Getting a CT UCC (Uniform Commercial Code) statement is a crucial step for businesses in Connecticut to maintain accurate records and ensure compliance with state regulations. In this article, we will guide you through the process of obtaining a CT UCC statement in 5 easy steps.

What is a CT UCC Statement?

A CT UCC statement is a document that provides information about a business's Uniform Commercial Code (UCC) filings, which are public records that contain information about a company's secured transactions, such as loans and leases. The statement is usually requested by lenders, creditors, or other parties interested in a business's financial activities.

Step 1: Determine the Type of UCC Statement You Need

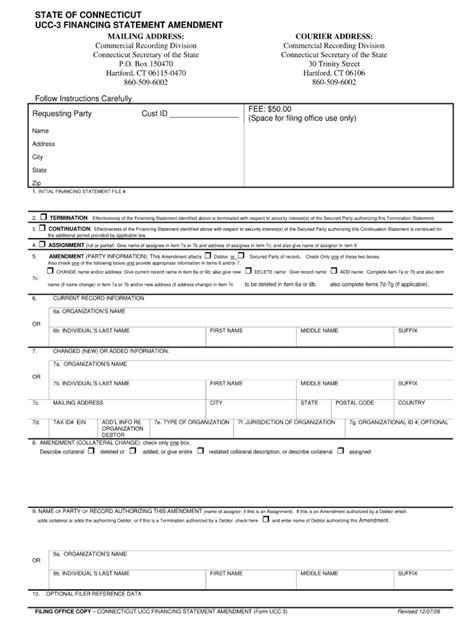

There are two types of CT UCC statements: a UCC-11 Information Request and a UCC-3 Financing Statement. A UCC-11 is used to request information about a specific business, while a UCC-3 is used to file a financing statement that provides details about a secured transaction.

Choosing the Right Statement Type

To determine which type of statement you need, consider the purpose of your request. If you are a lender or creditor seeking information about a business's secured transactions, a UCC-11 is the correct choice. If you are a business owner seeking to file a financing statement, a UCC-3 is the way to go.

Step 2: Gather Required Information

To request a CT UCC statement, you will need to provide specific information about the business or individual involved in the secured transaction. This includes:

- Business name or individual name

- Business address or individual address

- UCC file number (if available)

Tips for Gathering Information

Make sure to double-check the accuracy of the information you provide, as errors can delay or prevent the processing of your request.

Step 3: Submit Your Request

You can submit your request for a CT UCC statement online, by mail, or in person. The Connecticut Secretary of the State's office provides an online portal for submitting UCC-11 requests, while UCC-3 filings must be submitted through the mail or in person.

Online Submission Tips

When submitting your request online, make sure to follow the instructions carefully and provide all required information to avoid delays.

Step 4: Review and Verify Your Statement

Once you receive your CT UCC statement, review it carefully to ensure accuracy and completeness. Verify that all information, including business names, addresses, and UCC file numbers, is correct.

What to Look for in Your Statement

When reviewing your statement, check for:

- Accuracy of business names and addresses

- Correct UCC file numbers

- Completeness of secured transaction information

Step 5: Maintain Accurate Records

Finally, it is essential to maintain accurate records of your CT UCC statement, including the statement itself and any supporting documentation. This will help you stay compliant with state regulations and ensure that your business's financial activities are up-to-date.

Tips for Maintaining Accurate Records

- Store your CT UCC statement and supporting documentation in a secure location, such as a file cabinet or digital storage system.

- Regularly review and update your records to ensure accuracy and completeness.

By following these 5 easy steps, you can obtain a CT UCC statement and maintain accurate records of your business's secured transactions.

Take Action!

Get started today by visiting the Connecticut Secretary of the State's office website or contacting their office directly to request your CT UCC statement. Don't forget to review and verify your statement carefully to ensure accuracy and completeness.

Share Your Thoughts!

Have you obtained a CT UCC statement before? Share your experience in the comments below! Do you have any questions about the process? Ask us in the comments, and we'll do our best to help.

What is the purpose of a CT UCC statement?

+A CT UCC statement provides information about a business's Uniform Commercial Code (UCC) filings, which are public records that contain information about a company's secured transactions, such as loans and leases.

How long does it take to obtain a CT UCC statement?

+The processing time for a CT UCC statement varies depending on the method of submission and the complexity of the request. Online requests are typically processed within 24 hours, while mail and in-person requests may take longer.

What information is required to request a CT UCC statement?

+To request a CT UCC statement, you will need to provide specific information about the business or individual involved in the secured transaction, including business name or individual name, business address or individual address, and UCC file number (if available).