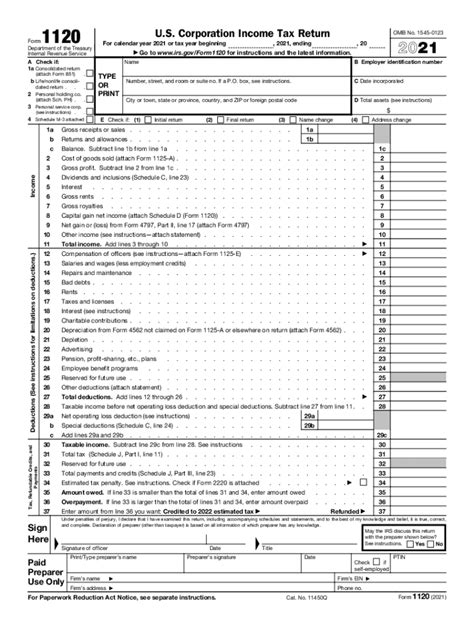

As a business owner, one of the most important tasks you'll face each year is filing your tax return. For corporations, this means submitting Form 1120 to the Internal Revenue Service (IRS). While this process can be complex and time-consuming, there are ways to simplify it. Filing Form 1120 online for free is a convenient and secure option that can save you time and money. In this article, we'll explore the benefits of e-filing Form 1120, how to do it for free, and what you need to know to ensure a smooth and successful tax filing experience.

The Benefits of E-Filing Form 1120

E-filing Form 1120 offers several benefits over traditional paper filing. Here are some of the advantages of submitting your tax return electronically:

• Faster Refunds: When you e-file your tax return, you can expect to receive your refund faster. The IRS typically processes e-filed returns within 1-2 weeks, compared to 6-8 weeks for paper returns.

• Reduced Errors: E-filing software checks your return for errors and inconsistencies, reducing the likelihood of mistakes that can delay processing.

• Increased Security: E-filing is a secure way to submit your tax return, as your data is encrypted and protected from unauthorized access.

• Environmentally Friendly: E-filing reduces the need for paper and helps minimize waste.

• Convenience: You can e-file your tax return from the comfort of your own home, 24/7.

How to File Form 1120 Online for Free

While the IRS doesn't offer free e-filing for all corporations, there are several options available for eligible businesses. Here are some ways to file Form 1120 online for free:

• IRS Free File: If your corporation's annual gross receipts are $50,000 or less, you may be eligible for the IRS Free File program. This program offers free e-filing through participating software providers.

• IRS e-file: If your corporation is required to e-file, you can use the IRS e-file system to submit your return. While this service is free, you'll need to purchase software that supports IRS e-file.

• Free E-File Software: Some tax software providers offer free e-filing for corporations, often with certain restrictions or limitations.

What You Need to Know Before E-Filing Form 1120

Before e-filing Form 1120, make sure you have the following information and documents:

• EIN: Your corporation's Employer Identification Number (EIN) is required for e-filing.

• Financial Statements: You'll need to provide financial statements, including your balance sheet and income statement.

• Tax Returns: You'll need to report any tax returns, including Forms W-2 and 1099.

• Supporting Documents: Depending on your corporation's specific situation, you may need to provide additional supporting documents, such as depreciation schedules or dividend payments.

Tips for a Smooth E-Filing Experience

To ensure a smooth e-filing experience, follow these tips:

• Gather all necessary documents and information before starting the e-filing process.

• Choose a reputable tax software provider that supports IRS e-file.

• Double-check your return for errors and inconsistencies before submitting.

• Keep a copy of your e-filed return for your records.

Common Errors to Avoid When E-Filing Form 1120

When e-filing Form 1120, it's essential to avoid common errors that can delay processing or even result in penalties. Here are some mistakes to watch out for:

• Incorrect EIN: Double-check your corporation's EIN to ensure it's accurate.

• Math Errors: Use tax software to help detect math errors and inconsistencies.

• Missing or Incomplete Information: Ensure you provide all required information and supporting documents.

• Incorrect Filing Status: Verify your corporation's filing status to ensure you're using the correct form and schedules.

What to Do If You Encounter Issues During E-Filing

If you encounter issues during the e-filing process, don't panic. Here are some steps to take:

• Contact the IRS: Reach out to the IRS for assistance with e-filing issues.

• Contact Your Tax Software Provider: If you're using tax software, contact the provider for technical support.

• Try a Different Browser or Device: Sometimes, switching to a different browser or device can resolve technical issues.

Conclusion: Simplify Your Tax Filing Experience with E-File Form 1120

E-filing Form 1120 is a convenient and secure way to submit your corporation's tax return. By following the tips and guidelines outlined in this article, you can simplify your tax filing experience and reduce the risk of errors and delays. Remember to gather all necessary documents and information, choose a reputable tax software provider, and double-check your return for errors before submitting.

We invite you to share your experiences with e-filing Form 1120 in the comments below. Have you encountered any issues or challenges during the e-filing process? What tips or advice do you have for others who are e-filing for the first time?

What is the deadline for filing Form 1120?

+The deadline for filing Form 1120 is typically March 15th for calendar-year corporations. However, this deadline may vary depending on your corporation's fiscal year-end.

Can I e-file Form 1120 if I have a complex tax situation?

+Yes, you can e-file Form 1120 even if you have a complex tax situation. However, you may need to use specialized tax software or consult with a tax professional to ensure accuracy and compliance.

What are the consequences of filing Form 1120 late?

+Filing Form 1120 late can result in penalties and interest on any tax owed. Additionally, you may be subject to a failure-to-file penalty, which can be up to 5% of the unpaid tax amount for each month or part of a month that the return is late.