The verification of rent (VOR) process is a crucial step in the mortgage underwriting process, especially for self-employed borrowers or those with non-traditional income sources. Fannie Mae, one of the largest mortgage investors in the US, requires lenders to verify a borrower's rental income to ensure they can afford their mortgage payments. In this article, we will delve into the Fannie Mae Verification of Rent form, its importance, and the steps involved in the verification process.

What is the Fannie Mae Verification of Rent form?

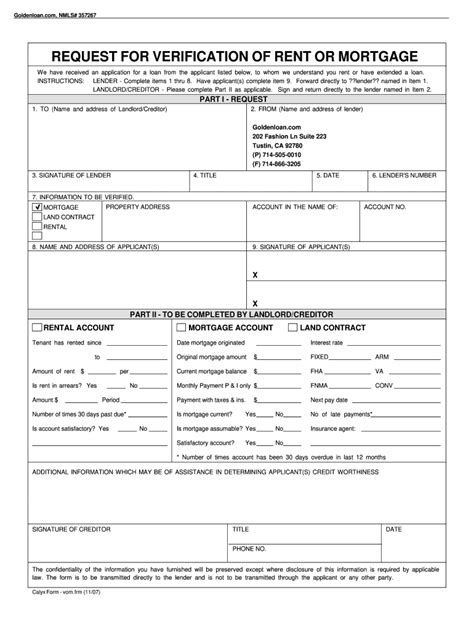

The Fannie Mae Verification of Rent form, also known as the VOR form, is a document used by lenders to verify a borrower's rental income. The form is designed to provide lenders with a clear understanding of a borrower's rental income, including the amount of rent paid, the frequency of payments, and the length of the rental agreement. The VOR form is typically completed by the borrower's landlord or property manager.

Why is the Verification of Rent form important?

The Verification of Rent form is essential in the mortgage underwriting process because it helps lenders assess a borrower's creditworthiness and ability to repay their mortgage. By verifying a borrower's rental income, lenders can determine whether they have a stable income stream to support their mortgage payments. This is particularly important for self-employed borrowers or those with non-traditional income sources, as their income may not be easily verifiable through traditional means.

What information is required on the Verification of Rent form?

The Fannie Mae Verification of Rent form requires the following information:

- Borrower's name and address

- Landlord's name and contact information

- Rental property address

- Rent amount and frequency of payments

- Length of rental agreement

- Date of last rent payment

- Confirmation of rent payments for the past 12-24 months

How does the verification process work?

The verification process typically involves the following steps:

- The lender requests the borrower to complete the VOR form and provide it to their landlord or property manager.

- The landlord or property manager completes the form and returns it to the lender.

- The lender reviews the form to verify the borrower's rental income.

- The lender may request additional documentation, such as cancelled checks or bank statements, to support the VOR form.

- The lender updates the borrower's loan application with the verified rental income information.

Benefits of the Verification of Rent form

The Verification of Rent form provides several benefits to lenders and borrowers, including:

- Improved creditworthiness assessment: By verifying a borrower's rental income, lenders can better assess their creditworthiness and ability to repay their mortgage.

- Reduced risk: The VOR form helps lenders reduce the risk of lending to borrowers with unstable or unverifiable income.

- Increased accuracy: The VOR form ensures that lenders have accurate information about a borrower's rental income, reducing the risk of errors or misrepresentations.

Challenges and limitations of the Verification of Rent form

While the Verification of Rent form is an essential tool in the mortgage underwriting process, it is not without its challenges and limitations. Some of the common issues include:

- Difficulty in obtaining landlord cooperation: Some landlords may be hesitant to complete the VOR form or provide supporting documentation.

- Inconsistent income: Borrowers with inconsistent or variable income may find it challenging to provide a stable income stream to support their mortgage payments.

- Limited rental history: Borrowers with limited rental history may find it difficult to provide a complete VOR form.

Best practices for completing the Verification of Rent form

To ensure a smooth verification process, lenders and borrowers should follow these best practices:

- Complete the form accurately and thoroughly: Ensure that all required information is provided, and the form is completed accurately.

- Provide supporting documentation: Borrowers should provide supporting documentation, such as cancelled checks or bank statements, to support the VOR form.

- Communicate with the landlord: Borrowers should communicate with their landlord or property manager to ensure they understand the verification process and can provide the required information.

Conclusion

The Fannie Mae Verification of Rent form is a critical component of the mortgage underwriting process, providing lenders with essential information to assess a borrower's creditworthiness and ability to repay their mortgage. By understanding the importance of the VOR form and the verification process, lenders and borrowers can ensure a smooth and efficient mortgage application process.

We encourage you to share your thoughts and experiences with the Verification of Rent form in the comments section below. If you have any questions or need further clarification on the VOR form, please don't hesitate to ask.

What is the purpose of the Verification of Rent form?

+The Verification of Rent form is used by lenders to verify a borrower's rental income and assess their creditworthiness and ability to repay their mortgage.

Who completes the Verification of Rent form?

+The Verification of Rent form is typically completed by the borrower's landlord or property manager.

What information is required on the Verification of Rent form?

+The Verification of Rent form requires information such as the borrower's name and address, landlord's name and contact information, rental property address, rent amount and frequency of payments, and length of rental agreement.