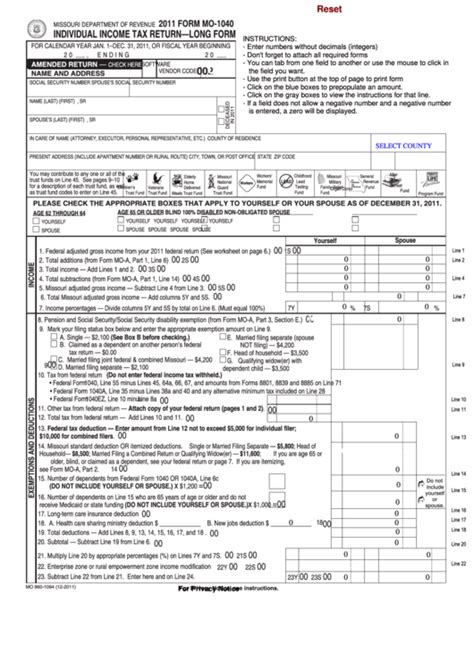

The world of taxes can be overwhelming, especially when it comes to filing your annual tax return. The Missouri State Tax Form 1040 is a crucial document that requires careful attention to detail to ensure accurate and timely filing. In this article, we will provide a comprehensive, step-by-step guide on how to fill out the Mo Tax Form 1040, making the process less daunting and more manageable.

Understanding the Importance of Accurate Filing

Accurate and timely filing of your Missouri State Tax Form 1040 is crucial to avoid penalties, fines, and delays in receiving your refund. The Missouri Department of Revenue uses the information provided on this form to determine your tax liability, so it's essential to ensure all details are correct and complete.

Gathering Necessary Documents and Information

Before starting the filing process, gather all necessary documents and information, including:

- W-2 forms from all employers

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

- Business expense receipts (if self-employed)

Completing the Mo Tax Form 1040: A Step-By-Step Guide

Step 1: Filing Status and Exemptions

Begin by selecting your filing status:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Claim any exemptions you're eligible for, including:

- Personal exemption

- Spousal exemption (if married filing jointly)

- Dependents (children, elderly, or disabled individuals)

Step 2: Income

Report all income earned during the tax year, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividend income

- Capital gains and losses

- Unemployment compensation

Step 3: Deductions and Credits

Claim deductions and credits to reduce your tax liability:

- Standard deduction or itemized deductions (choose one)

- Mortgage interest deduction

- Charitable donation deduction

- Medical expense deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Step 4: Tax Liability and Payment

Calculate your total tax liability by subtracting deductions and credits from your total income. If you owe taxes, you can:

- Pay online through the Missouri Department of Revenue website

- Mail a check or money order with your return

- Set up a payment plan

If you're due a refund, you can:

- Choose direct deposit for faster processing

- Receive a paper check

Step 5: Sign and Date the Return

Carefully review your return for accuracy and completeness. Sign and date the return, and make sure to include your Social Security number or Individual Taxpayer Identification Number (ITIN).

E-Filing vs. Paper Filing

The Missouri Department of Revenue encourages e-filing, as it's faster, more secure, and reduces errors. However, if you prefer to paper file, make sure to use the correct forms and follow the instructions carefully.

Common Mistakes to Avoid

- Inaccurate or incomplete information

- Failure to claim deductions and credits

- Not signing and dating the return

- Missing deadlines

Conclusion: You're Now a Mo Tax Form 1040 Pro!

Congratulations! You've completed the Mo Tax Form 1040 filing guide. By following these steps and avoiding common mistakes, you'll ensure accurate and timely filing, avoiding penalties and delays in receiving your refund.

Encourage others to take control of their taxes by sharing this article on social media or with friends and family.

FAQ Section

What is the deadline for filing the Mo Tax Form 1040?

+The deadline for filing the Mo Tax Form 1040 is typically April 15th of each year.

Can I e-file my Mo Tax Form 1040?

+Yes, the Missouri Department of Revenue encourages e-filing, as it's faster, more secure, and reduces errors.

What happens if I miss the filing deadline?

+If you miss the filing deadline, you may face penalties and fines. It's essential to file as soon as possible to avoid additional charges.