Business owners and entrepreneurs often find themselves at a crossroads when it comes to choosing the right tax form for their entity. Two of the most common forms used by businesses are Form 1 and Form 4. While both forms are used for tax purposes, they serve different purposes and have distinct characteristics. In this article, we will delve into the key differences between Form 1 and Form 4, helping you make an informed decision for your business.

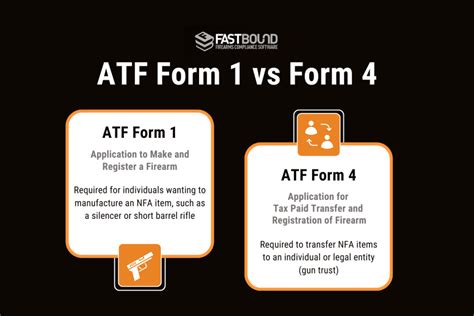

What is Form 1?

Form 1, also known as the Individual Income Tax Return, is a tax form used by sole proprietors and single-member limited liability companies (LLCs) to report their business income and expenses. This form is typically used by small businesses or freelancers who operate as a single entity. Form 1 is a straightforward form that requires businesses to report their income, deductions, and credits.

What is Form 4?

Form 4, also known as the Employer's Quarterly Federal Tax Return, is a tax form used by employers to report employment taxes, including Social Security and Medicare taxes. This form is typically used by businesses that have employees and are required to withhold and pay employment taxes. Form 4 is used to report the employer's portion of employment taxes, as well as the employee's portion of taxes withheld.

Key Differences Between Form 1 and Form 4

Now that we have a brief understanding of what each form is used for, let's dive into the key differences between Form 1 and Form 4:

1. Purpose

The primary purpose of Form 1 is to report business income and expenses, while the primary purpose of Form 4 is to report employment taxes.

2. Business Structure

Form 1 is typically used by sole proprietors and single-member LLCs, while Form 4 is used by businesses that have employees and are required to withhold and pay employment taxes.

3. Tax Reporting

Form 1 requires businesses to report their income, deductions, and credits, while Form 4 requires employers to report employment taxes, including Social Security and Medicare taxes.

4. Filing Frequency

Form 1 is typically filed annually, while Form 4 is filed quarterly.

5. Requirements

Form 1 requires businesses to report their business income and expenses, while Form 4 requires employers to report employment taxes and withholdings.

Who Should Use Form 1?

Form 1 is ideal for businesses that meet the following criteria:

- Sole proprietors or single-member LLCs

- Businesses with no employees

- Businesses that do not withhold employment taxes

Benefits of Using Form 1

Using Form 1 provides several benefits, including:

- Simplified tax reporting

- Reduced administrative burden

- Ability to report business income and expenses on a single form

Who Should Use Form 4?

Form 4 is ideal for businesses that meet the following criteria:

- Employers with employees

- Businesses that withhold employment taxes

- Businesses that are required to pay employment taxes

Benefits of Using Form 4

Using Form 4 provides several benefits, including:

- Ability to report employment taxes and withholdings

- Compliance with employment tax regulations

- Ability to take advantage of employment tax credits

Conclusion

In conclusion, Form 1 and Form 4 serve different purposes and are used by different types of businesses. Form 1 is ideal for sole proprietors and single-member LLCs with no employees, while Form 4 is ideal for employers with employees who are required to withhold and pay employment taxes. By understanding the key differences between these two forms, businesses can make informed decisions about which form to use and ensure compliance with tax regulations.

Call to Action

If you're unsure about which form to use for your business, we encourage you to consult with a tax professional or accountant. They can help you determine which form is best for your business and ensure that you're in compliance with tax regulations.

FAQ Section

What is the purpose of Form 1?

+The primary purpose of Form 1 is to report business income and expenses.

Who should use Form 4?

+Form 4 is ideal for employers with employees who are required to withhold and pay employment taxes.

What is the difference between Form 1 and Form 4?

+Form 1 is used to report business income and expenses, while Form 4 is used to report employment taxes and withholdings.