The Fillable Form 720 is a crucial document for businesses and individuals required to report and pay the Annual Return of Withholding Income Tax and Additional Withholding Income Tax on Dividends and Interest on Certain Bonds. Mastering the fillable form is essential to ensure accurate reporting, timely submission, and avoidance of penalties. In this article, we will explore five ways to master the Fillable Form 720.

Understanding the Basics of Fillable Form 720

The Fillable Form 720 is a two-part form, consisting of the main form (Form 720) and the accompanying schedules. The main form requires basic business information, including the business name, address, and employer identification number (EIN). Schedules 1-8 provide detailed information on the types of taxes reported and paid. To master the fillable form, it's essential to understand the basics, including:

- Who needs to file: Businesses and individuals with withholding income tax obligations

- Filing deadline: April 30th of each year

- Types of taxes reported: Withholding income tax, additional withholding income tax on dividends, and interest on certain bonds

Step 1: Gather Required Information

Before starting to fill out the form, gather all required information, including:

- Business name and address

- EIN

- Tax year

- Withholding income tax obligations

- Dividend and interest income

- Tax payment records

Having all necessary information on hand will ensure accuracy and speed up the filling process.

Mastering the Fillable Form 720 Schedules

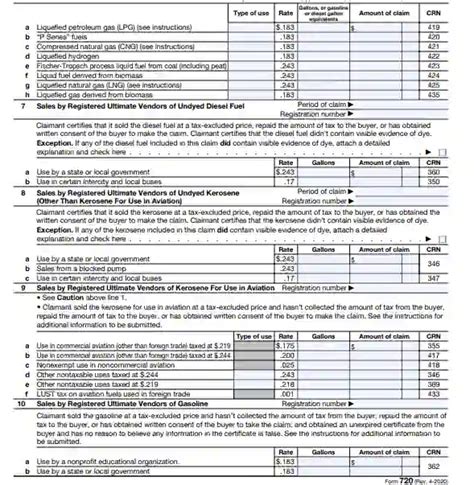

The Fillable Form 720 schedules provide detailed information on the types of taxes reported and paid. Mastering the schedules requires understanding the specific reporting requirements for each schedule, including:

- Schedule 1: Withholding income tax on wages and salaries

- Schedule 2: Withholding income tax on pensions and annuities

- Schedule 3: Withholding income tax on dividends and interest

- Schedule 4: Additional withholding income tax on dividends and interest

- Schedule 5: Tax credit for foreign withholding tax

- Schedule 6: Tax credit for federal income tax withheld

- Schedule 7: Statement of adjustments to tax

- Schedule 8: Amended return

Step 2: Calculate Tax Obligations

Calculate tax obligations accurately to ensure compliance and avoid penalties. Use the following steps:

- Calculate withholding income tax on wages and salaries (Schedule 1)

- Calculate withholding income tax on pensions and annuities (Schedule 2)

- Calculate withholding income tax on dividends and interest (Schedule 3)

- Calculate additional withholding income tax on dividends and interest (Schedule 4)

- Calculate tax credits (Schedules 5 and 6)

Avoiding Common Errors

Common errors on the Fillable Form 720 can result in penalties and delays. Avoid the following errors:

- Inaccurate business information

- Incorrect tax year

- Missing or incomplete schedules

- Inaccurate tax calculations

- Late submission

Step 3: Review and Verify Information

Review and verify information carefully before submitting the form to ensure accuracy and avoid errors. Use the following steps:

- Review business information for accuracy

- Verify tax year and reporting obligations

- Check schedules for completeness and accuracy

- Review tax calculations for accuracy

- Verify submission deadline

Leveraging Technology to Simplify the Process

Leverage technology to simplify the Fillable Form 720 process, including:

- Electronic filing options

- Tax preparation software

- Online calculators and tools

- Automated scheduling and reminders

Step 4: Seek Professional Assistance

Seek professional assistance if needed, including:

- Tax professionals and accountants

- Tax preparation services

- IRS assistance and resources

Best Practices for Mastering the Fillable Form 720

Mastering the Fillable Form 720 requires best practices, including:

- Understanding the basics and requirements

- Gathering required information

- Mastering the schedules

- Calculating tax obligations accurately

- Avoiding common errors

- Leveraging technology

- Seeking professional assistance

Step 5: Stay Organized and Compliant

Stay organized and compliant by:

- Maintaining accurate records and documentation

- Meeting submission deadlines

- Responding to IRS inquiries and notices

- Staying up-to-date with tax law changes and updates

By following these five steps and best practices, businesses and individuals can master the Fillable Form 720 and ensure compliance with reporting and payment obligations.

Now that you've read this article, take a moment to:

- Share your thoughts and experiences with the Fillable Form 720 in the comments below.

- Like and share this article with others who may benefit from this information.

- Take action and start mastering the Fillable Form 720 today!

What is the Fillable Form 720?

+The Fillable Form 720 is a two-part form used to report and pay the Annual Return of Withholding Income Tax and Additional Withholding Income Tax on Dividends and Interest on Certain Bonds.

Who needs to file the Fillable Form 720?

+Businesses and individuals with withholding income tax obligations need to file the Fillable Form 720.

What is the filing deadline for the Fillable Form 720?

+The filing deadline for the Fillable Form 720 is April 30th of each year.