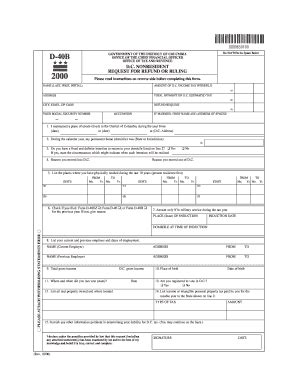

Filing taxes can be a daunting task, especially for residents of Washington D.C. who are required to file the D.C. Form D-40B. This form is used to report income and claim deductions and credits for the District of Columbia. In this article, we will provide 5 tips for filing D.C. Form D-40B, helping you navigate the process with ease.

Understanding the Basics of D.C. Form D-40B

Before we dive into the tips, it's essential to understand the basics of D.C. Form D-40B. This form is required for individuals who are residents of Washington D.C. and have income that is subject to D.C. taxation. The form is used to report income from various sources, including wages, salaries, tips, and self-employment income. It also allows taxpayers to claim deductions and credits, such as the standard deduction, personal exemption, and earned income tax credit.

Tip 1: Gather Required Documents

To file D.C. Form D-40B, you will need to gather various documents, including:

- W-2 forms from employers

- 1099 forms for self-employment income

- Interest statements from banks and financial institutions

- Dividend statements from investments

- Records of charitable donations and medical expenses

Having all the necessary documents will help you accurately report your income and claim deductions and credits.

Reporting Income on D.C. Form D-40B

Reporting income is a critical part of filing D.C. Form D-40B. You will need to report income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rental income

It's essential to accurately report your income to avoid errors and potential penalties.

Types of Income to Report

- Wages, salaries, and tips: Report income from W-2 forms

- Self-employment income: Report income from 1099 forms and self-employment tax returns

- Interest and dividends: Report income from interest statements and dividend statements

- Capital gains and losses: Report income from Schedule D and Form 8949

- Rental income: Report income from Schedule E

Tip 2: Claim Deductions and Credits

D.C. Form D-40B allows taxpayers to claim deductions and credits, which can reduce their tax liability. Some common deductions and credits include:

- Standard deduction: A fixed amount that can be deducted from taxable income

- Personal exemption: An exemption for each individual and dependent

- Earned income tax credit: A credit for low-income working individuals

- Child tax credit: A credit for taxpayers with qualifying children

It's essential to claim all eligible deductions and credits to minimize your tax liability.

Deductions and Credits Available on D.C. Form D-40B

- Standard deduction: $12,000 for single filers and $24,000 for joint filers

- Personal exemption: $4,050 for each individual and dependent

- Earned income tax credit: Up to $6,728 for eligible taxpayers

- Child tax credit: Up to $2,000 for each qualifying child

Tip 3: File Electronically

Filing electronically is a convenient and efficient way to file D.C. Form D-40B. The D.C. Office of Tax and Revenue (OTR) offers an online filing system, which allows taxpayers to file their returns electronically. Electronic filing can help reduce errors and processing time.

Benefits of Electronic Filing

- Faster processing time

- Reduced errors

- Convenient and easy to use

- Available 24/7

Tip 4: Seek Professional Help

Filing D.C. Form D-40B can be complex, especially for taxpayers with complex tax situations. Seeking professional help from a tax professional or accountant can help ensure that your return is accurate and complete.

Benefits of Seeking Professional Help

- Accurate and complete returns

- Reduced errors and potential penalties

- Expert knowledge of tax laws and regulations

- Convenient and stress-free filing experience

Tip 5: Keep Records and Supporting Documentation

It's essential to keep records and supporting documentation for at least three years in case of an audit or examination. This includes:

- W-2 forms and 1099 forms

- Interest statements and dividend statements

- Records of charitable donations and medical expenses

- Supporting documentation for deductions and credits

Keeping accurate records can help you respond to any audit or examination and reduce potential penalties.

Importance of Keeping Records and Supporting Documentation

- Reduces potential penalties

- Helps respond to audits and examinations

- Ensures accurate reporting of income and deductions

- Supports claims for deductions and credits

By following these 5 tips, you can ensure a smooth and stress-free filing experience for D.C. Form D-40B. Remember to gather required documents, report income accurately, claim deductions and credits, file electronically, seek professional help, and keep records and supporting documentation.

We hope this article has provided you with valuable insights and tips for filing D.C. Form D-40B. If you have any questions or comments, please feel free to share them with us.

What is D.C. Form D-40B?

+D.C. Form D-40B is a tax form used to report income and claim deductions and credits for the District of Columbia.

What documents do I need to file D.C. Form D-40B?

+You will need to gather W-2 forms, 1099 forms, interest statements, dividend statements, and records of charitable donations and medical expenses.

Can I file D.C. Form D-40B electronically?

+Yes, you can file D.C. Form D-40B electronically through the D.C. Office of Tax and Revenue (OTR) online filing system.