As a resident of Colorado, understanding how to properly fill out forms related to taxes, registration, or other official purposes is crucial to avoid delays or rejections. One such form is the Colorado Form DR2395, which is essential for various transactions involving the state's Department of Revenue. Whether you're dealing with vehicle registration, sales tax, or other financial matters, navigating the DR2395 form can be daunting without the right guidance. This article will walk you through the steps and considerations for accurately filling out Colorado Form DR2395, ensuring you complete your tasks efficiently and effectively.

Understanding Colorado Form DR2395

Colorado Form DR2395 is a critical document used for reporting and paying taxes, fees, or other financial obligations to the State of Colorado. It's essential to understand the form's purpose and how it applies to your specific situation. The DR2395 form is versatile and can be used for different purposes, including vehicle registration, sales tax, and other revenue-related matters.

Purpose of the Form

- Vehicle Registration: For individuals or businesses registering vehicles with the Colorado Department of Motor Vehicles.

- Sales Tax: Reporting and remitting sales tax to the Department of Revenue.

- Other Revenue Matters: Includes other financial obligations such as use tax, withholding tax, or any other payments due to the state.

5 Steps to Fill Out Colorado Form DR2395

Filling out the DR2395 form requires attention to detail and an understanding of the specific sections and requirements. Here are five key steps to guide you through the process:

Step 1: Gather Necessary Information

Before starting, ensure you have all the required information and documents. This may include:

- Your Taxpayer Identification Number (FEIN or SSN)

- Business or individual name

- Address

- Specific tax or registration details (e.g., vehicle information for registration purposes)

Step 2: Download or Obtain the Form

Access the Colorado Department of Revenue's official website to download the latest version of Form DR2395. It's crucial to use the current form to ensure compliance with the latest regulations.

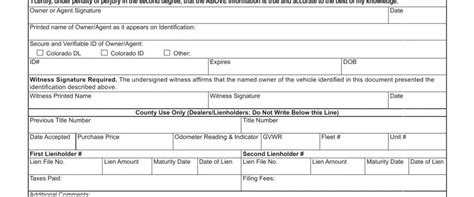

Step 3: Fill Out the Form Accurately

- Section 1: Provide your taxpayer identification information.

- Section 2: Specify the type of tax or registration you are reporting (e.g., sales tax, vehicle registration).

- Section 3: Calculate and enter the amount of tax due or payment being made.

- Section 4: Attach supporting documentation as required (e.g., receipts, invoices for sales tax).

Step 4: Review and Verify the Information

Carefully review the form for accuracy and completeness. Verify all calculations and ensure you have attached all required documents.

Step 5: Submit the Form

Once the form is complete and reviewed, submit it according to the instructions provided. This may involve mailing the form to the Department of Revenue, submitting it online, or delivering it in person, depending on the specific requirements and your preference.

Common Mistakes to Avoid

- Inaccurate Information: Ensure all details, including names, addresses, and taxpayer IDs, are correct.

- Insufficient Documentation: Failing to attach required supporting documents can lead to delays or rejections.

- Incorrect Calculations: Double-check all calculations to avoid underpayment or overpayment.

- Using Outdated Forms: Always use the latest version of Form DR2395.

Tips for Smooth Filing

- Plan Ahead: Allow sufficient time to gather information and complete the form.

- Use Online Resources: Utilize the Colorado Department of Revenue's website for guidance, FAQs, and to download the form.

- Consult Professionals: If unsure, consider consulting with a tax professional or legal advisor.

Conclusion - Achieving Compliance with Ease

Completing Colorado Form DR2395 accurately is crucial for compliance with state regulations and to avoid any unnecessary complications. By understanding the form's purpose, gathering necessary information, and following the outlined steps, you can ensure a smooth process. Remember to review and verify your information, avoid common mistakes, and seek help when needed. This approach will not only streamline your filing process but also contribute to your peace of mind.

What is Colorado Form DR2395 used for?

+Colorado Form DR2395 is used for various transactions with the Colorado Department of Revenue, including vehicle registration, sales tax reporting, and other revenue-related matters.

How do I obtain Colorado Form DR2395?

+You can download the latest version of Form DR2395 from the Colorado Department of Revenue's official website.

What are the common mistakes to avoid when filling out Colorado Form DR2395?

+Common mistakes include providing inaccurate information, insufficient documentation, incorrect calculations, and using outdated forms.