For individuals and businesses operating in the Lone Star State, having a clear understanding of how to complete a DBA (Doing Business As) application form in Texas is crucial. A DBA, also known as an assumed name, allows you to operate your business under a name that differs from your personal name or the name of your company. This is particularly useful for sole proprietors, partnerships, and limited liability companies (LLCs) looking to brand their businesses effectively. In this comprehensive guide, we will walk you through the 5 easy steps to complete a DBA application form in Texas.

Understanding the Importance of a DBA in Texas

Before diving into the application process, it's essential to understand why obtaining a DBA is vital for your business in Texas. A DBA is required by law for any business that operates under a name that isn't the owner's personal name. This applies to both individuals and entities like corporations or LLCs. By filing for a DBA, you can:

- Enhance your business's identity and credibility

- Open a business bank account under your DBA name

- Differentiate your business from competitors

- Protect your business name from being used by others in the state

Step 1: Choose Your DBA Name

The first step in the DBA application process is to choose your business name carefully. Ensure that your chosen name complies with Texas law and isn't already in use. Here are some guidelines to follow:

- Uniqueness: Your DBA name must be unique and not identical to any existing business names in Texas. You can check the availability of your desired name using the Texas Secretary of State's database.

- Compliance with Texas Law: Ensure your name complies with Texas statutes. For instance, certain words like "bank," "insurance," and "university" may require special approval.

- Domain Name Availability: Even though not required by law, it's wise to choose a name for which the domain name is available to ensure online brand consistency.

Tips for Selecting a DBA Name

- Keep it simple, memorable, and easy to spell.

- Ensure it reflects your business brand and identity.

- Verify the availability of social media handles.

Step 2: Prepare Your DBA Application Form

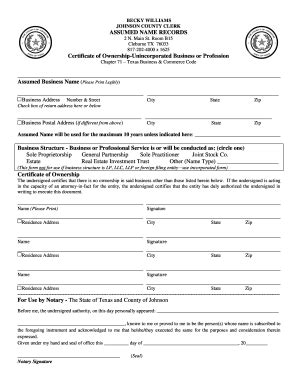

Once you've chosen your DBA name, the next step is to prepare your application. You can obtain the form from the Texas Secretary of State's website or through a registered agent service. Here's what you'll need:

- Business Name: Your desired DBA name.

- Business Address: Your business's physical address in Texas.

- Owner/Entity Information: Your name and address, or the entity's name and address if filing as a corporation or LLC.

- Statement of Purpose: A brief description of your business's purpose.

Step 3: File Your DBA Application

After completing your application, you'll need to file it with the Texas Secretary of State. You can submit your application:

- Online: Through the Texas Secretary of State's SOSDirect platform.

- By Mail: Send your application to the Texas Secretary of State, P.O. Box 13697, Austin, TX 78711.

- In Person: You can also file in person at the James Earl Rudder Office Building, 1019 Brazos, Austin, TX 78701.

Filing Fees

- The filing fee for a DBA application in Texas is $25 for online filings and $25 for mail or in-person filings.

- There may be additional fees for expedited processing or certified copies.

Step 4: Publish Your DBA Notice (If Required)

In some cases, Texas law requires you to publish a notice of your DBA filing in a newspaper. This is typically required if you're filing as a sole proprietor or partnership in certain counties. The notice must include:

- Your DBA name

- Your business address

- A statement indicating that you've filed for a DBA with the Texas Secretary of State

Publishing Requirements

- Check with your county clerk's office to see if publication is required.

- The notice must be published once a week for two consecutive weeks.

- You'll need to file an affidavit of publication with the county clerk's office.

Step 5: Maintain Your DBA

After your DBA application is approved, it's essential to maintain your filing to ensure your business remains compliant with Texas law. Here's what you need to do:

- File Renewals: DBA filings in Texas are valid for 10 years from the date of filing. You'll need to renew your filing before it expires.

- Update Your Filing: If you change your business name, address, or ownership structure, you'll need to file an amendment with the Texas Secretary of State.

Maintenance Tips

- Keep your DBA filing up to date to avoid penalties or loss of your business name.

- Consider filing for a trademark to protect your business name further.

By following these 5 easy steps, you can successfully complete your DBA application form in Texas and start operating your business under your chosen name. Remember to maintain your filing to ensure ongoing compliance with state regulations.