Filing the FCC Form 499-A is a crucial requirement for telecommunications companies, VoIP providers, and other entities that offer interstate telecommunications services. The Federal Communications Commission (FCC) mandates that these companies file this form annually to report their revenue and other relevant data. In this article, we will guide you through the process of filing the FCC Form 499-A successfully, highlighting the key steps and requirements to ensure compliance.

Step 1: Understand the Filing Requirements and Deadlines

Before starting the filing process, it's essential to understand the requirements and deadlines associated with the FCC Form 499-A. The form is due on April 1st of each year, and it covers the preceding calendar year. For example, the 2023 FCC Form 499-A will cover the 2022 calendar year.

Key Filing Requirements:

- All entities that offer interstate telecommunications services, including:

- Telecommunications companies

- VoIP providers

- Cable companies

- Satellite providers

- Revenue thresholds: Companies with annual revenues exceeding $62,150 are required to file

- Filing deadline: April 1st of each year

Step 2: Gather Required Information and Documents

To complete the FCC Form 499-A successfully, you'll need to gather various information and documents. These include:

- Company identification and contact information

- Revenue data for the preceding calendar year, including:

- Interstate and international revenues

- Intrastate revenues

- Universal Service Fund (USF) contributions

- Employee and agent information, including:

- Employee counts

- Agent names and addresses

- Other relevant data, such as:

- Number of subscribers

- Network infrastructure information

Tips for Gathering Information:

- Ensure accuracy and completeness of revenue data

- Verify employee and agent information

- Keep records of supporting documentation, such as invoices and financial statements

Step 3: Complete the FCC Form 499-A

Once you have gathered the required information and documents, you can start completing the FCC Form 499-A. The form consists of multiple sections, including:

- Section 1: Company Identification and Contact Information

- Section 2: Revenue Data

- Section 3: Employee and Agent Information

- Section 4: Universal Service Fund Contributions

- Section 5: Other Relevant Data

Tips for Completing the Form:

- Follow the FCC's instructions and guidelines carefully

- Ensure accuracy and completeness of all information

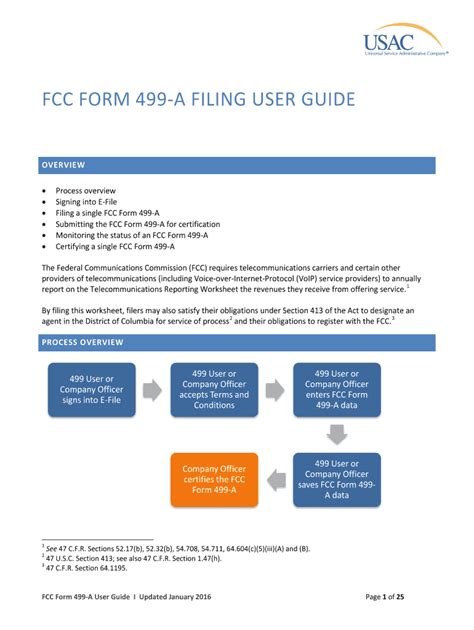

- Use the FCC's online filing system, E-File, to submit the form electronically

Step 4: Submit the FCC Form 499-A

After completing the FCC Form 499-A, you'll need to submit it to the FCC. The FCC offers an online filing system, E-File, which allows you to submit the form electronically. You can also submit the form by mail or fax, but electronic filing is recommended.

Submission Requirements:

- Electronic filing: Use the FCC's E-File system

- Mail submission: Send the form to the FCC's address

- Fax submission: Fax the form to the FCC's fax number

Tips for Submission:

- Ensure timely submission by the April 1st deadline

- Verify receipt of the form by the FCC

- Keep a copy of the submitted form for your records

Step 5: Review and Update Your Filing (If Necessary)

After submitting the FCC Form 499-A, review your filing carefully to ensure accuracy and completeness. If you need to make changes or corrections, you can update your filing electronically through the E-File system.

Tips for Review and Update:

- Review your filing carefully for errors or omissions

- Update your filing electronically through the E-File system

- Verify receipt of the updated filing by the FCC

By following these 5 steps, you can ensure successful filing of the FCC Form 499-A and maintain compliance with the FCC's requirements. Remember to review and update your filing as necessary to avoid any potential issues or penalties.

We encourage you to share your experiences or ask questions about the FCC Form 499-A filing process in the comments below.

What is the deadline for filing the FCC Form 499-A?

+The deadline for filing the FCC Form 499-A is April 1st of each year.

What revenue threshold requires filing the FCC Form 499-A?

+Companies with annual revenues exceeding $62,150 are required to file the FCC Form 499-A.

How do I submit the FCC Form 499-A?

+You can submit the FCC Form 499-A electronically through the FCC's E-File system, by mail, or by fax.