Mastering the CT appearance form is essential for businesses and individuals who file tax returns or other financial documents with the state of Connecticut. The CT appearance form, also known as the Appearance Form, is a document that must be filed with the Connecticut Secretary of the State's office in order to register a business or file certain types of tax returns. In this article, we will explore five ways to master the CT appearance form and ensure that your business or individual filing needs are met.

Understanding the CT Appearance Form

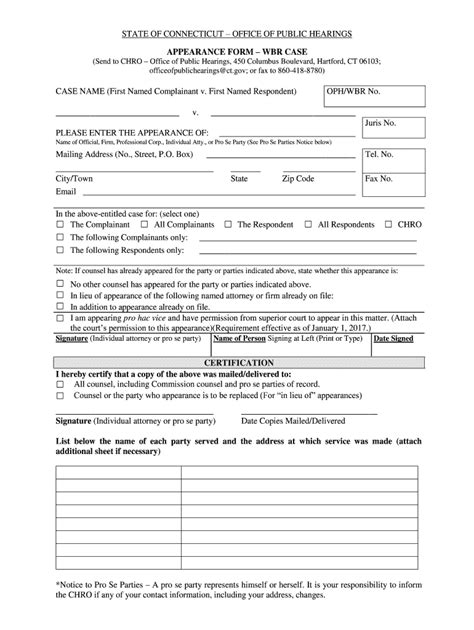

The CT appearance form is a critical document that provides the state of Connecticut with information about the filer, including their name, address, and other contact information. The form is used to register businesses, file tax returns, and make other types of filings with the state. In order to master the CT appearance form, it is essential to understand the purpose of the form and the information that is required.

1. Familiarize Yourself with the Form Requirements

To master the CT appearance form, it is essential to familiarize yourself with the form requirements. The form requires the following information:

- Name and address of the filer

- Name and address of the business or organization (if applicable)

- Type of filing (e.g. tax return, business registration)

- Date of filing

- Signature of the filer or authorized representative

By understanding the form requirements, you can ensure that you have all of the necessary information and documentation before beginning the filing process.

Key Information Required on the CT Appearance Form

- Business name and address

- Type of business (e.g. corporation, LLC, partnership)

- Business tax ID number (if applicable)

- Name and title of authorized representative (if applicable)

2. Use the Correct Filing Status

The CT appearance form requires filers to select the correct filing status. The filing status determines the type of form that must be filed and the fees associated with the filing. The following filing statuses are available:

- Individual

- Business

- Non-profit organization

- Government agency

By selecting the correct filing status, you can ensure that your filing is processed correctly and that you are not required to pay unnecessary fees.

Common Filing Statuses for the CT Appearance Form

- Individual: sole proprietorships, personal tax returns

- Business: corporations, LLCs, partnerships

- Non-profit organization: 501(c)(3) organizations, charities

- Government agency: state and local government agencies

3. Ensure Accuracy and Completeness

To master the CT appearance form, it is essential to ensure that the form is accurate and complete. Inaccurate or incomplete filings can result in delays or rejection of the filing. By double-checking the form for errors and ensuring that all required information is provided, you can avoid common mistakes and ensure that your filing is processed quickly and efficiently.

Common Mistakes to Avoid on the CT Appearance Form

- Inaccurate or incomplete business information

- Incorrect filing status

- Missing or incomplete signatures

- Failure to pay required fees

4. Use the Correct Filing Method

The CT appearance form can be filed electronically or by mail. Electronic filing is the preferred method, as it is faster and more efficient. However, mail filing is also available for filers who do not have access to electronic filing. By selecting the correct filing method, you can ensure that your filing is processed quickly and efficiently.

Benefits of Electronic Filing for the CT Appearance Form

- Faster processing times

- Increased accuracy and completeness

- Reduced risk of lost or misplaced filings

- Environmentally friendly

5. Seek Professional Assistance (If Necessary)

Finally, to master the CT appearance form, it may be necessary to seek professional assistance. If you are unsure about the form requirements or the filing process, it is recommended that you consult with a qualified tax professional or attorney. By seeking professional assistance, you can ensure that your filing is accurate and complete and that you are in compliance with all applicable laws and regulations.

Benefits of Seeking Professional Assistance for the CT Appearance Form

- Accurate and complete filings

- Compliance with all applicable laws and regulations

- Reduced risk of errors or omissions

- Increased confidence in the filing process

By following these five steps, you can master the CT appearance form and ensure that your business or individual filing needs are met.

What is the purpose of the CT appearance form?

+The CT appearance form is used to register businesses, file tax returns, and make other types of filings with the state of Connecticut.

What information is required on the CT appearance form?

+The CT appearance form requires the name and address of the filer, the name and address of the business or organization (if applicable), the type of filing, the date of filing, and the signature of the filer or authorized representative.