The Form 8949 is a crucial document for taxpayers who have sold or traded investment securities, such as stocks, bonds, and mutual funds. One of the most important aspects of completing this form accurately is understanding the adjustment codes. In this article, we will delve into the world of Form 8949 adjustment codes, explaining what they are, how to use them, and providing examples to help you navigate this complex process.

What are Form 8949 Adjustment Codes?

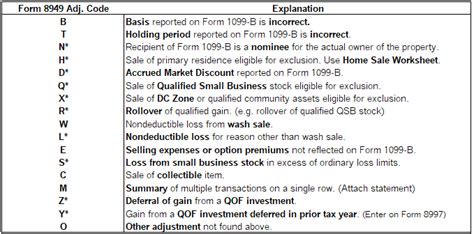

Form 8949 adjustment codes are used to report adjustments to the gain or loss from the sale or trade of investment securities. These codes are used to identify the type of adjustment being made and to provide additional information about the transaction. There are several adjustment codes available, each with its own specific purpose.

Types of Form 8949 Adjustment Codes

The following are some of the most common Form 8949 adjustment codes:

- Code A: Accrued interest on tax-exempt bonds

- Code B: Adjustment for amortizable bond premium

- Code C: Adjustment for contingent payment debt instrument

- Code D: Adjustment for indexed debt instrument

- Code E: Adjustment for inflation-indexed debt instrument

- Code F: Adjustment for non-qualified stock option

- Code G: Adjustment for original issue discount (OID)

- Code H: Adjustment for section 988 transaction

- Code I: Adjustment for straddle or other section 1092(b) transaction

- Code J: Adjustment for wash sale

How to Use Form 8949 Adjustment Codes

Using Form 8949 adjustment codes requires a thorough understanding of the specific transaction being reported. Here are some steps to follow:

- Determine the type of adjustment needed: Review the transaction and determine which adjustment code applies.

- Enter the adjustment code: Enter the corresponding adjustment code in column (f) of Form 8949.

- Enter the adjustment amount: Enter the adjustment amount in column (g) of Form 8949.

- Complete any additional required information: Depending on the adjustment code, additional information may be required, such as the date of the transaction or the type of security.

Examples of Form 8949 Adjustment Codes

The following examples illustrate how to use Form 8949 adjustment codes:

- Example 1: Adjustment for Accrued Interest on Tax-Exempt Bonds

- Transaction: Sale of tax-exempt bond with accrued interest

- Adjustment Code: A

- Adjustment Amount: $100 (accrued interest)

- Example 2: Adjustment for Original Issue Discount (OID)

- Transaction: Sale of OID bond

- Adjustment Code: G

- Adjustment Amount: $500 (OID)

Common Mistakes to Avoid

When using Form 8949 adjustment codes, it is essential to avoid common mistakes, such as:

- Incorrectly entering the adjustment code or amount

- Failing to complete additional required information

- Not reporting all adjustments

Best Practices for Using Form 8949 Adjustment Codes

To ensure accurate reporting, follow these best practices:

- Review the transaction carefully to determine the correct adjustment code

- Double-check the adjustment amount and additional required information

- Use the correct formatting and coding conventions

Conclusion

In conclusion, Form 8949 adjustment codes are a critical component of accurately reporting the sale or trade of investment securities. By understanding the different types of adjustment codes, how to use them, and avoiding common mistakes, taxpayers can ensure compliance with tax regulations and avoid potential penalties.

What is the purpose of Form 8949 adjustment codes?

+Form 8949 adjustment codes are used to report adjustments to the gain or loss from the sale or trade of investment securities.

How do I determine the correct adjustment code?

+Review the transaction carefully to determine the correct adjustment code. Consult the IRS instructions or seek professional advice if necessary.

What are the consequences of incorrectly reporting adjustments?

+Incorrectly reporting adjustments can result in penalties, fines, or even an audit. Ensure accurate reporting to avoid these consequences.