Starting a new business can be an exciting venture, but it can also be overwhelming, especially when it comes to navigating the various regulations and paperwork required to get started. In New Jersey, one of the key steps in registering a business is completing the NJ Form BA-49, also known as the Business Registration Application. In this article, we will delve into the details of the NJ Form BA-49, its importance, and what you need to know to successfully register your business.

What is the NJ Form BA-49?

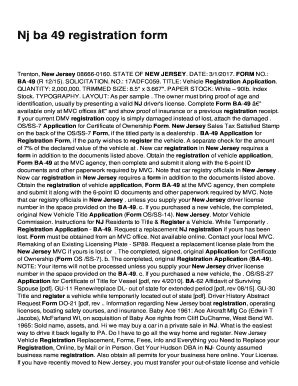

The NJ Form BA-49 is a document required by the New Jersey Department of the Treasury, Division of Revenue, to register a business in the state. It is a comprehensive application that collects information about the business, including its structure, ownership, and tax obligations. The form is used to register various types of businesses, including corporations, limited liability companies (LLCs), partnerships, and sole proprietorships.

Why is the NJ Form BA-49 Important?

Completing the NJ Form BA-49 is crucial for several reasons:

- It provides the state with essential information about your business, including its name, address, and ownership structure.

- It helps to establish your business's tax obligations and ensures that you are in compliance with state tax laws.

- It allows you to obtain any necessary licenses and permits to operate your business in New Jersey.

- It provides a unique Business Entity ID, which is required for various business purposes, such as opening a bank account or applying for credit.

What Information is Required on the NJ Form BA-49?

The NJ Form BA-49 requires a range of information about your business, including:

- Business name and address

- Business type (corporation, LLC, partnership, etc.)

- Ownership structure (sole proprietorship, partnership, etc.)

- Tax obligations (federal and state tax IDs, etc.)

- Business activity code (NAICS code)

- Business start date

- Business owner/officer information (names, addresses, etc.)

How to Complete the NJ Form BA-49

To complete the NJ Form BA-49, follow these steps:

- Download the form from the New Jersey Department of the Treasury website or pick one up from a local office.

- Carefully review the instructions and ensure you have all necessary information and documentation.

- Fill out the form accurately and completely, using black ink or typing.

- Sign and date the form.

- Submit the form, along with any required supporting documentation and fees, to the New Jersey Department of the Treasury.

Filing Fees and Requirements

The filing fee for the NJ Form BA-49 varies depending on the type of business and the filing method. The current fees are as follows:

- Online filing: $125 ( immediate processing)

- Paper filing: $150 (processing time: 2-3 weeks)

In addition to the filing fee, you may also need to provide supporting documentation, such as:

- Business name registration certificate

- Articles of incorporation or articles of organization

- Partnership agreement or operating agreement

Common Mistakes to Avoid

When completing the NJ Form BA-49, avoid the following common mistakes:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Insufficient or missing supporting documentation

- Incorrect filing fee or payment method

Conclusion

In conclusion, the NJ Form BA-49 is a critical document required to register a business in New Jersey. By understanding the importance of this form and providing accurate and complete information, you can ensure a smooth registration process and establish a strong foundation for your business. Remember to carefully review the instructions, avoid common mistakes, and seek professional advice if needed.

What is the purpose of the NJ Form BA-49?

+The NJ Form BA-49 is used to register a business in the state of New Jersey, providing essential information about the business, including its structure, ownership, and tax obligations.

How do I file the NJ Form BA-49?

+You can file the NJ Form BA-49 online or by mail. Online filing is recommended for immediate processing, while paper filing takes 2-3 weeks.

What is the filing fee for the NJ Form BA-49?

+The filing fee for the NJ Form BA-49 varies depending on the type of business and the filing method. The current fees are $125 for online filing and $150 for paper filing.