The 403b plan is a type of tax-deferred retirement savings plan that allows employees of certain tax-exempt organizations, such as schools and hospitals, to save for their future. One of the most critical aspects of a 403b plan is the withdrawal process, which can be complex and may involve significant tax implications. In this article, we will delve into the 403b withdrawal form and provide a comprehensive guide to help you navigate the process of equitable distribution.

Understanding 403b Withdrawal Rules

Before we dive into the 403b withdrawal form, it's essential to understand the rules surrounding withdrawals from a 403b plan. The IRS sets specific rules for withdrawals, which vary depending on your age, employment status, and other factors. Generally, you can withdraw funds from a 403b plan after you reach age 59 1/2 or if you experience a qualifying event, such as separation from service or a first-time home purchase.

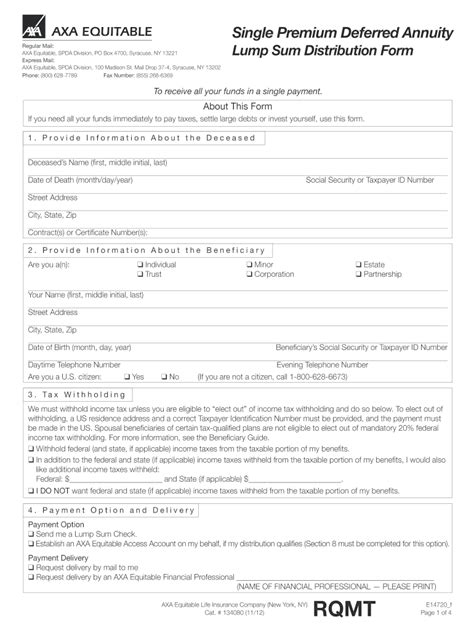

The 403b Withdrawal Form

The 403b withdrawal form is a document that you'll need to complete to initiate a withdrawal from your 403b plan. The form will typically require you to provide personal and account information, as well as specify the amount you wish to withdraw. The form may also ask you to choose how you want to receive the funds, such as a lump sum or installments.

Types of 403b Withdrawals

There are several types of 403b withdrawals, each with its own rules and tax implications. The most common types of withdrawals include:

- Lump Sum Withdrawal: A lump sum withdrawal allows you to take a single, large payment from your 403b plan.

- Installment Withdrawal: An installment withdrawal allows you to take a series of smaller payments over a set period.

- Annuity Withdrawal: An annuity withdrawal allows you to convert your 403b balance into a guaranteed income stream for life or a set period.

403b Withdrawal Form Requirements

To complete a 403b withdrawal form, you'll typically need to provide the following information:

- Account Information: Your account number, plan name, and employer information.

- Personal Information: Your name, address, social security number, and date of birth.

- Withdrawal Amount: The amount you wish to withdraw, which may be subject to plan limits and tax implications.

- Distribution Method: How you want to receive the funds, such as a lump sum or installments.

Tax Implications of 403b Withdrawals

403b withdrawals are subject to income tax, which can significantly impact your take-home amount. The tax implications will depend on your age, income tax bracket, and other factors. It's essential to consult with a tax professional to understand the tax implications of your withdrawal.

Penalties for Early Withdrawal

If you withdraw funds from a 403b plan before age 59 1/2, you may be subject to a 10% penalty, in addition to income tax. However, there are some exceptions to this rule, such as separation from service or a first-time home purchase.

RMDs and 403b Withdrawals

Required Minimum Distributions (RMDs) are mandatory withdrawals from a 403b plan that you must take starting at age 72. RMDs are calculated based on your account balance and life expectancy, and are subject to income tax.

403b Withdrawal Form Deadlines

The deadlines for completing a 403b withdrawal form vary depending on the plan and the type of withdrawal. Generally, you'll need to complete the form and submit it to the plan administrator by a specific date to ensure timely processing.

Tips for Completing the 403b Withdrawal Form

- Consult with a Financial Advisor: Before completing the form, consult with a financial advisor to understand the implications of your withdrawal.

- Review Plan Documents: Review your plan documents to understand the rules and requirements for withdrawals.

- Complete the Form Accurately: Complete the form accurately and thoroughly to avoid delays or errors.

Conclusion

The 403b withdrawal form is a critical document that requires careful attention to detail. By understanding the rules and requirements surrounding 403b withdrawals, you can ensure an equitable distribution of your retirement savings. Remember to consult with a financial advisor, review plan documents, and complete the form accurately to avoid delays or errors.

FAQs

What is the 403b withdrawal form?

+The 403b withdrawal form is a document that you'll need to complete to initiate a withdrawal from your 403b plan.

What are the tax implications of 403b withdrawals?

+403b withdrawals are subject to income tax, which can significantly impact your take-home amount.

What is the deadline for completing the 403b withdrawal form?

+The deadlines for completing the 403b withdrawal form vary depending on the plan and the type of withdrawal.