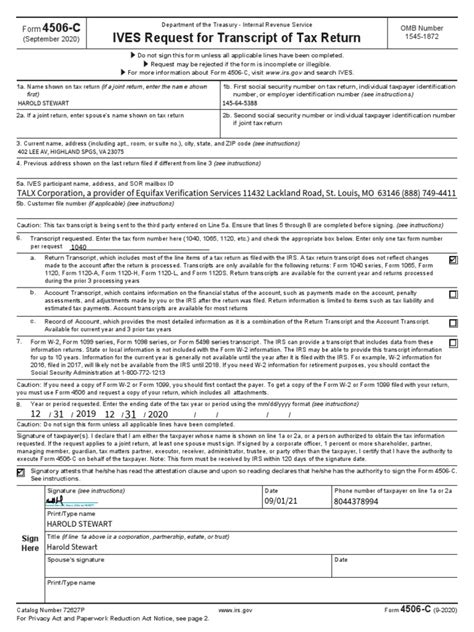

The IRS Form 4506-C, also known as the IVES Request for Transcript of Tax Return, is a crucial document that allows taxpayers to request transcripts of their tax returns from the Internal Revenue Service (IRS). This form is essential for various purposes, including tax preparation, mortgage applications, and identity verification. In this article, we will explore five ways to use the IRS Consent Form 4506-C and provide a comprehensive guide on how to utilize it effectively.

What is IRS Form 4506-C?

The IRS Form 4506-C is a consent form that allows taxpayers to authorize the IRS to disclose their tax return information to a third-party provider, such as a tax preparation service or a lender. The form is used to request transcripts of tax returns, which can be useful for various purposes, including tax preparation, mortgage applications, and identity verification.

5 Ways to Use IRS Consent Form 4506-C

1. Tax Preparation

One of the primary uses of the IRS Form 4506-C is for tax preparation purposes. Taxpayers can use this form to authorize their tax preparer to access their tax return information, which can help streamline the tax preparation process. By signing the form, taxpayers consent to the disclosure of their tax return information to their tax preparer, allowing them to prepare and file their tax returns accurately and efficiently.

2. Mortgage Applications

When applying for a mortgage, lenders often require borrowers to provide transcripts of their tax returns as part of the loan application process. The IRS Form 4506-C can be used to authorize the IRS to disclose tax return information to the lender, which can help facilitate the mortgage application process.

3. Identity Verification

In today's digital age, identity verification is a critical aspect of many financial transactions. The IRS Form 4506-C can be used to verify an individual's identity by requesting transcripts of their tax returns. This can be particularly useful for individuals who need to verify their income or employment status.

4. Student Loan Applications

Students applying for financial aid may be required to provide transcripts of their tax returns as part of the application process. The IRS Form 4506-C can be used to authorize the IRS to disclose tax return information to the student loan provider, which can help facilitate the application process.

5. Estate Planning

When it comes to estate planning, having access to an individual's tax return information can be essential for executors, trustees, and beneficiaries. The IRS Form 4506-C can be used to authorize the IRS to disclose tax return information to these individuals, which can help facilitate the estate planning process.

How to Complete IRS Form 4506-C

Completing the IRS Form 4506-C is a straightforward process that requires taxpayers to provide their personal and tax return information. Here's a step-by-step guide on how to complete the form:

- Section 1: Taxpayer Information: Provide your name, Social Security number or Individual Taxpayer Identification Number (ITIN), and date of birth.

- Section 2: Request for Transcript: Specify the type of transcript you are requesting (e.g., tax return transcript, wage and income transcript, etc.).

- Section 3: Period Requested: Specify the tax year or period for which you are requesting the transcript.

- Section 4: Consent: Sign and date the form to authorize the IRS to disclose your tax return information to the designated third-party provider.

Tips for Using IRS Form 4506-C

1. Ensure Accuracy

When completing the IRS Form 4506-C, ensure that all information is accurate and complete. Inaccurate information can lead to delays or rejection of your request.

2. Specify the Correct Period

When requesting a transcript, specify the correct tax year or period to ensure that you receive the correct information.

3. Use the Correct Form

Use the correct form (IRS Form 4506-C) to request transcripts of your tax returns. Other forms, such as the IRS Form 4506, may not be suitable for this purpose.

4. Keep a Copy

Keep a copy of the completed form for your records, as you may need to refer to it later.

FAQs

What is the purpose of the IRS Form 4506-C?

+The IRS Form 4506-C is a consent form that allows taxpayers to authorize the IRS to disclose their tax return information to a third-party provider.

How do I complete the IRS Form 4506-C?

+Complete the form by providing your personal and tax return information, specifying the type of transcript you are requesting, and signing and dating the form.

What are the uses of the IRS Form 4506-C?

+The IRS Form 4506-C can be used for tax preparation, mortgage applications, identity verification, student loan applications, and estate planning.

We hope this article has provided you with a comprehensive guide on how to use the IRS Consent Form 4506-C. Remember to complete the form accurately and specify the correct period to ensure that you receive the correct information. If you have any further questions or concerns, feel free to comment below or share this article with others who may find it useful.