Setting up a direct deposit can simplify your life by ensuring your paycheck or other regular payments are automatically deposited into your bank account. For customers of Fifth Third Bank, using the Fifth Third direct deposit form can streamline this process. In this article, we'll guide you through the easy enrollment process, highlighting the benefits and providing a step-by-step walkthrough.

What is Direct Deposit?

Direct deposit is a payment option that allows your employer or other payers to electronically transfer funds into your bank account. It's a convenient and secure way to receive your payments, reducing the need for physical checks or visits to the bank. This method benefits both the payer and the payee, as it minimizes the risk of lost or delayed checks.

Benefits of Using Fifth Third Direct Deposit

- Convenience: Receive your payments automatically without the need for manual depositing.

- Security: Reduces the risk of lost, stolen, or delayed checks.

- Faster Access: Get immediate access to your funds on the payment date.

- Environmental Benefits: Less paper usage, which is more environmentally friendly.

How to Enroll in Fifth Third Direct Deposit

Enrolling in direct deposit with Fifth Third Bank is a straightforward process. Here's a step-by-step guide:

Step 1: Gather Necessary Information

- Your Fifth Third Bank account number.

- The routing number of Fifth Third Bank (for Ohio accounts, it's usually 042000314, but this can vary by location).

- A voided check or deposit slip from your Fifth Third Bank account.

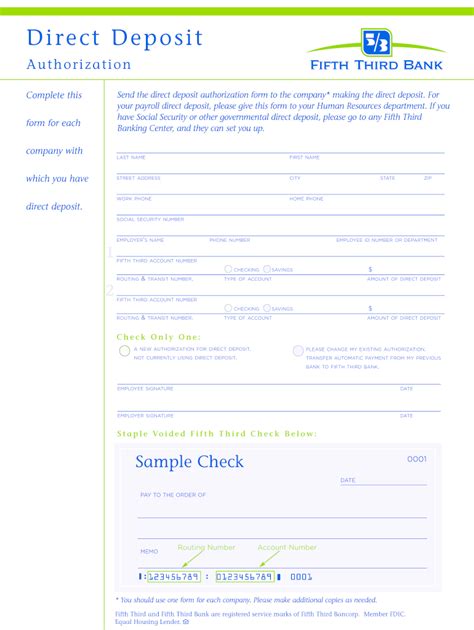

Step 2: Obtain a Direct Deposit Form

- You can download the direct deposit form from the Fifth Third Bank website or pick one up at a local branch.

- Fill out the form with your account information and sign it.

Step 3: Provide the Form to Your Employer or Payer

- Give the completed and signed direct deposit form to your employer's payroll department or the payer.

- They will need this information to set up the direct deposit in their system.

Step 4: Verify the Direct Deposit Setup

- After submitting the form, wait a few days for the direct deposit setup to be processed.

- Verify with your employer or payer that the setup was successful.

- You can also check your bank account to confirm that deposits are being made as expected.

Tips for a Smooth Enrollment Process

- Double-check Information: Ensure all information on the form is accurate to avoid delays or complications.

- Follow Up: Confirm with your employer or payer that the direct deposit form has been processed and that deposits will start on the expected date.

Common Issues and Troubleshooting

Despite the ease of the process, issues can arise. Here are some common problems and how to address them:

- Delayed Deposits: If your deposit is delayed, check with your employer or payer to ensure the setup was completed correctly and that there are no issues on their end.

- Incorrect Information: If your deposits are going into the wrong account, verify that the account number and routing number on the direct deposit form are correct.

Conclusion - Simplifying Your Finances with Fifth Third Direct Deposit

Using the Fifth Third direct deposit form simplifies receiving your payments by automating the deposit process. This method is not only convenient but also more secure and environmentally friendly. By following the steps outlined in this guide, you can easily enroll in direct deposit and start enjoying the benefits of having your payments deposited directly into your bank account.

If you're already a Fifth Third Bank customer, taking advantage of their direct deposit service can further streamline your financial management. Remember to always verify the information on your direct deposit form to ensure a smooth enrollment process.

What is the routing number for Fifth Third Bank?

+The routing number for Fifth Third Bank varies by location, but for Ohio accounts, it's usually 042000314. It's essential to check with your local branch or the bank's website for the correct routing number for your account.

How long does it take to set up direct deposit with Fifth Third Bank?

+The setup process is relatively quick. After providing the completed direct deposit form to your employer or payer, it usually takes a few days for the setup to be processed and for direct deposits to begin.

Can I use direct deposit for all types of payments?

+Direct deposit can be used for various types of payments, including payroll, Social Security benefits, and tax refunds. However, it's best to check with the payer to confirm they offer direct deposit as a payment option.