Are you tired of feeling overwhelmed by debt? Do you dream of financial freedom, but don't know where to start? You're not alone. Millions of people struggle with debt, but with the right strategy, you can pay off your debts and start building wealth. One popular method for getting out of debt is the Debt Snowball, created by financial expert Dave Ramsey. In this article, we'll break down the Debt Snowball formula and provide a step-by-step guide to help you get started.

What is the Debt Snowball?

The Debt Snowball is a debt reduction strategy that involves paying off debts in a specific order, regardless of the interest rate. The idea is to build momentum by quickly eliminating smaller debts first, while making minimum payments on larger debts. This approach can help you stay motivated and see progress faster, making it easier to stick to your debt repayment plan.

Why Does the Debt Snowball Work?

The Debt Snowball works because it:

- Provides a clear plan of action

- Helps you build momentum and confidence

- Allows you to see progress quickly

- Takes advantage of psychological factors, such as the feeling of accomplishment when you eliminate a debt

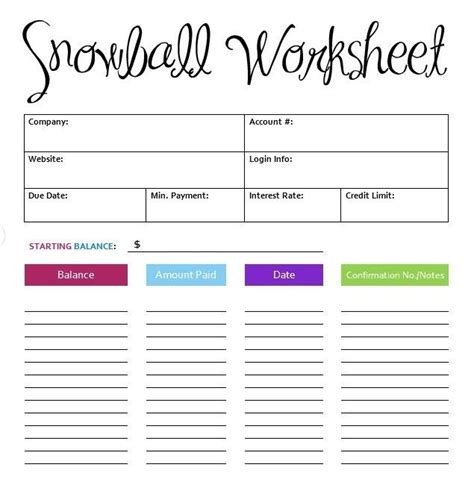

How to Use the Debt Snowball Form

To use the Debt Snowball form, follow these steps:

- List all your debts: Start by making a list of all your debts, including credit cards, loans, and other debts. Make sure to include the balance and minimum payment for each debt.

- Sort your debts: Sort your debts in order of smallest balance to largest. This is the order in which you'll pay them off.

- Pay minimum payments: Make the minimum payment on all debts except the smallest one.

- Attack the smallest debt: Put as much money as possible towards the smallest debt until it's paid off.

- Move to the next debt: Once you've paid off the smallest debt, move on to the next debt on the list and repeat the process.

Example of the Debt Snowball in Action

Let's say you have the following debts:

- Credit card A: $500 balance, $25 minimum payment

- Credit card B: $2,000 balance, $50 minimum payment

- Car loan: $10,000 balance, $200 minimum payment

- Student loan: $30,000 balance, $100 minimum payment

You would sort your debts in order of smallest balance to largest and pay them off in that order. In this example, you would pay off Credit card A first, followed by Credit card B, then the Car loan, and finally the Student loan.

Tips for Success with the Debt Snowball

Here are some tips to help you succeed with the Debt Snowball:

- Create a budget: Make sure you have a solid budget in place to track your income and expenses.

- Pay more than the minimum: Try to pay more than the minimum payment on your debts, especially the smallest one.

- Use the 50/30/20 rule: Allocate 50% of your income towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Cut expenses: Look for ways to cut expenses and free up more money to put towards your debts.

- Stay motivated: Share your progress with a friend or family member and celebrate your successes along the way.

Common Mistakes to Avoid with the Debt Snowball

Here are some common mistakes to avoid when using the Debt Snowball:

- Not creating a budget: Failing to create a budget can lead to overspending and make it difficult to pay off debts.

- Not paying more than the minimum: Paying only the minimum payment on debts can lead to a longer payoff period and more interest paid over time.

- Not cutting expenses: Failing to cut expenses can make it difficult to free up more money to put towards debts.

- Getting discouraged: Getting discouraged by the debt repayment process can lead to giving up.

Conclusion: Taking Control of Your Finances

Taking control of your finances is a powerful feeling. By using the Debt Snowball formula and following the steps outlined in this article, you can pay off your debts and start building wealth. Remember to stay motivated, avoid common mistakes, and celebrate your successes along the way.

What's your experience with the Debt Snowball? Share your story and tips in the comments below!

Want to learn more about personal finance and debt repayment? Check out our other articles and resources!

FAQ Section:

What is the Debt Snowball?

+The Debt Snowball is a debt reduction strategy that involves paying off debts in a specific order, regardless of the interest rate.

How does the Debt Snowball work?

+The Debt Snowball works by providing a clear plan of action, helping you build momentum and confidence, and allowing you to see progress quickly.

What are some common mistakes to avoid with the Debt Snowball?

+Some common mistakes to avoid include not creating a budget, not paying more than the minimum, not cutting expenses, and getting discouraged.