As the real estate market continues to evolve, condo owners and buyers are facing increasing scrutiny from lenders. One key aspect of the condo loan approval process is the Fannie Mae Condo Questionnaire Form, a comprehensive document designed to assess the financial health and stability of a condominium project. In this article, we will delve into the world of condo lending and provide a step-by-step guide on completing the Fannie Mae Condo Questionnaire Form.

The Importance of Condo Project Review

Condominium projects can be complex and often require specialized financing. Lenders must carefully evaluate the project's financials, governance, and physical condition to determine the level of risk involved. The Fannie Mae Condo Questionnaire Form is a critical tool used by lenders to gather essential information about a condo project. By completing this form, lenders can assess the project's viability and make informed decisions about loan approvals.

Understanding the Fannie Mae Condo Questionnaire Form

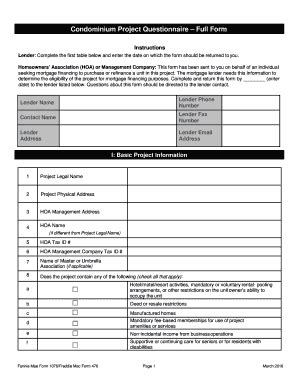

The Fannie Mae Condo Questionnaire Form is a detailed document that requires condo associations, property managers, or individual owners to provide information about the project's financials, governance, and physical condition. The form is divided into several sections, each designed to capture specific information about the project.

Section 1: General Information

This section requires basic information about the condo project, including:

- Project name and address

- Property type (residential, commercial, or mixed-use)

- Number of units and buildings

- Year built and age of the project

Section 2: Financial Information

This section delves into the project's financials, including:

- Current budget and financial statements

- Reserve fund balance and funding plans

- Any outstanding debts or liens

- Information about any pending or settled lawsuits

Section 3: Governance and Management

This section examines the project's governance and management structure, including:

- Information about the condo association, including its name, contact details, and governing documents

- Details about the property management company, including its name, contact details, and scope of work

- Information about the board of directors, including their names, titles, and contact details

Section 4: Physical Condition

This section assesses the project's physical condition, including:

- Information about the building's age, construction, and condition

- Details about any renovations or capital improvements

- Information about any environmental hazards, such as lead-based paint or asbestos

Section 5: Additional Information

This section requires any additional information that may be relevant to the lender's evaluation, including:

- Information about any special assessments or fees

- Details about any disputes or conflicts within the condo association

- Information about any planned or pending changes to the project

Step-by-Step Guide to Completing the Form

Completing the Fannie Mae Condo Questionnaire Form can be a daunting task, especially for those unfamiliar with the process. Here's a step-by-step guide to help you navigate the form:

- Gather all necessary documents: Before starting the form, ensure you have all necessary documents, including financial statements, governing documents, and property management contracts.

- Review the form carefully: Take the time to review the form carefully and understand what information is required.

- Complete each section thoroughly: Complete each section of the form thoroughly, providing as much detail as possible.

- Ensure accuracy and completeness: Double-check the form for accuracy and completeness, ensuring that all required information is provided.

- Submit the form: Once complete, submit the form to the lender or other designated party.

Tips and Best Practices

When completing the Fannie Mae Condo Questionnaire Form, keep the following tips and best practices in mind:

- Be thorough and accurate: Provide as much detail as possible, ensuring that all required information is accurate and complete.

- Use clear and concise language: Avoid using jargon or technical terms that may be unfamiliar to lenders.

- Provide supporting documentation: Include supporting documentation, such as financial statements and governing documents, to substantiate the information provided.

- Seek professional help: If needed, seek professional help from a condo attorney or property manager to ensure the form is completed correctly.

Conclusion

The Fannie Mae Condo Questionnaire Form is a critical tool used by lenders to evaluate the financial health and stability of a condominium project. By following this step-by-step guide, condo owners and buyers can ensure that the form is completed accurately and thoroughly, increasing the chances of loan approval.

What are your experiences with the Fannie Mae Condo Questionnaire Form? Share your thoughts and comments below!

What is the purpose of the Fannie Mae Condo Questionnaire Form?

+The Fannie Mae Condo Questionnaire Form is used by lenders to gather essential information about a condo project, including its financials, governance, and physical condition.

Who should complete the Fannie Mae Condo Questionnaire Form?

+The form should be completed by the condo association, property manager, or individual owner, depending on the project's governance structure.

What documents are required to complete the form?

+Required documents may include financial statements, governing documents, property management contracts, and other relevant information.