As a business owner in California, understanding the tax requirements for your Limited Liability Company (LLC) is crucial for avoiding penalties and ensuring compliance with state regulations. One of the most important tax forms for California LLCs is the Form 568, also known as the Limited Liability Company Return of Income. In this article, we will delve into the essential filing tips for the California LLC Tax Form 568, helping you navigate the process with ease.

Understanding the Purpose of Form 568

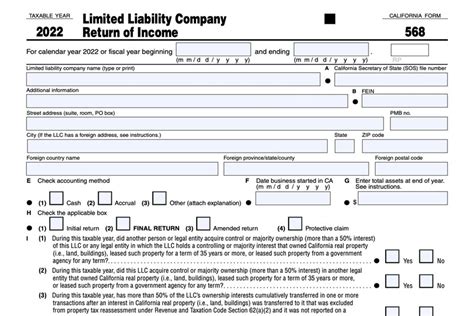

The California LLC Tax Form 568 is used by the state's Franchise Tax Board (FTB) to report the income, deductions, and credits of an LLC. The form is typically filed annually, and its purpose is to calculate the LLC's tax liability, which includes the annual franchise tax, income tax, and other taxes. As an LLC owner, it's essential to understand the purpose of Form 568 and the information required to complete it accurately.

Tip 1: Determine Your LLC's Tax Classification

Before filing Form 568, you need to determine your LLC's tax classification. California LLCs can be classified as partnerships, corporations, or single-member LLCs, each with its own tax implications. If your LLC is classified as a partnership, you'll need to file Form 568 and attach Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.) for each partner. If your LLC is classified as a corporation, you'll need to file Form 100 (California Corporation Franchise or Income Tax Return) instead.

Who Needs to File Form 568?

Not all LLCs are required to file Form 568. If your LLC meets certain criteria, you may be exempt from filing. For example, if your LLC has no income or loss, and no members are required to report income or loss, you may not need to file. However, if your LLC has income or loss, or if you're required to report income or loss as a member, you'll need to file Form 568.

Tip 2: Gather Required Documents and Information

To complete Form 568, you'll need to gather various documents and information, including:

- Your LLC's federal income tax return (Form 1120 or Form 1065)

- Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.) for each partner

- Your LLC's financial statements, including balance sheets and income statements

- Information about your LLC's members, including their names, addresses, and tax identification numbers

Tip 3: Calculate Your LLC's Tax Liability

To calculate your LLC's tax liability, you'll need to complete the tax computation section of Form 568. This involves calculating your LLC's total income, deductions, and credits. You'll also need to determine your LLC's tax classification and apply the applicable tax rates.

Tip 4: File Form 568 on Time

The deadline for filing Form 568 is typically April 15th of each year, but this can vary depending on your LLC's tax classification and other factors. It's essential to file Form 568 on time to avoid penalties and interest. If you need an extension, you can file Form 3536 (Application for Automatic Extension of Time) by the original deadline.

Tip 5: Seek Professional Help If Needed

Filing Form 568 can be complex, especially if you're new to business taxes. If you're unsure about how to complete the form or need help with calculations, consider seeking professional help from a tax professional or accountant.

Common Mistakes to Avoid When Filing Form 568

When filing Form 568, it's essential to avoid common mistakes that can lead to penalties and delays. Some common mistakes to avoid include:

- Failing to report all income and deductions

- Incorrectly classifying your LLC's tax status

- Failing to attach required schedules and forms

- Missing the filing deadline

Conclusion

Filing the California LLC Tax Form 568 requires careful attention to detail and a thorough understanding of the tax requirements for your LLC. By following these essential filing tips, you can ensure that your LLC is in compliance with state regulations and avoid costly penalties. Remember to determine your LLC's tax classification, gather required documents and information, calculate your LLC's tax liability, file Form 568 on time, and seek professional help if needed. By taking these steps, you can navigate the complex world of business taxes with confidence.

What is the purpose of Form 568?

+The purpose of Form 568 is to report the income, deductions, and credits of an LLC to the California Franchise Tax Board (FTB).

Who needs to file Form 568?

+What documents do I need to file Form 568?

+You'll need to gather various documents, including your LLC's federal income tax return, Schedule K-1 for each partner, and your LLC's financial statements.