Creating a budget can be a daunting task, but with the right tools and guidance, it can be made easy. One of the most popular and effective budgeting methods is the Dave Ramsey Simple Budget Form. In this article, we will break down the key components of the Dave Ramsey budget form and provide a step-by-step guide on how to use it to take control of your finances.

Understanding the Dave Ramsey Budget Form

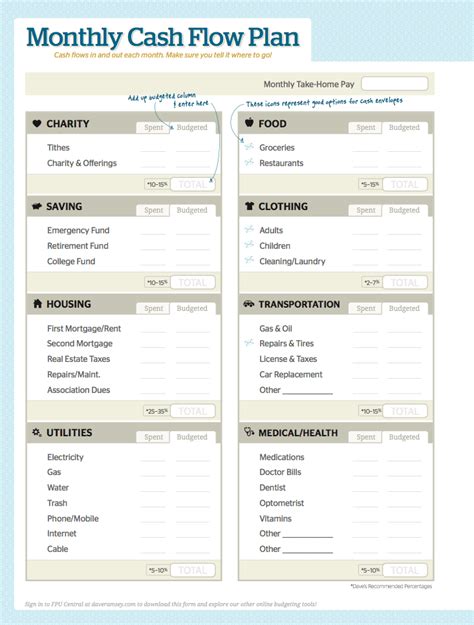

The Dave Ramsey budget form is based on a simple, yet effective principle: allocating 70% of your income towards necessary expenses, 10% towards saving and debt repayment, and 20% towards discretionary spending. This form is designed to help you prioritize your spending, pay off debt, and build wealth.

Step 1: Calculate Your Income

Before you start filling out the budget form, you need to calculate your total monthly income. This includes your take-home pay, investments, and any other sources of income. Make sure to include all income sources, including side hustles and freelance work.Step 2: Categorize Your Expenses

The Dave Ramsey budget form categorizes expenses into seven main categories:- Housing (rent/mortgage, utilities, maintenance)

- Transportation (car loan/lease, insurance, gas, maintenance)

- Food (groceries, dining out)

- Insurance (health, life, disability)

- Debt repayment (credit cards, student loans, personal loans)

- Savings (emergency fund, retirement)

- Entertainment (hobbies, travel, entertainment)

Assigning Percentages

Once you have categorized your expenses, assign a percentage of your income to each category based on the 70/10/20 rule:- Housing: 30%

- Transportation: 10%

- Food: 10%

- Insurance: 5%

- Debt repayment: 5%

- Savings: 10%

- Entertainment: 10%

Step 3: Fill Out the Budget Form

Now that you have calculated your income and assigned percentages to each category, it's time to fill out the budget form. Start by filling in your income, then allocate the corresponding percentage to each category. Make sure to prioritize your necessary expenses, such as housing and utilities, before allocating funds to discretionary spending.

Step 4: Track Your Expenses

To ensure you are staying on track with your budget, it's essential to track your expenses throughout the month. Use a budgeting app, spreadsheet, or simply keep a notebook to record every purchase, no matter how small.Step 5: Review and Adjust

At the end of each month, review your budget to see where you can make adjustments. Identify areas where you can cut back on unnecessary spending and allocate those funds towards debt repayment or savings.Benefits of Using the Dave Ramsey Budget Form

The Dave Ramsey budget form offers several benefits, including:

- Simplified budgeting: The 70/10/20 rule makes it easy to allocate your income towards necessary expenses, savings, and debt repayment.

- Prioritized spending: By categorizing your expenses, you can prioritize your necessary expenses, such as housing and utilities, before allocating funds to discretionary spending.

- Debt repayment: The budget form helps you allocate funds towards debt repayment, which can help you pay off debt faster.

- Savings: By allocating 10% of your income towards savings, you can build an emergency fund and work towards long-term financial goals.

Common Mistakes to Avoid

When using the Dave Ramsey budget form, there are several common mistakes to avoid:- Underestimating expenses: Make sure to accurately estimate your expenses, including utilities, insurance, and maintenance costs.

- Overestimating income: Be realistic about your income, and avoid overestimating your take-home pay.

- Not tracking expenses: Failing to track your expenses can lead to overspending and budget blowouts.

Conclusion

Creating a budget can be a daunting task, but with the Dave Ramsey Simple Budget Form, it can be made easy. By following the steps outlined in this article, you can take control of your finances, prioritize your spending, and work towards long-term financial goals. Remember to track your expenses, review and adjust your budget regularly, and avoid common mistakes to ensure success.What is the 70/10/20 rule?

+The 70/10/20 rule is a budgeting principle that allocates 70% of your income towards necessary expenses, 10% towards savings and debt repayment, and 20% towards discretionary spending.

How do I prioritize my expenses?

+Prioritize your necessary expenses, such as housing and utilities, before allocating funds to discretionary spending. Use the 70/10/20 rule to guide your allocations.

Can I use the Dave Ramsey budget form if I have a variable income?

+Yes, you can use the Dave Ramsey budget form even if you have a variable income. Simply use your average monthly income as a guide, and adjust your allocations as needed.