Filing taxes can be a daunting task, especially for those who are new to the process. One of the most important forms for individuals with foreign earned income is the Eoir 42b form. In this article, we will break down the essentials of the Eoir 42b form and provide 5 essential filing tips to help you navigate the process.

The Eoir 42b form, also known as the "Application for Relief from Dual Capacity Taxpayer" is used by individuals who have earned income from foreign sources. This form is used to claim relief from double taxation on foreign earned income, which can be a significant tax savings for those who qualify.

Understanding the Eoir 42b Form

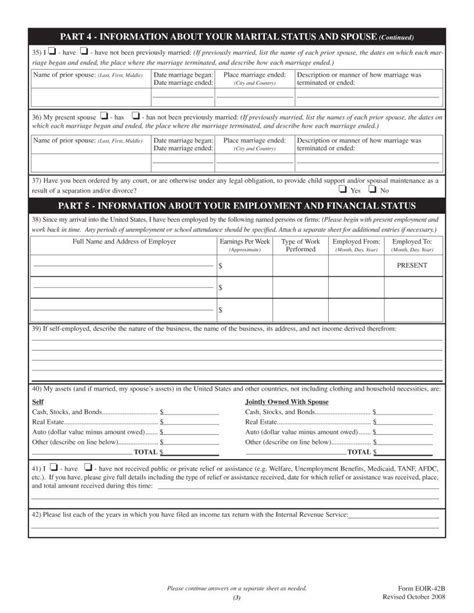

Before we dive into the 5 essential filing tips, it's essential to understand the purpose and requirements of the Eoir 42b form. The form is used to claim relief from dual capacity taxation, which occurs when an individual is taxed by both the United States and a foreign country on the same income. The form requires individuals to provide detailed information about their foreign earned income, including the country where the income was earned, the type of income, and the amount of tax paid.

Tip 1: Determine if You Qualify for Relief

Before filing the Eoir 42b form, it's essential to determine if you qualify for relief from dual capacity taxation. To qualify, you must have earned income from a foreign source, and you must have paid tax on that income in the foreign country. You must also meet the requirements of the Internal Revenue Code, which includes having a tax home in a foreign country and being a resident of the United States.

Types of Foreign Earned Income

Foreign earned income includes:

- Wages and salaries earned from a foreign employer

- Self-employment income earned from a foreign business

- Dividends and interest earned from foreign investments

Tip 2: Gather Required Documents

To complete the Eoir 42b form, you will need to gather several documents, including:

- Your tax return from the foreign country where you earned the income

- Proof of your tax home in the foreign country

- Proof of your residency in the United States

- A copy of your U.S. tax return

Documents to Support Your Claim

You may also need to provide additional documents to support your claim for relief, including:

- A letter from your employer stating your employment dates and income earned

- A copy of your contract or agreement with your employer

- A copy of your passport and visa (if applicable)

Tip 3: Complete the Form Accurately

When completing the Eoir 42b form, it's essential to ensure that all information is accurate and complete. The form requires detailed information about your foreign earned income, including the country where the income was earned, the type of income, and the amount of tax paid.

Common Mistakes to Avoid

Common mistakes to avoid when completing the Eoir 42b form include:

- Failure to sign and date the form

- Incomplete or inaccurate information

- Failure to attach required documents

Tip 4: Attach Required Schedules and Statements

In addition to the Eoir 42b form, you may need to attach required schedules and statements, including:

- Schedule A (Itemized Deductions)

- Schedule C (Business Income and Expenses)

- Form 2555 (Foreign Earned Income Exclusion)

Required Schedules and Statements

You may also need to attach additional schedules and statements, including:

- Form 8938 (Statement of Specified Foreign Financial Assets)

- Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding)

Tip 5: File on Time and Respond to IRS Notices

It's essential to file the Eoir 42b form on time and respond to any IRS notices or requests for additional information. Failure to file on time or respond to IRS notices can result in delays or denial of your claim for relief.

Consequences of Late Filing

Consequences of late filing include:

- Delayed processing of your claim for relief

- Denial of your claim for relief

- Additional taxes and penalties

In conclusion, filing the Eoir 42b form can be a complex and time-consuming process. By following these 5 essential filing tips, you can ensure that your claim for relief is processed efficiently and effectively. Don't hesitate to reach out to a tax professional if you have any questions or concerns about the Eoir 42b form or the filing process.

What is the Eoir 42b form used for?

+The Eoir 42b form is used to claim relief from dual capacity taxation on foreign earned income.

Who qualifies for relief from dual capacity taxation?

+Individuals who have earned income from a foreign source and have paid tax on that income in the foreign country may qualify for relief.

What documents do I need to attach to the Eoir 42b form?

+You will need to attach your tax return from the foreign country, proof of your tax home in the foreign country, and proof of your residency in the United States.