transparent

The FL-341 D form is a sworn statement, and honesty and transparency are crucial. Failure to disclose assets, income, or debts can lead to severe consequences. Ensure that you provide accurate and complete information, even if it's uncomfortable or inconvenient.

3. Use the Correct Form Version

The FL-341 D form is subject to updates and revisions. Ensure that you use the most current version of the form, which can be found on the California Courts website.

4. Seek Professional Help

Filing the FL-341 D form can be complex and overwhelming. Consider seeking the help of a family law attorney or a professional document preparer. They can guide you through the process, ensure accuracy, and help you avoid costly mistakes.

5. File the Form on Time

The FL-341 D form must be filed within a specific timeframe, usually 60 days after serving the summons and petition. Failing to file the form on time can lead to delays and additional costs.

Additional Tips and Reminders

- Ensure that you serve the FL-341 D form on the other party, if applicable.

- Keep a copy of the filed form for your records.

- Review and update the form as necessary throughout the divorce process.

Conclusion: Taking Control of Your FL-341 D Form Filing

Filing the FL-341 D form can seem daunting, but with the right guidance and expertise, you can take control of the process. By following these expert tips, you can ensure a successful and stress-free FL-341 D form filing experience. Remember to stay organized, honest, and transparent throughout the process, and don't hesitate to seek professional help when needed.

What's Next?

Now that you have the expert tips and guidance, it's time to take action. Start by gathering all necessary documents, and don't hesitate to seek professional help if needed. Remember to file the form on time and serve it on the other party, if applicable.

Final Thoughts

Filing the FL-341 D form is a critical step in the California divorce process. By following these expert tips and staying organized, honest, and transparent, you can ensure a successful and stress-free experience. Remember to take control of the process, and don't hesitate to seek professional help when needed.

What is the purpose of the FL-341 D form?

+The FL-341 D form is a declaration that discloses all assets, debts, income, and expenses in a California divorce case.

Why is honesty and transparency important when filing the FL-341 D form?

+Honesty and transparency are crucial when filing the FL-341 D form, as failure to disclose assets, income, or debts can lead to severe consequences.

What happens if I fail to file the FL-341 D form correctly?

+Failing to file the FL-341 D form correctly can lead to delays, additional costs, and even the dismissal of your case.