As a business owner, navigating the complex world of corporate taxes can be a daunting task. One of the most critical forms for corporations to file is the CT Form 1120, also known as the Corporate Income Tax Return. This form is used to report a corporation's income, deductions, and credits, and it's essential to understand the ins and outs of filing this form accurately and on time.

In this article, we'll delve into the world of CT Form 1120, exploring its importance, key components, and step-by-step instructions on how to file it correctly. By the end of this guide, you'll be well-equipped to tackle the CT Form 1120 with confidence and ensure your corporation remains compliant with tax regulations.

What is CT Form 1120?

CT Form 1120 is a tax form used by corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is a critical component of a corporation's tax obligations and is used to calculate the corporation's tax liability. The CT Form 1120 is typically filed annually, and the deadline for submission is usually March 15th for calendar-year corporations.

Why is CT Form 1120 Important?

Filing the CT Form 1120 is crucial for several reasons:

- It allows corporations to report their income and claim deductions and credits, which can reduce their tax liability.

- It provides the IRS with necessary information to assess the corporation's tax obligations.

- Failure to file or accurately complete the CT Form 1120 can result in penalties, fines, and even loss of corporate status.

Key Components of CT Form 1120

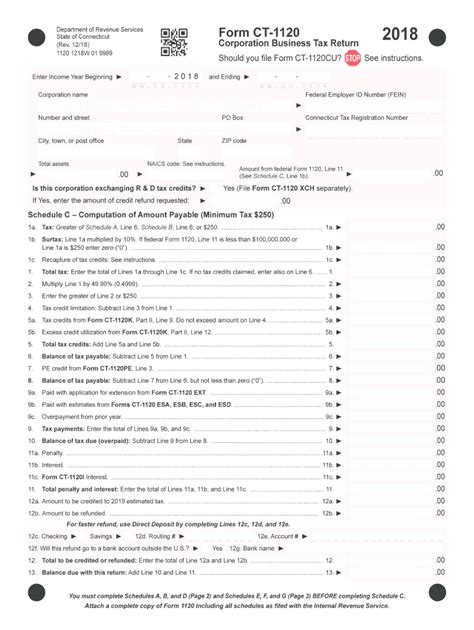

The CT Form 1120 consists of several key components, including:

- Income: Corporations must report all income earned during the tax year, including gross receipts, dividends, and interest.

- Deductions: Corporations can claim deductions for business expenses, depreciation, and amortization.

- Credits: Corporations can claim credits for taxes paid, research and development expenses, and other qualified activities.

- Tax Liability: The corporation's tax liability is calculated based on its income, deductions, and credits.

Step-by-Step Instructions for Filing CT Form 1120

Filing the CT Form 1120 can seem daunting, but by following these step-by-step instructions, you'll be well on your way to accurate and timely filing:

- Gather necessary documents: Collect all necessary financial documents, including income statements, balance sheets, and depreciation schedules.

- Complete Form 1120: Fill out the CT Form 1120, ensuring accuracy and completeness.

- Calculate tax liability: Calculate the corporation's tax liability based on its income, deductions, and credits.

- Submit the form: Submit the completed CT Form 1120 to the IRS by the deadline.

Tips and Tricks for Filing CT Form 1120

To ensure accurate and timely filing of the CT Form 1120, keep the following tips and tricks in mind:

- Seek professional help: Consult with a tax professional or accountant to ensure accuracy and compliance.

- Keep accurate records: Maintain accurate and detailed financial records to support your tax filing.

- File electronically: Consider filing the CT Form 1120 electronically to reduce errors and expedite processing.

Common Mistakes to Avoid When Filing CT Form 1120

When filing the CT Form 1120, it's essential to avoid common mistakes that can result in penalties, fines, and even loss of corporate status. Some common mistakes to avoid include:

- Inaccurate or incomplete information: Ensure accuracy and completeness when reporting income, deductions, and credits.

- Missed deadlines: Submit the CT Form 1120 by the deadline to avoid penalties and fines.

- Failure to claim deductions and credits: Claim all eligible deductions and credits to minimize tax liability.

Conclusion

Filing the CT Form 1120 is a critical component of a corporation's tax obligations. By understanding the key components, following step-by-step instructions, and avoiding common mistakes, you'll be well-equipped to tackle the CT Form 1120 with confidence. Remember to seek professional help, keep accurate records, and file electronically to ensure accurate and timely filing.

We hope this comprehensive guide has provided you with the necessary knowledge and tools to navigate the complex world of corporate taxes. If you have any further questions or concerns, please don't hesitate to reach out.

What is the deadline for filing CT Form 1120?

+The deadline for filing CT Form 1120 is usually March 15th for calendar-year corporations.

Can I file CT Form 1120 electronically?

+Yes, you can file CT Form 1120 electronically to reduce errors and expedite processing.

What are the consequences of failing to file CT Form 1120?

+Failing to file CT Form 1120 can result in penalties, fines, and even loss of corporate status.