As a business owner, ensuring compliance with the Fair Credit Reporting Act (FCRA) is crucial to maintaining a positive reputation and avoiding costly lawsuits. One way to simplify FCRA compliance is by utilizing Form 604, also known as the "Notice to Users of Consumer Reports." In this article, we will delve into the six ways Form 604 simplifies FCRA compliance and provide practical guidance on how to effectively implement it in your business practices.

Understanding the Fair Credit Reporting Act

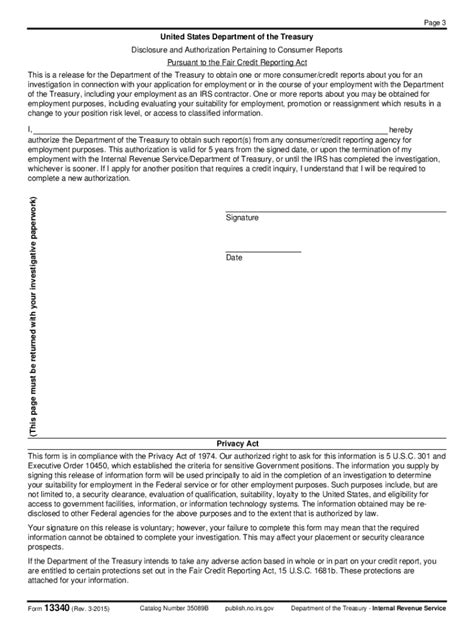

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the use of consumer reports, which include credit reports, employment background checks, and other types of consumer data. The FCRA requires businesses to obtain consent from consumers before obtaining their consumer reports and to provide clear disclosures about the use of these reports.

What is Form 604?

Form 604, also known as the "Notice to Users of Consumer Reports," is a document that provides a clear and concise explanation of the FCRA's requirements and guidelines for using consumer reports. The form outlines the responsibilities of users of consumer reports, including the obligation to obtain consent from consumers and to provide adverse action notices.

6 Ways Form 604 Simplifies FCRA Compliance

1. Clear Disclosure Requirements

Form 604 provides a clear and concise explanation of the FCRA's disclosure requirements, making it easier for businesses to understand and comply with the law. The form outlines the specific language and formatting requirements for disclosures, eliminating confusion and reducing the risk of non-compliance.

2. Simplified Consent Process

Form 604 streamlines the consent process by providing a standardized template for obtaining consent from consumers. This template ensures that businesses obtain the necessary information and signatures, reducing the risk of incomplete or invalid consent forms.

3. Adverse Action Notice Requirements

Form 604 clearly outlines the requirements for adverse action notices, which must be provided to consumers when a business takes adverse action based on information in a consumer report. The form ensures that businesses provide the necessary information, including the name and address of the consumer reporting agency and the reason for the adverse action.

4. Reduced Risk of Non-Compliance

By utilizing Form 604, businesses can reduce the risk of non-compliance with the FCRA. The form provides a clear and concise explanation of the FCRA's requirements, eliminating confusion and reducing the risk of mistakes.

5. Improved Consumer Education

Form 604 provides consumers with a clear and concise explanation of their rights under the FCRA, improving consumer education and awareness. This can help to reduce disputes and complaints, and improve overall consumer satisfaction.

6. Streamlined Record-Keeping

Form 604 provides a standardized template for record-keeping, making it easier for businesses to maintain accurate and complete records. This can help to reduce the risk of audits and lawsuits, and improve overall compliance with the FCRA.

Best Practices for Implementing Form 604

To effectively implement Form 604, businesses should:

- Use the form as a template for obtaining consent from consumers

- Provide clear and concise disclosures about the use of consumer reports

- Ensure that adverse action notices are provided in a timely and accurate manner

- Maintain accurate and complete records of consumer reports and consent forms

- Provide consumer education and awareness about the FCRA and consumer rights

Conclusion

In conclusion, Form 604 is an essential tool for simplifying FCRA compliance and reducing the risk of non-compliance. By utilizing the form, businesses can ensure clear disclosure requirements, simplified consent processes, and improved consumer education. By implementing Form 604, businesses can improve overall compliance with the FCRA and reduce the risk of costly lawsuits and reputational damage.

Call to Action

Take the first step towards simplifying FCRA compliance by implementing Form 604 in your business practices. Share your experiences and best practices in the comments below, and help others to improve their compliance with the FCRA.

What is the purpose of Form 604?

+Form 604, also known as the "Notice to Users of Consumer Reports," provides a clear and concise explanation of the FCRA's requirements and guidelines for using consumer reports.

What are the benefits of using Form 604?

+The benefits of using Form 604 include clear disclosure requirements, simplified consent processes, and improved consumer education.

How can I implement Form 604 in my business practices?

+To implement Form 604, use the form as a template for obtaining consent from consumers, provide clear and concise disclosures, and maintain accurate and complete records.