The Appraisal 1007 form is a crucial document in the real estate industry, playing a vital role in determining the value of properties. As a homebuyer, seller, or investor, it's essential to understand the purpose, contents, and significance of this form. In this comprehensive guide, we will delve into the details of the Appraisal 1007 form, its importance, and how it affects real estate transactions.

What is the Appraisal 1007 Form?

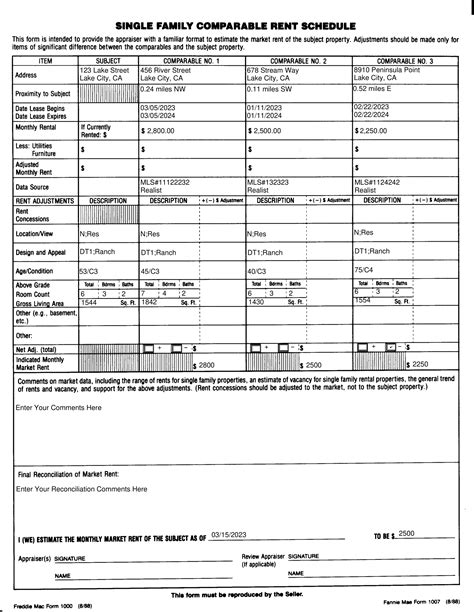

The Appraisal 1007 form is a standardized document used by appraisers to report their findings on the value of a property. It's also known as the Uniform Residential Appraisal Report (URAR). The form is designed to provide a comprehensive analysis of the property's value, taking into account various factors such as its condition, location, size, and amenities.

Why is the Appraisal 1007 Form Important?

The Appraisal 1007 form is a critical component of the real estate appraisal process. It serves several purposes:

- Determines property value: The form provides an objective assessment of the property's value, which is essential for buyers, sellers, and lenders.

- Ensures accuracy: The standardized format ensures that appraisers provide a comprehensive and accurate analysis of the property.

- Facilitates comparison: The form allows for easy comparison of different properties, making it easier for buyers and sellers to make informed decisions.

- Meets regulatory requirements: The Appraisal 1007 form meets the requirements of regulatory agencies, such as Fannie Mae and Freddie Mac.

What's Included in the Appraisal 1007 Form?

The Appraisal 1007 form is divided into several sections, each providing specific information about the property. The main sections include:

Section 1: Property Identification

- Property address

- Property type (residential, commercial, etc.)

- Property characteristics (age, size, etc.)

Section 2: Property Description

- Property features (number of bedrooms, bathrooms, etc.)

- Property condition (good, fair, poor, etc.)

- Property amenities (pool, view, etc.)

Section 3: Site Analysis

- Site characteristics (size, topography, etc.)

- Site improvements (driveway, patio, etc.)

- Site amenities (parking, outdoor kitchen, etc.)

Section 4: Highest and Best Use Analysis

- Analysis of the property's highest and best use

- Explanation of the appraiser's conclusion

Section 5: Sales Comparison Approach

- Analysis of comparable sales (comps)

- Explanation of the appraiser's conclusion

Section 6: Income Approach

- Analysis of the property's income potential

- Explanation of the appraiser's conclusion

Section 7: Cost Approach

- Analysis of the property's cost to replace or reproduce

- Explanation of the appraiser's conclusion

Section 8: Reconciliation

- Reconciliation of the different approaches to value

- Explanation of the appraiser's final value conclusion

Section 9: Certification and Limiting Conditions

- Appraiser's certification and signature

- Limiting conditions and assumptions

How Does the Appraisal 1007 Form Affect Real Estate Transactions?

The Appraisal 1007 form plays a significant role in real estate transactions, influencing the buying and selling process in several ways:

- Determines sale price: The appraised value of the property can impact the sale price, as buyers and sellers may use the appraisal as a basis for negotiations.

- Affects financing: Lenders rely on the appraisal to determine the property's value, which can affect the loan amount and interest rate.

- Impacts renovations and repairs: The appraisal can highlight areas that need improvement or repair, which can impact the sale price or the buyer's decision to purchase.

Best Practices for Working with the Appraisal 1007 Form

To ensure a smooth real estate transaction, follow these best practices when working with the Appraisal 1007 form:

- Understand the form: Take the time to review and understand the contents of the form.

- Communicate with the appraiser: Ask questions and clarify any concerns with the appraiser.

- Provide accurate information: Ensure that all information provided to the appraiser is accurate and up-to-date.

- Review the report carefully: Carefully review the appraisal report to ensure that it accurately reflects the property's value.

Conclusion: Mastering the Appraisal 1007 Form for Real Estate Success

The Appraisal 1007 form is a vital component of the real estate appraisal process. By understanding the form's contents, significance, and best practices, buyers, sellers, and investors can navigate real estate transactions with confidence. Whether you're a seasoned professional or a first-time homebuyer, mastering the Appraisal 1007 form can help you achieve success in the real estate market.

We encourage you to share your thoughts and experiences with the Appraisal 1007 form in the comments section below. Your feedback can help others better understand this critical document and make informed decisions in their real estate journeys.

What is the purpose of the Appraisal 1007 form?

+The Appraisal 1007 form is used to report the appraised value of a property, taking into account various factors such as its condition, location, size, and amenities.

Who uses the Appraisal 1007 form?

+The Appraisal 1007 form is used by appraisers, lenders, buyers, and sellers in real estate transactions.

What are the main sections of the Appraisal 1007 form?

+The main sections of the Appraisal 1007 form include Property Identification, Property Description, Site Analysis, Highest and Best Use Analysis, Sales Comparison Approach, Income Approach, Cost Approach, Reconciliation, and Certification and Limiting Conditions.