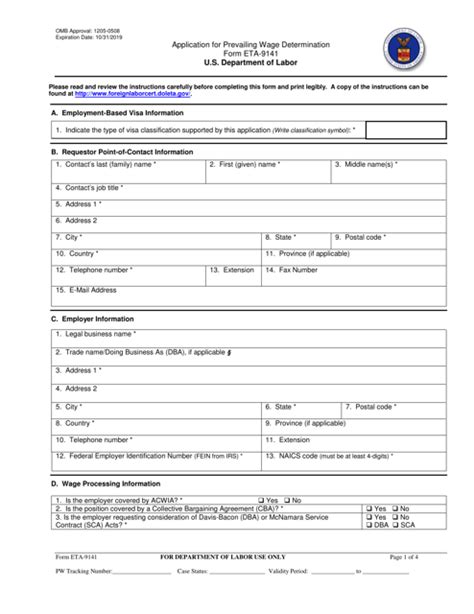

Complying with the ever-changing landscape of labor laws and regulations can be a daunting task for employers, especially when it comes to hiring foreign workers. One crucial step in this process is completing the ETA Form 9141, also known as the Application for Prevailing Wage Determination. This form is a critical component of the H-2B visa program, which allows U.S. employers to hire foreign workers for temporary or seasonal work.

Understanding the complexities of the ETA Form 9141 can be overwhelming, but with the right guidance, employers can navigate the process successfully. In this article, we will break down the key components of the form and provide five essential tips to ensure a smooth and successful application process.

Understanding the ETA Form 9141

The ETA Form 9141 is used to determine the prevailing wage for a specific occupation in a particular geographic area. The prevailing wage is the average wage paid to similarly employed workers in the area, and it serves as the basis for determining the wage that must be paid to H-2B workers.

The form requires employers to provide detailed information about the job, including the occupation, job duties, and working conditions. It also requires employers to provide information about the wages and benefits offered to U.S. workers in the same occupation and geographic area.

Why is the ETA Form 9141 Important?

The ETA Form 9141 is a critical component of the H-2B visa program, and it plays a crucial role in ensuring that H-2B workers are paid fairly and in compliance with U.S. labor laws. By determining the prevailing wage, employers can ensure that they are offering competitive wages and benefits to both U.S. and foreign workers.

Moreover, the ETA Form 9141 helps to prevent wage depression and ensures that U.S. workers are not unfairly disadvantaged by the hiring of foreign workers. It also helps to promote transparency and accountability in the hiring process, which is essential for maintaining the integrity of the H-2B program.

5 Ways to Complete the ETA Form 9141 Successfully

Completing the ETA Form 9141 can be a complex and time-consuming process, but with the right guidance, employers can ensure a successful application. Here are five essential tips to help you complete the form successfully:

1. Gather Required Information

Before starting the application process, it's essential to gather all the required information. This includes detailed information about the job, such as the occupation, job duties, and working conditions. You will also need to provide information about the wages and benefits offered to U.S. workers in the same occupation and geographic area.

Make sure to review the form carefully and gather all the necessary documentation, including:

- Job description and duties

- Wage and benefit information for U.S. workers

- Geographic location and prevailing wage data

- Employer identification number (EIN)

2. Determine the Correct Occupation and Job Title

One of the most critical components of the ETA Form 9141 is determining the correct occupation and job title. This requires careful review of the job duties and responsibilities to ensure that you are using the correct occupational classification.

The Occupational Information Network (ONET) is a useful resource for determining the correct occupation and job title. ONET provides detailed information about occupations, including job duties, skills, and wages.

3. Provide Accurate Wage and Benefit Information

Accurate wage and benefit information is critical for determining the prevailing wage. You will need to provide information about the wages and benefits offered to U.S. workers in the same occupation and geographic area.

Make sure to provide detailed information about the wages, including:

- Hourly or annual wage rate

- Benefits, such as health insurance, retirement plans, and paid time off

- Bonuses or overtime pay

4. Ensure Compliance with Labor Laws and Regulations

Compliance with labor laws and regulations is essential for a successful application. Make sure to review the form carefully and ensure that you are complying with all applicable laws and regulations, including:

- Fair Labor Standards Act (FLSA)

- Immigration and Nationality Act (INA)

- H-2B visa program regulations

5. Submit the Form Electronically

The ETA Form 9141 can be submitted electronically through the FLAG system, which is a secure online portal for submitting labor certifications and prevailing wage determinations.

Make sure to follow the instructions carefully and submit the form electronically to avoid delays and errors.

Conclusion

Completing the ETA Form 9141 can be a complex and time-consuming process, but with the right guidance, employers can ensure a successful application. By gathering required information, determining the correct occupation and job title, providing accurate wage and benefit information, ensuring compliance with labor laws and regulations, and submitting the form electronically, employers can navigate the process successfully.

Remember, compliance with labor laws and regulations is essential for a successful application. Make sure to review the form carefully and ensure that you are complying with all applicable laws and regulations.

If you have any questions or concerns about completing the ETA Form 9141, don't hesitate to reach out to a qualified immigration attorney or labor law expert.

What is the ETA Form 9141?

+The ETA Form 9141 is an application for prevailing wage determination used to determine the prevailing wage for a specific occupation in a particular geographic area.

Why is the ETA Form 9141 important?

+The ETA Form 9141 is important because it helps to ensure that H-2B workers are paid fairly and in compliance with U.S. labor laws. It also helps to prevent wage depression and ensures that U.S. workers are not unfairly disadvantaged by the hiring of foreign workers.

What information is required to complete the ETA Form 9141?

+To complete the ETA Form 9141, you will need to provide detailed information about the job, including the occupation, job duties, and working conditions. You will also need to provide information about the wages and benefits offered to U.S. workers in the same occupation and geographic area.