As a customer of the State Bank of India (SBI), you may need to request various services or facilities from the bank. To facilitate this, SBI has introduced a customer request form that allows you to submit your requests in a convenient and efficient manner. In this article, we will guide you through the process of filling out the SBI customer request form, highlighting the key steps and requirements involved.

Understanding the SBI Customer Request Form

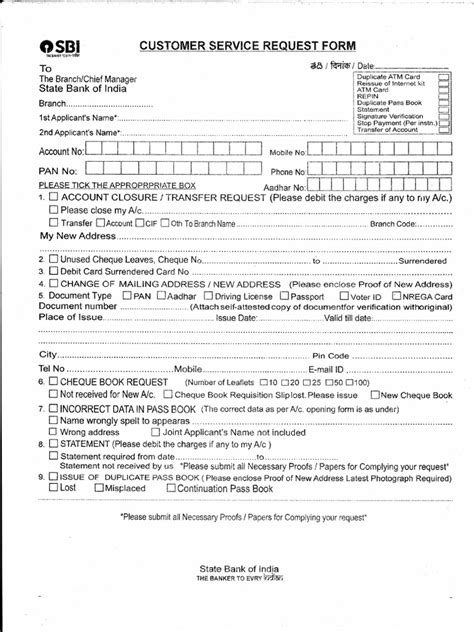

The SBI customer request form is a standardized document that enables customers to request various services, such as account-related changes, loan applications, credit card services, and more. The form is designed to ensure that customers provide all necessary information, making it easier for the bank to process their requests.

Who Can Use the SBI Customer Request Form?

The SBI customer request form is available to all SBI customers, including individuals, businesses, and organizations. Whether you are an existing customer or a new one, you can use this form to request various services from the bank.

Step-by-Step Guide to Filling Out the SBI Customer Request Form

To fill out the SBI customer request form, follow these steps:

Step 1: Download the Form

You can download the SBI customer request form from the official SBI website or obtain it from your nearest SBI branch. Make sure to check the form's version and ensure it is the latest one.

Step 2: Choose the Request Type

The form has multiple sections, each corresponding to a specific request type. Choose the relevant section that corresponds to your request, such as:

- Account-related changes (e.g., address change, account closure)

- Loan applications (e.g., personal loan, home loan)

- Credit card services (e.g., credit card application, limit increase)

- Other services (e.g., ATM card, internet banking)

Step 3: Fill Out the Request Details

Provide detailed information about your request, including:

- Your account number or customer ID

- Request description (be specific and concise)

- Relevant dates (e.g., date of birth, date of account opening)

- Supporting documents (if required)

Step 4: Provide Required Documents

Depending on the request type, you may need to attach supporting documents, such as:

- Identity proof (e.g., PAN card, Aadhaar card)

- Address proof (e.g., utility bill, passport)

- Income proof (e.g., salary slip, income tax return)

Step 5: Sign and Submit the Form

Sign the form in the presence of an SBI official or at your nearest SBI branch. Ensure that you have filled out the form accurately and completely, as incomplete forms may be rejected.

Types of Requests That Can Be Made Through the SBI Customer Request Form

The SBI customer request form allows you to make a wide range of requests, including:

- Account-related changes: Change your address, phone number, or email ID; close or reopen your account; or request a statement or passbook update.

- Loan applications: Apply for a personal loan, home loan, car loan, or other types of loans offered by SBI.

- Credit card services: Apply for a credit card, request a limit increase, or report a lost or stolen credit card.

- Other services: Request an ATM card, internet banking, or mobile banking services.

Benefits of Using the SBI Customer Request Form

Using the SBI customer request form offers several benefits, including:

- Convenience: You can submit your requests from anywhere, at any time, without having to visit the bank.

- Efficiency: The form helps you provide all necessary information, reducing the likelihood of errors or delays.

- Transparency: You can track the status of your request and receive updates on the processing time.

Common Issues Faced While Filling Out the SBI Customer Request Form

While filling out the SBI customer request form, you may encounter some common issues, such as:

- Incomplete or inaccurate information: Double-check your form to ensure that you have provided all necessary details accurately.

- Missing supporting documents: Make sure to attach all required documents to avoid delays or rejections.

- Technical issues: If you are submitting the form online, ensure that you have a stable internet connection and a compatible browser.

Conclusion

The SBI customer request form is a convenient and efficient way to request various services from the bank. By following the step-by-step guide outlined in this article, you can ensure that your request is processed smoothly and quickly. If you have any questions or concerns, you can always reach out to SBI customer support for assistance.

We encourage you to share your experiences or ask questions about the SBI customer request form in the comments section below.