Importing goods into the United States can be a complex process, involving various forms and regulations. One crucial document in this process is the Customs Form 7512, also known as the Entry Summary Declaration. This form is used to declare goods being imported into the country and is a critical component of the customs clearance process. In this article, we will delve into the world of Customs Form 7512, exploring its purpose, components, and the steps involved in completing it.

The Importance of Customs Form 7512

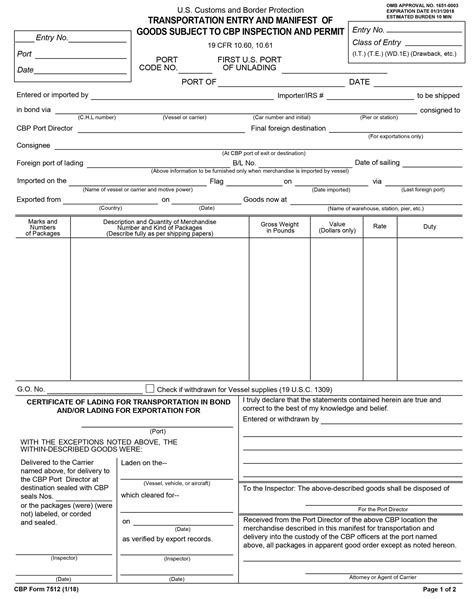

The Customs Form 7512 is a mandatory document that must be submitted to U.S. Customs and Border Protection (CBP) when importing goods into the United States. The form serves as a declaration of the goods being imported, providing detailed information about the shipment, including the type and value of the goods, the country of origin, and the importer's information. The purpose of the form is to facilitate the customs clearance process, ensuring that imported goods comply with U.S. laws and regulations.

Components of Customs Form 7512

The Customs Form 7512 consists of several sections, each requiring specific information about the imported goods. The main components of the form include:

- Section 1: Entry Summary Information: This section requires the entry number, entry date, and the port of entry.

- Section 2: Importer Information: This section requires the importer's name, address, and Employer Identification Number (EIN).

- Section 3: Consignee Information: This section requires the consignee's name, address, and EIN.

- Section 4: Commercial Invoice Information: This section requires the commercial invoice number, date, and a description of the goods.

- Section 5: Country of Origin: This section requires the country of origin for each item being imported.

- Section 6: Harmonized Tariff Schedule (HTS) Number: This section requires the HTS number for each item being imported.

Steps to Complete Customs Form 7512

Completing the Customs Form 7512 requires careful attention to detail and accuracy. Here are the steps to follow:

- Gather required documents: Before completing the form, ensure you have all necessary documents, including the commercial invoice, bill of lading, and packing list.

- Fill out Section 1: Enter the entry number, entry date, and port of entry.

- Fill out Section 2: Enter the importer's name, address, and EIN.

- Fill out Section 3: Enter the consignee's name, address, and EIN.

- Fill out Section 4: Enter the commercial invoice number, date, and a description of the goods.

- Fill out Section 5: Enter the country of origin for each item being imported.

- Fill out Section 6: Enter the HTS number for each item being imported.

- Review and verify: Review the form for accuracy and completeness.

Common Mistakes to Avoid

When completing the Customs Form 7512, it's essential to avoid common mistakes that can delay or even prevent customs clearance. Some common mistakes to avoid include:

- Incomplete or inaccurate information: Ensure all required fields are completed accurately.

- Incorrect HTS numbers: Verify the HTS numbers for each item being imported.

- Missing or invalid documentation: Ensure all required documents are attached to the form.

Benefits of Accurate Customs Form 7512

Completing the Customs Form 7512 accurately and thoroughly can have several benefits, including:

- Faster customs clearance: Accurate information can speed up the customs clearance process.

- Reduced risk of delays: Incomplete or inaccurate information can lead to delays or even prevent customs clearance.

- Compliance with regulations: Accurate information ensures compliance with U.S. laws and regulations.

Best Practices for Customs Form 7512

To ensure accurate and efficient completion of the Customs Form 7512, follow these best practices:

- Use a template: Use a template to ensure all required fields are completed accurately.

- Verify information: Verify all information before submitting the form.

- Attach required documents: Attach all required documents to the form.

Conclusion

The Customs Form 7512 is a critical document in the customs clearance process. By understanding its purpose, components, and steps involved in completing it, importers can ensure accurate and efficient customs clearance. Remember to avoid common mistakes and follow best practices to ensure compliance with U.S. laws and regulations.

What's Next?

Now that you have a comprehensive guide to Customs Form 7512, you can ensure accurate and efficient customs clearance for your imported goods. Share your experiences or ask questions in the comments below.

What is the purpose of Customs Form 7512?

+The purpose of Customs Form 7512 is to declare goods being imported into the United States, providing detailed information about the shipment, including the type and value of the goods, the country of origin, and the importer's information.

What are the components of Customs Form 7512?

+The components of Customs Form 7512 include Section 1: Entry Summary Information, Section 2: Importer Information, Section 3: Consignee Information, Section 4: Commercial Invoice Information, Section 5: Country of Origin, and Section 6: Harmonized Tariff Schedule (HTS) Number.

What are common mistakes to avoid when completing Customs Form 7512?

+Common mistakes to avoid include incomplete or inaccurate information, incorrect HTS numbers, and missing or invalid documentation.