As a CVS employee, receiving your W2 form is an essential part of the tax filing process. The W2 form, also known as the Wage and Tax Statement, is a document that details your income and taxes withheld from your employer, CVS. In this article, we will guide you through the process of accessing and understanding your CVS W2 form.

What is a W2 Form?

A W2 form is a crucial document that employers must provide to their employees by January 31st of each year. The form details the employee's income, taxes withheld, and other relevant tax information. It is used to file taxes with the Internal Revenue Service (IRS) and is a critical component of the tax filing process.

Why is it Important to Understand Your W2 Form?

Understanding your W2 form is essential for several reasons:

- It helps you file your taxes accurately

- It ensures you receive the correct refund or pay the right amount of taxes

- It provides a record of your income and taxes withheld

How to Access Your CVS W2 Form

CVS employees can access their W2 form through the CVS HR Portal or by contacting the CVS HR department directly. Here are the steps to access your W2 form:

- Log in to the CVS HR Portal using your username and password

- Click on the "Pay and Benefits" tab

- Select "W2 Forms" from the drop-down menu

- Choose the tax year for which you want to view your W2 form

- Click on "View W2 Form" to access and print your W2 form

Alternatively, you can contact the CVS HR department directly to request a copy of your W2 form. They will be able to provide you with a printed copy or guide you through the process of accessing it online.

Understanding the Components of Your W2 Form

A W2 form consists of several components, including:

- Employee information (name, address, and Social Security number)

- Employer information (name, address, and Employer Identification Number)

- Income and taxes withheld (gross income, federal income tax withheld, and state income tax withheld)

- Other relevant tax information (Social Security tax withheld, Medicare tax withheld, and retirement plan contributions)

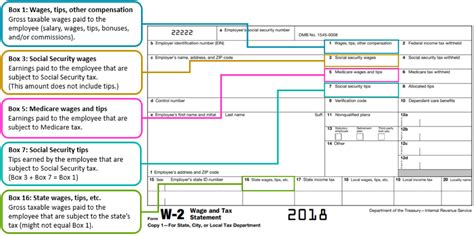

Interpreting the Boxes on Your W2 Form

The W2 form consists of several boxes that provide detailed information about your income and taxes withheld. Here's a breakdown of the most common boxes on your W2 form:

- Box 1: Gross income

- Box 2: Federal income tax withheld

- Box 3: Social Security wages

- Box 4: Social Security tax withheld

- Box 5: Medicare wages and tips

- Box 6: Medicare tax withheld

Troubleshooting Common Issues with Your W2 Form

If you encounter any issues with your W2 form, such as errors or discrepancies, here are some troubleshooting steps to follow:

- Review your W2 form carefully for errors or discrepancies

- Contact the CVS HR department directly to report any issues

- Provide documentation to support any corrections or changes

Frequently Asked Questions About W2 Forms

Here are some frequently asked questions about W2 forms:

- What is the deadline for employers to provide W2 forms to employees?

- January 31st of each year

- Can I access my W2 form online?

- Yes, through the CVS HR Portal or by contacting the CVS HR department directly

- What if I have errors or discrepancies on my W2 form?

- Contact the CVS HR department directly to report any issues

What is the purpose of a W2 form?

+A W2 form is a document that details an employee's income and taxes withheld from their employer, used to file taxes with the IRS.

How do I access my CVS W2 form?

+Log in to the CVS HR Portal or contact the CVS HR department directly to request a copy of your W2 form.

What if I have errors or discrepancies on my W2 form?

+Contact the CVS HR department directly to report any issues and provide documentation to support corrections or changes.

We hope this comprehensive guide has helped you understand and access your CVS W2 form. If you have any further questions or concerns, please don't hesitate to comment below. Remember to share this article with your colleagues and friends who may also benefit from this information.