The Colorado Form 104CR is a crucial document for individuals and businesses in Colorado, serving as the state's income tax credit form. It's essential to complete this form accurately to claim the credits you're eligible for and minimize your tax liability. In this article, we'll guide you through the 5 steps to complete Colorado Form 104CR, making it easier for you to navigate the process.

Step 1: Determine Your Eligibility

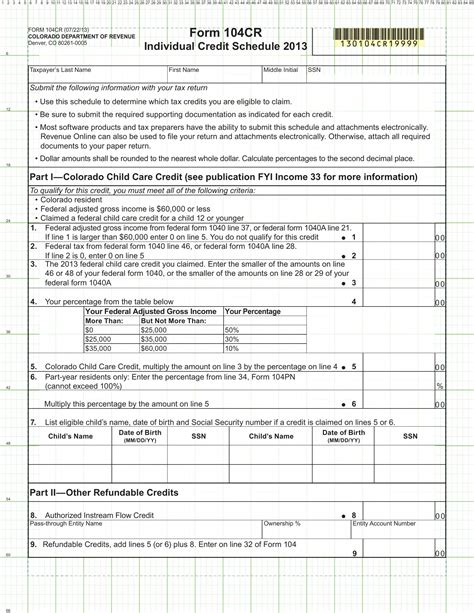

Before diving into the form, it's essential to determine if you're eligible to claim the credits. The Colorado Department of Revenue provides a list of eligible credits on their website. Review the list to see if you qualify for any of the credits, such as the Child Care Credit, Earned Income Tax Credit, or the Credit for Taxes Paid to Another State.

Step 2: Gather Required Documents

Gathering Required Documents for Colorado Form 104CR

To complete the form accurately, you'll need to gather several documents, including:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for any freelance or contract work

- Proof of child care expenses (if claiming the Child Care Credit)

- Proof of earned income (if claiming the Earned Income Tax Credit)

Make sure you have all the necessary documents before proceeding to the next step.

Step 3: Calculate Your Credits

Calculating Your Credits for Colorado Form 104CR

Using the documents you've gathered, calculate the credits you're eligible for. You can use the Colorado Department of Revenue's website to access the credit calculation worksheets. These worksheets will guide you through the calculation process, ensuring you accurately determine the credits you're eligible for.

Step 4: Complete the Form

Completing Colorado Form 104CR

Now that you've calculated your credits, it's time to complete the form. The Colorado Form 104CR is a relatively straightforward document, but it's essential to follow the instructions carefully. Make sure to:

- Enter your name and address accurately

- List the credits you're claiming and the corresponding calculation worksheets

- Sign and date the form

Step 5: Submit the Form

Submitting Colorado Form 104CR

Once you've completed the form, it's time to submit it to the Colorado Department of Revenue. You can submit the form electronically through the Colorado Department of Revenue's website or by mail. Make sure to follow the submission instructions carefully to avoid any delays or penalties.

By following these 5 steps, you'll be able to complete the Colorado Form 104CR accurately and claim the credits you're eligible for. Remember to stay organized, and don't hesitate to seek professional help if you're unsure about any part of the process.

We hope this article has been helpful in guiding you through the process of completing Colorado Form 104CR. If you have any questions or need further clarification, please don't hesitate to comment below.

What is the deadline for submitting Colorado Form 104CR?

+The deadline for submitting Colorado Form 104CR is typically April 15th of each year, but it's essential to check the Colorado Department of Revenue's website for any updates or changes.